With Ethereum’s merge event just days away, the entire industry is preparing for the network’s most highly-anticipated upgrade.

Bounty hunters are on the lookout for any bugs in the code; blockchain firm ConsenSys is launching so-called "sustainable" NFTs to celebrate the occasion; and crypto exchanges are making room for another potential fork of the Ethereum blockchain.

DeFi degens are also keeping a close eye on any possible fork. If that were to happen, it would mean that anyone holding ETH at the time of the fork would also earn another airdropped token for the new chain.

For those who were trading crypto back in 2017, you’ll remember that Bitcoin holders earned free Bitcoin Cash (BCH), Bitcoin Gold (BTG), and even something called Bitcoin Diamond (BCD) thanks to various forks of the original cryptocurrency.

A well-known Chinese crypto miner Chandler Guo is currently leading the charge for an Ethereum proof-of-work fork. That’s because after the merge, Ethereum will no longer need mining machines to maintain itself, leaving many mining operations out in the cold.

There’s quite a bit at stake here.

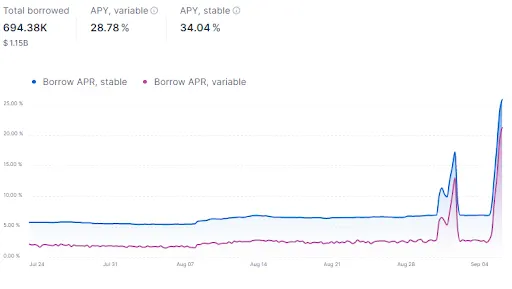

And while Guo attempts to rally the mining troops to execute their fork, degens are borrowing tons of ETH in hopes of also enjoying a windfall of the forked coin (which will apparently carry the ticker ETHPoW).

The borrowing has been so excessive that some protocols are making moves to limit how much can be doled out. Aave, the popular lending and borrowing protocol, has actually just paused ETH borrowing because of this massive demand.

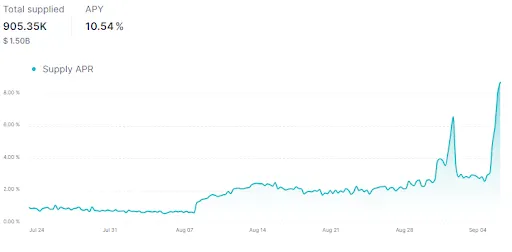

And insofar as the yield you earn for lending on Aave are a function of demand, interest rates for depositing Ethereum have also entered double-digit territory. Right now, you can earn 10.54% on your ETH.

Instead of pausing borrowing, rival protocol Compound is putting a 100,000 ETH cap on how much users can borrow. The current proposal also stipulates that if the platform’s utilization rate hits 100% (which some expect will happen), then the cost to borrow could rise to 1,000%.

Utilization rate is a metric that DeFi protocols like Aave and Compound use to reflect how much of an asset in a given pool is being lent out. A high utilization rate indicates that demand to borrow an asset is close to the total amount of said asset available.

Ciaran McVeigh of 0xA Technologies put it thusly: “If I have a pool with $100 of Dai and $80 of those Dai have been borrowed that represents a utilization rate of 80%.”

What’s the big deal? In the free market of crypto, high demand will be equally met by attractive rates on the supply side, right?

While that’s certainly true, high utilization rates can still pose two key issues.

First and foremost, as soon as 100% of all funds in a pool are in use, depositors won’t be able to withdraw their money out of the system. Second, high utilization rate can cause liquidation problems for these platforms. When there isn’t any collateral in the system because it’s all being borrowed, liquidators won’t be able to close certain positions, potentially leaving the protocol under-collateralized (which is just a fancy way of saying insolvent). And that would be really, really bad.

Finally, something that Ethereum borrowers should be reminded of is that none of these platforms are going to call you up and tell you that the cost of borrowing has just skyrocketed to 1,000%. It will just happen.

And if you’re borrowing specifically to speculate on a potential airdrop should the network fork, then you’re also betting that that new token will also skyrocket. If it doesn’t, you’re in for a world of pain.

Good luck out there.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.