In DeFi’s volatile lending and borrowing sector, fixed-rate lending services are fast gaining attention. Swivel Finance is the latest to turn investors’ heads.

Multicoin Capital again participated in Swivel Finance's latest $3.5 million funding round and was joined by trading desks GSR Markets, SCC Investments, and CMT Digital. OKEx Ventures, Fenbushi Capital, IOSG Ventures, and SevenX Ventures also contributed to the latest round.

With this additional investment, Swivel has received $4.65 million in total financing to build out its fixed-interest rate protocol. This idea is key for larger institutions looking to enter the fast-growing decentralized finance space, according to the managing director of GSR Markets Jake Dwyer.

"The optimizations Swivel has implemented make it attractive for institutions looking to participate in the growing fixed-yield space," Dwyer said in a prepared statement. "The lack of liquidity in the space is currently a big barrier, but Swivel is taking the right steps to bootstrap liquidity in such a fragmented industry."

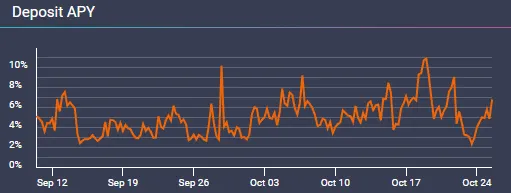

At present, offerings on popular lending and borrowing platforms like Aave and Compound are variable and can fluctuate dramatically. Since September, the deposit interest rate on Aave has ranged from as high as 11% to as low as 2%.

This may not be an issue for retail investors, after all, gains are gains. But for more buttoned-down outfits, such variability can pose serious risks for portfolio managers.

“For institutions, many times you aren't just lending your own capital for revenue, but trying to meet cash obligations from other revenue sources (e.g. borrow at 3%, then lend to a consumer at 5%),” Julien Traversa, the founder of Swivel Finance, told Decrypt via Telegram. “If a company takes on a borrowed position with liabilities due at a future date, a reduction in variable rates can leave institutions insolvent.”

What is Swivel Finance?

Swivel uses a two-token model to achieve a fixed-interest yield, in contrast to the likes of Aave, which offers just one. If you deposit Ethereum in Aave, you get aETH, the yield-bearing version of Ethereum, in return. Compound uses a very similar yield-bearing token for user deposits.

The two tokens on Swivel are called “nTokens” and “zcTokens,” with the former behaving in a similar manner to a traditional yield-bearing token.

When a user deposits 100 USDC into Swivel, that deposit is then split into 100 nUSDC and 100 zcUSDC.

The zcUSDC is locked up for a predetermined period and can be redeemed 1:1 for the underlying USDC once this period is finished. Until that period, however, the zcUSDC is traded at a discount equivalent to the predicted future yield generated by the nUSDC.

Traversa explained how in this arrangement 1 nUSDC, the yield-bearing version of the USDC, could be equal to .05 USDC and 1 zcUSDC could equal to .95 USDC. As the tokens mature, zcUSDC moves closer to 1 USDC, and nUSDC moves towards zero. Assuming a lender holds the tokens for 1 year, the projected yield in this scenario is roughly 5%.

And as these rates are tokenized, traders can just as easily short and long expectations within the variable-rate market, says Traversa. “If a trader wants to long variable rates, all they do is purchase nTokens which increase in value as rates increase. Then, to short rates, a trader borrows and then sells nTokens, similar to shorting spot markets,” he explained.

For now, all of these opportunities are limited to Ethereum’s Rinkeby testnet.

But with the fresh funding in hand, Traversa and his team are expected to launch on mainnet “early this coming month.”