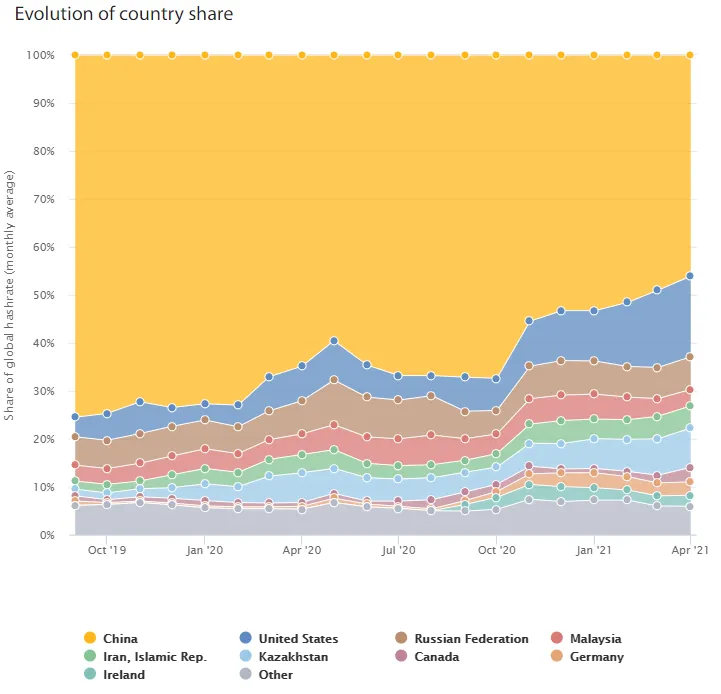

New research by the Cambridge Centre for Alternative Finance (CCAF) shows that China's share of Bitcoin mining fell from an impressive 75.5% in September 2019 to 46% in April 2021—a period before the recent government crackdown on the mining industry.

The analysis, which is based on the updated Cambridge Bitcoin Electricity Consumption Index (CBECI) and includes data from four Bitcoin mining pools–BTC.com, Poolin, ViaBTC, and Foundry, also shows that the United States' share of the hash rate has soared from 4.1% to 16.8%, making it the second-largest force in the Bitcoin mining industry.

Kazakhstan, despite plans to introduce additional taxes on the sector, is also considered among the top destinations for cryptocurrency miners. The country has seen its share of Bitcoin’s computational power increase almost six-fold–from a mere 1.4% to 8.2%.

Russia and Iran made it to the top five as well with 6.8% and 4.6% respectively.

Evolution of the share of global Bitcoin mining. Source: Cambridge Bitcoin Electricity Consumption Index

Bitcoin mining on the move

Despite the lack of clear crypto regulations in China and bans on initial coin offerings (ICO) and exchanges in 2017, the country has long been the epicenter of the Bitcoin mining industry. Some of the largest mining pools and major mining equipment manufacturers, such as Bitmain Technologies and Canaan, are all based in the country.

Things changed dramatically in May this year, however, when China’s State Council decided to add Bitcoin mining to the list of key sectors to monitor due to underlying financial risks. To add to the woes, the decision triggered a string of bans on mining operations in several provinces, including Inner Mongolia, Xinjiang, Qinghai, Yunnan, and–most recently–Anhui.

However, as the fresh data shows, miners began to leave China some time before the latest crackdown.

One notable observation, though, is that once enacted, the crackdown “has effectively led to all of China’s hashrate disappearing overnight, suggesting that miners and their equipment are on the move,” reads the report.

Where exactly miners are moving is the question yet to be answered. Still, North America and Middle Asia, as the dataset reveals, are among the most likely destinations.