Bitcoin miners are increasingly facing off against a new foe to contend with ahead of this week’s halving: the AI boom.

Analysts at investment firm AllianceBernstein, Gautam Chhugani and Mahika Sapra, said that miners are now competing with AI data centers in places like Texas.

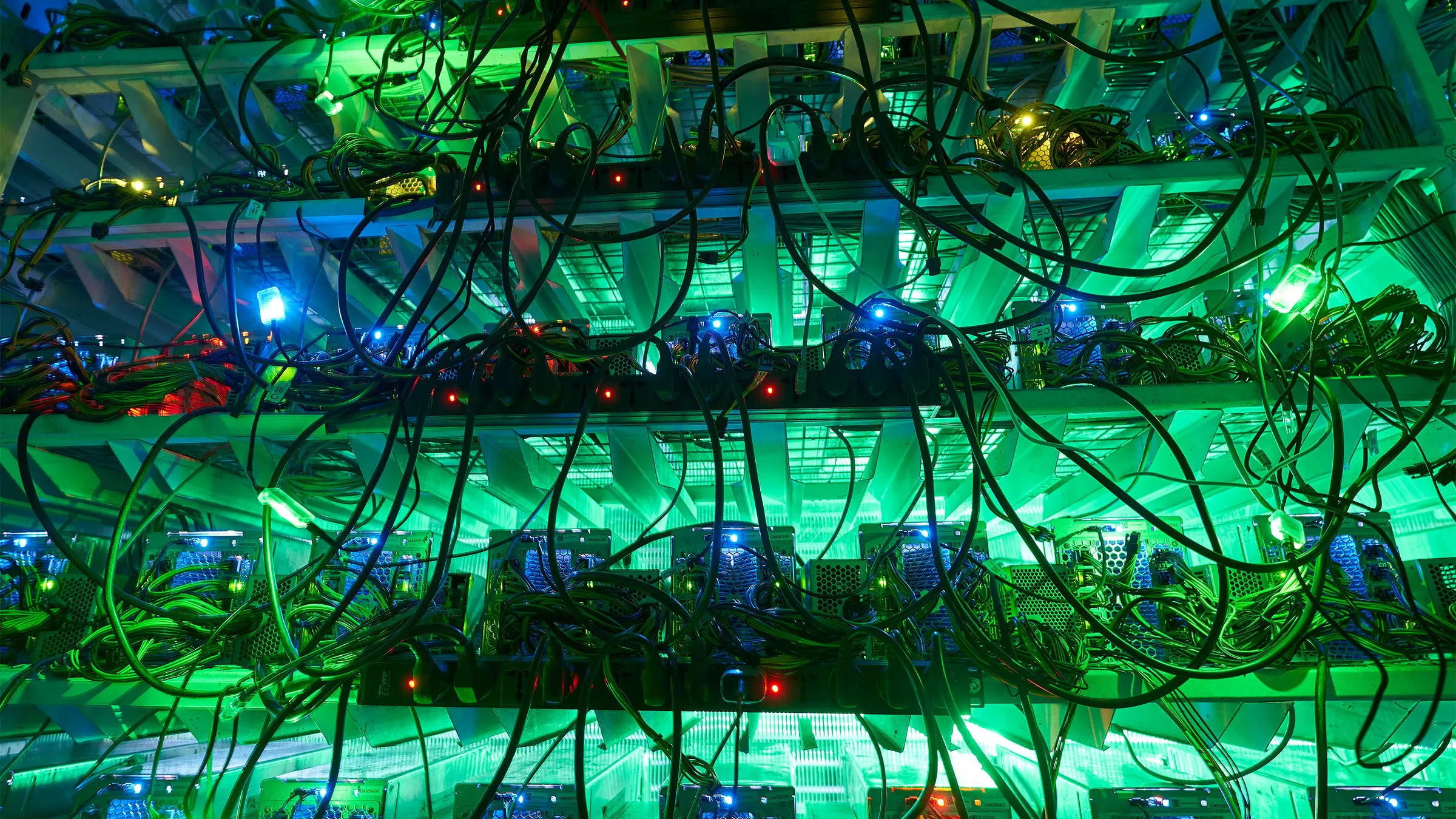

Bitcoin miners are largely centralized operations that mint new digital coins. To do so, a Monday report explains, they need to use a lot of computers and therefore energy. Meanwhile, the booming AI industry is also power-hungry. Both industries look to places like Texas, which has cheap energy and lots of land to build data centers.

Today’s report said that the growing competition with the AI industry “has made land acquisition with power contracts relatively competitive for miners.”

The report also added that the AI hype might also help miners who have spare cash flow, however.

“Bitcoin ASIC chips have had to compete with strong AI chips demand this cycle, and thus manufacturers have been keen on bulk contracts/purchase options with miners who are flush with cash” from capital raises.

The analysts added that miners have been at a “relative advantage” with the upcoming halving.

Miners are rewarded with Bitcoin for minting new coins but this week’s event—which occurs every four years—will cut those rewards in half from 6.25 BTC to 3.125 BTC. This means miners have been preparing to work more efficiently to stay in the race.

The Bernstein analysts also said that CEOs of mining companies have claimed their firms are in a relatively comfortable financial position ahead of the halving—despite Bitcoin’s current price dip.

“The CEOs also point to relatively low debt on the balance sheet and further no equipment financing pledging mining rigs,” the report added.

Bitcoin’s price has dipped well below its March all-time high of nearly $74,000 per coin. The asset is now trading for $63,145, according to CoinGecko—below its previous all-time high of $69,044 it touched in 2021.

Edited by Ryan Ozawa.