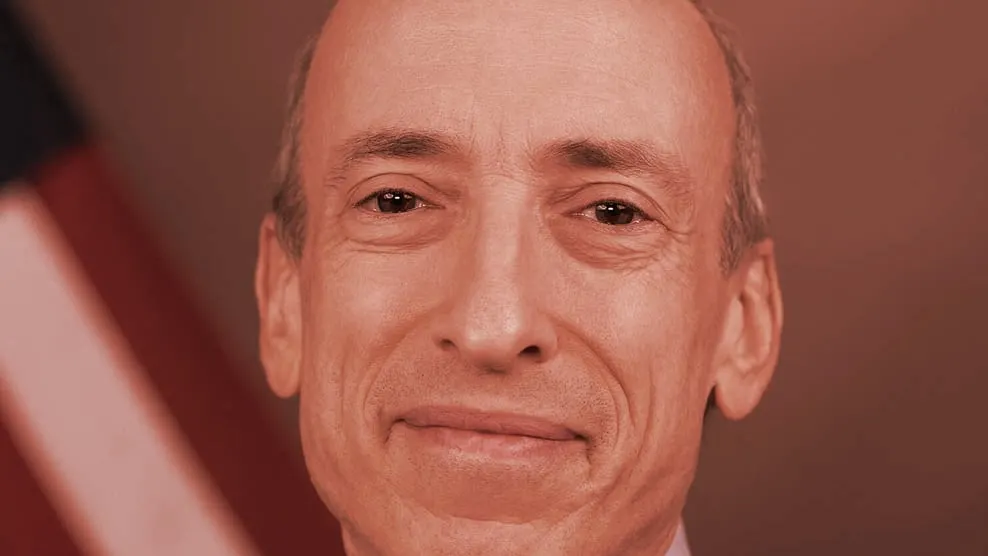

U.S. Securities and Exchange Commission Chair Gary Gensler may have appeared to sidestep questions recently on whether Ethereum and other crypto assets are securities—but he certainly seemed confident back in 2018.

A video has emerged on Twitter showing the top regulator giving a lecture at the Massachusetts Institute of Technology. In it, he says that Ethereum is “not a security” in the eyes of the SEC.

Ethereum is the second biggest cryptocurrency, with a market cap of $227 billion at the time of writing. In the past, regulators have struggled with how to label the asset.

“In 2018, the Securities and Exchange Commission has said regardless of what it might have been in [2014],” Gensler said, referring to when Ethereum launched and announced an ICO using Bitcoin to buy it, “it’s now sufficiently decentralized that we’ll consider it not a security.”

Gensler, a civilian at the time and speaking only in his capacity as a professor, appeared to simply be relaying the opinions of the SEC back in 2018—specifically, the opinion expressed by former Director of Corporate Finance William Hinman in his much-cited "sufficiently decentralized" speech from June of that year.

Still, the irony wasn't lost on Crypto Twitter—especially when juxtaposed against Gensler's recent duel with Rep. Patrick McHenry (R-NC) during an appearance before a House Oversight Committee. Repeatedly asked to give his opinion as to whether Ethereum should be classified a security, and even confronted with Hinman's comments from 2018, Gensler refuses to answer the question.

The clip of Gensler's lecture at MIT is one of many recently surfaced by Twitter user "ZK_shark." Earlier this week, another clip shared by ZK_shark was retweeted by Coinbase CEO Brian Armstrong, whose company is currently in the SEC's crosshairs over its Ethereum staking product. In the clip, Genlser says he believes most of the crypto market is made up of "non-securities." It's a statement that directly contradicts more recent comments as chair of the SEC in which he said he believes the "vast majority" of tokens in the crypto market are securities.

Many have jumped in to criticize the regulator and former MIT teacher—but crypto lawyer Preston Byrne chimed in on Twitter by saying that Gensler speaking as a professor and then as a top regulator are two different things. “As a professor, he can talk about what things are in the abstract,” he wrote. “As a law enforcer, he’s required to enforce the laws as they’re written.”

Gensler's refusal to answer lawmakers on whether Ethereum is security or a commodity is nothing new: Last year, he also refused to give a clear-cut answer when pressed. And crypto industry bigwigs—from lawyers to CEOs—have poked fun at the fact that Gensler has failed to answer straightforward questions in the past.

A security is a tradable financial asset that has monetary value—like stocks or bonds—that meets a specific legal definition as outlined by the so-called Howey Test.

Under U.S. law, an asset meets the definition of a security if it is an investment of money in a common enterprise from which there is an expectation of profit based on the efforts of others.

Gensler has said that Bitcoin, the biggest cryptocurrency by market cap, is not a security—but rather a commodity. It's the only crypto asset for which he's currently willing to give a public opinion.

The SEC has launched an intense crackdown on the crypto industry during Gensler's tenure—most recently targeting three U.S.-based cryptocurrency exchanges in as many months: Kraken, Bittrex, and Coinbase.

Some political leaders in the U.S.—especially Republican lawmakers—have criticized the regulator for his latest actions. They claim he is stifling regulation in the world’s largest economy and forcing American tech companies overseas.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.