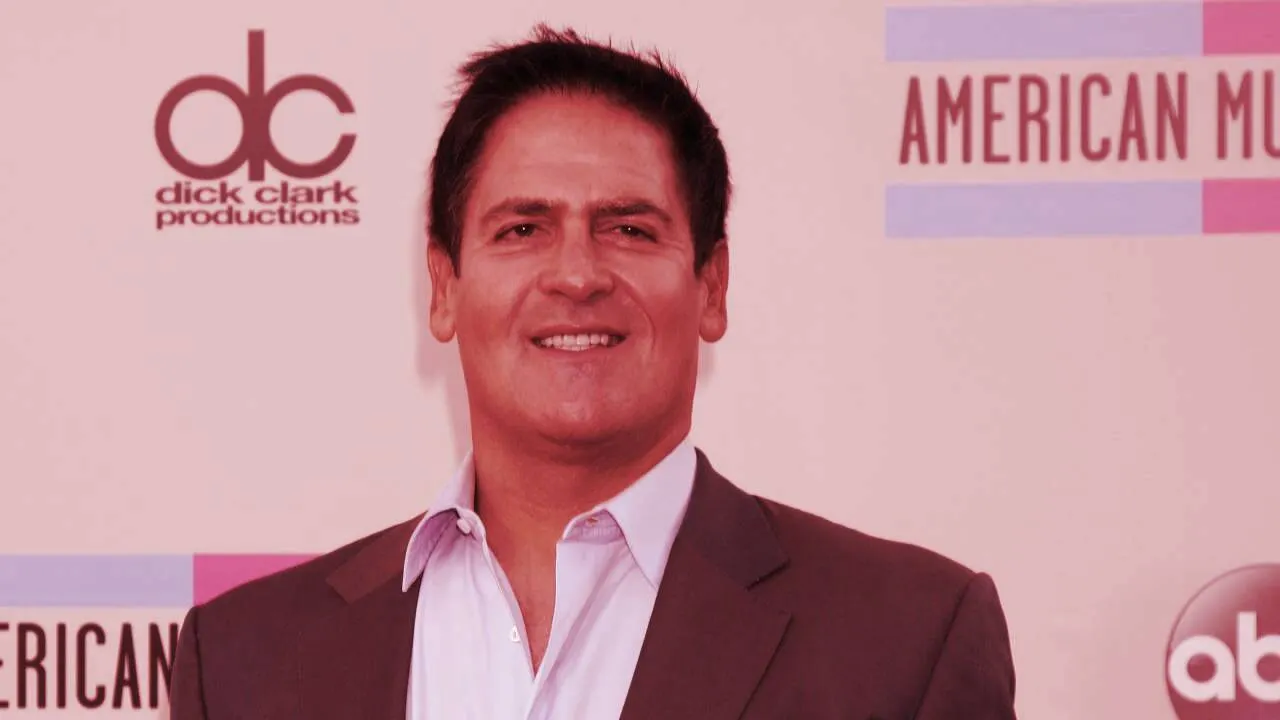

Billionaire owner of the Dallas Mavericks Mark Cuban has weighed in on the latest crypto crash, saying that projects with no “valid” business model will eventually die out.

“In stocks and crypto, you will see companies that were sustained by cheap, easy money—but didn’t have valid business prospects—will disappear,” Cuban said in an interview with Fortune.

The 63-year-old entrepreneur also recalled the American magnate Warren Buffet, who once said that, “when the tide goes out, you get to see who is swimming naked.”

Last month, amid a broader tech market decline, the crypto industry was rocked by the implosion of the Terra ecosystem as its algorithmic stablecoin UST lost its dollar peg—wiping out billions in investor wealth.

The crypto industry took a further hit this week, after Celsius Network, a crypto lending platform with $11.8 billion in assets under management, abruptly stopped withdrawals.

Major cryptocurrencies plunged following the announcement, with the price of Bitcoin (BTC) touching $20,000 on Wednesday.

As the combined market capitalization of the crypto market slipped below $1 trillion, several leading crypto companies, including America’s digital asset exchange Coinbase and lending platform BlockFi, moved to cut staff, bringing more uncertainty to the market.

The crypto crash also drew increased attention to software manufacturer MicroStrategy, which is reportedly facing a margin call on a $205 million Bitcoin-backed loan with Silvergate Bank that was taken in March to buy more crypto, as well as the Singapore-based crypto hedge fund Three Arrows Capital, which is in danger of seeing its multimillion-dollar crypto loans liquidated.

Key to success is innovation

Despite the clearly negative market environment, Cuban sees light at the end of the tunnel and is placing his bets on innovation.

According to the billionaire, “disruptive applications and technology released during a bear market, whether stocks or crypto or any business, will always find a market and succeed.”

Cuban’s latest remarks also echo comments he made last month, when he compared the current state of the crypto industry with the dot-com bubble of the early 2000s.

Back then, Cuban also said that he still sees plenty of room for advancement, especially in areas involving commercial smart contract platforms replacing software as a service (SAAS).