Blockchain analytics platform Chainalysis has released a report analysing the crash of Terra’s stablecoin UST, concluding that it while it was a factor in the recent crypto market crash, it wasn’t the deciding factor.

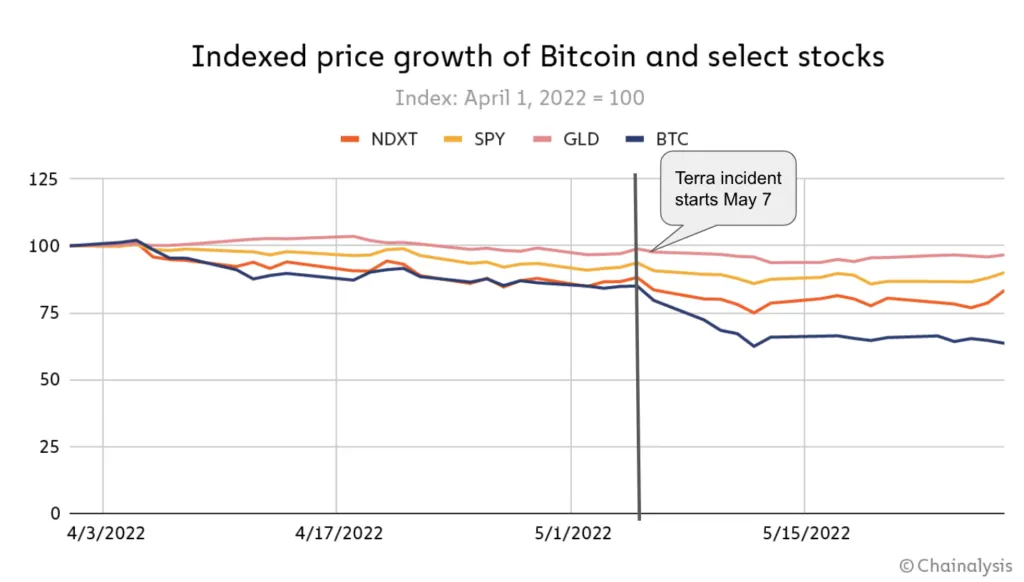

Instead, the report read, “the crypto market’s recent downturn appears more closely linked to the tech market decline than to UST’s collapse.”

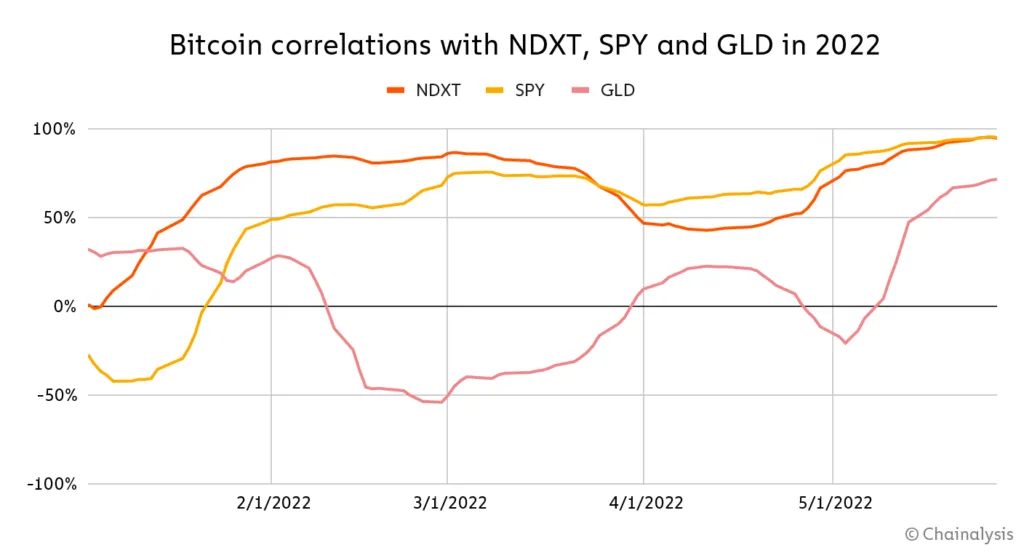

According to Chainalysis, Bitcoin’s correlation with tech stocks is “a relatively new development,” with the leading cryptocurrency maintaining “significant price correlations” with the NASDAQ-100 Technology Sector Index and the S&P 500 Index in 2022, and falling in concert with them.

UST’s crash did exacerbate Bitcoin’s downward trend, Chainalysis found, but the effect was “short-lived,” with the end of the accelerated decline coinciding with the close of UST’s collapse. Following this, Bitcoin’s price action “fell back in line with non-crypto tech assets.”

The crash also caused a spike in redemptions of stablecoins, with data from exchanges showing a spike in stablecoin trading volume between 9th May and 12th May, during Terra’s collapse.

“All kinds of investors sold their stablecoins during the crash, from big, institutional players to retail investors,” wrote Chainalysis.

How did UST crash?

On May 7, 2022, Terraform Labs (TFL), the organization behind Terra, executed a planned, publicly announced withdrawal of $150 million from 3pool, a Curve liquidity pool.

But shortly after the withdrawal was made, two users swapped approximately $185 million UST for USDC in a span of two hours, attacking the vulnerable pool with less liquidity.

In response, TFL withdrew another 100 million UST from 3pool to rebalance it.

The two large trades caused UST to slip from its dollar peg, triggering a major sell-off in exchanges that caused the peg to slide further.

Why are #crypto prices plummeting? Did the UST-Luna situation cause this? What’s an algorithmic stablecoin?

Our experts break down the recent events in the market and share key takeaways. https://t.co/yojWjVnSRn

— Chainalysis (@chainalysis) June 9, 2022

On May 9, in an effort to save the coin’s peg, Luna Foundation Guard (LFG), the custodian of UST, sold billions worth of its Bitcoin reserves to counter-purchase UST from the market.

However, with its reserves diminishing, LFG was unable to save UST from its death spiral.

How did LUNA crash?

An algorithmic stablecoin, UST’s dollar peg was governed by smart contract-based algorithms.

The algorithm that kept UST at its dollar peg was a mint-and-burn mechanism between LUNA and UST.

If the price of UST fell below a dollar, investors could burn 1 UST for $1 worth of LUNA, removing it from the supply. The newly minted LUNA could then be sold, with the investor pocketing the difference as profit.

If the price of UST went above a dollar, investors could burn $1 worth of LUNA for 1 UST. with UST trading at more than a dollar, investors could then sell the newly minted UST for a profit.

The artificial supply-demand ratio collapsed when UST lost its peg, rapidly opening up huge arbitrage opportunities.

Users bought less valued UST from exchanges and burned them for $1 worth of LUNA. As a result, LUNA was minted en masse, with the resulting hyperinflation in LUNA’s supply sending the token price plummeting 100% in less than a week.

Terra’s dramatic collapse has drawn attention from regulators around the world, with both the U.S. Securities And Exchange Commission (SEC) and South Korean prosecutors opening investigations into the crash.