In brief

- The potential size of Libra's assets and links with the wider financial system pose a risk to stability, says a new ECB report.

- The report estimated that Libra could amass assets of up to $3 trillion.

- The report warns that if developer don't comply with existing regulations, new ones should be introduced.

If Facebook’s Libra proves popular it could amass up to $3 trillion in assets, according to a European Central Bank paper published this week. But the ECB warned that if Libra goes badly, it could pose risks for financial stability.

"[In] a scenario where Libra coins prove as popular as Facebook—the global size of the Libra Reserve could reach almost €3tn [$3.2 trillion] of assets under management!” said the report.

With that in mind, the report took a deep dive into the stability of stablecoins, specifically Libra. Facebook’s project has generated debate among policy makers far and wide on the risks and regulation of stablecoins, and their impact on the wider market.

How stable are stablecoins?

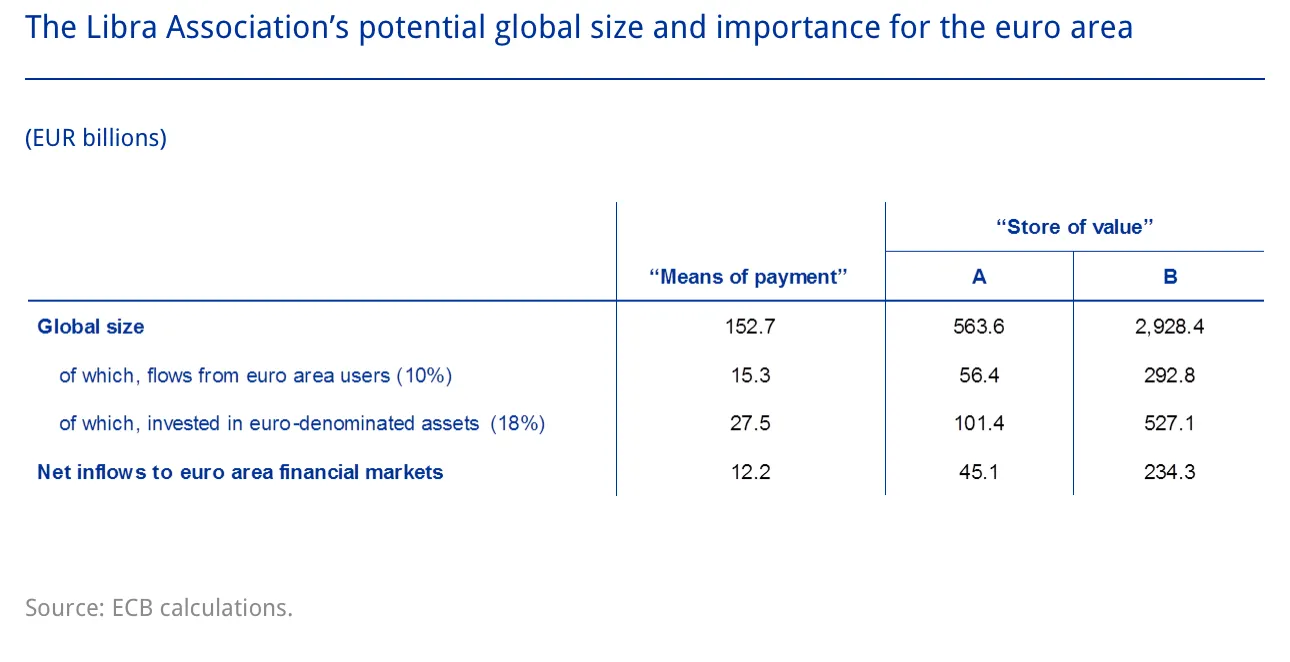

The report looked at Libra, in three different scenarios: as a widespread means of payment, as a store of value which is regulated, and as a store of value which isn’t. In the later, extreme-case scenario, the global size of the Libra Reserve could reach almost €3 trillion of assets under management, the researchers estimated.

A more modest projection of Libra’s popularity still finds a potential reserve of €152.7 billion.

Stablecoins are an alternative for investors who don’t want to put their money into volatile crypto assets like Bitcoin. To better manage volatility, stablecoins like Libra transfer their values from assets or baskets of currencies pegged to the coin.

The reports’ primary gripe is that the technological, legal and operational qualities of stablecoins ensure that asset management isn’t covered by current rules. The ECB is concerned that this leaves users unprotected. It argues that stablecoins’ raison d’être is compromised, and flawed.

“There is a risk that end users will regard the stablecoin as being equivalent to a deposit, given the promise of 'stable' value and the possibility of converting coin holdings back into fiat currency at any time,” says the paper.

Risks to financial stability of the eurozone

In common with money management funds, the Libra Association has promised to invest the assets under its management in high‑quality, highly liquid assets, including government bonds and cash.

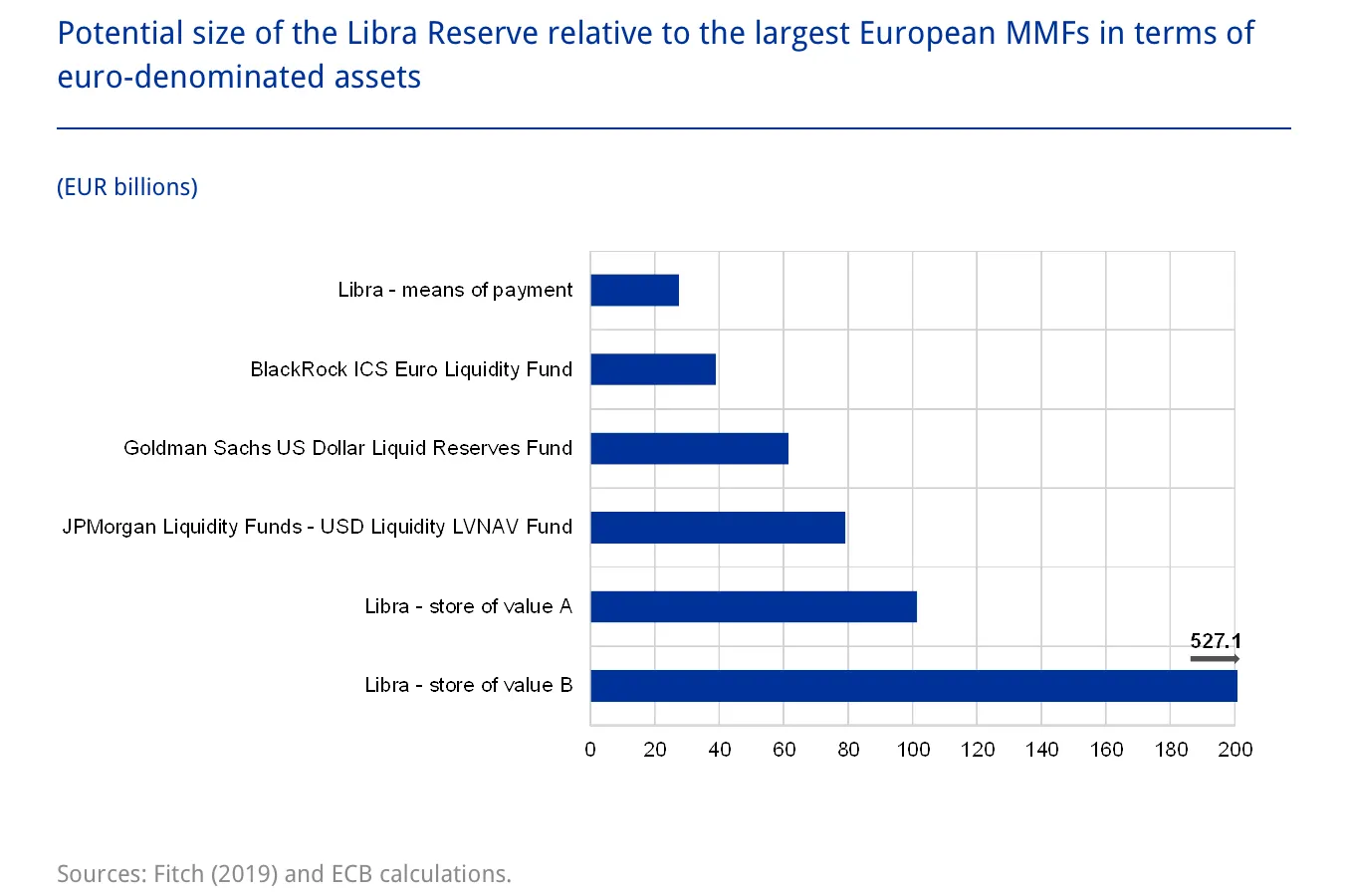

Depending on the assets and their maturity, Libra could thus be considered a money market fund. And the volume of assets under management, would make it one of the largest such funds in the eurozone, said the report.

But short-term money market investments could create instability, the report argued. If Libra suddenly needed to offload a large amount of an asset, that could impact market liquidity, and create problems for the very governments and banks that the Libra Reserve supports through its investments.

It could also create imbalance in the European market. Although 10% of the global assets are likely to be used by Europeans, Libra has said that 18% of the currency would be backed by Euros, warns the report.

In view of the potential size of assets under management and links with the wider financial system, the report ends with a plea to developers to comply with existing regulations, given the risks malfunctioning asset management poses for financial stability.

Otherwise a new regulatory framework must be put in place to avoid a vacuum. Facebook has been warned.

Tips

Have a news tip or inside information on a crypto, blockchain, or Web3 project? Email us at: tips@decrypt.co.