How do you get online strangers to organize around a common goal and mobilize capital efficiently in a manner that requires no human trust? Decentralized autonomous organizations, or DAOs, are crypto’s answer to that question. And they’ve become immensely popular over the past year.

DAOs are often described as “group chats with a wallet,” but that’s something of an understatement: DAO treasuries across all networks currently hold over $10 billion in total, according to DAO analytics tracker DeepDAO.

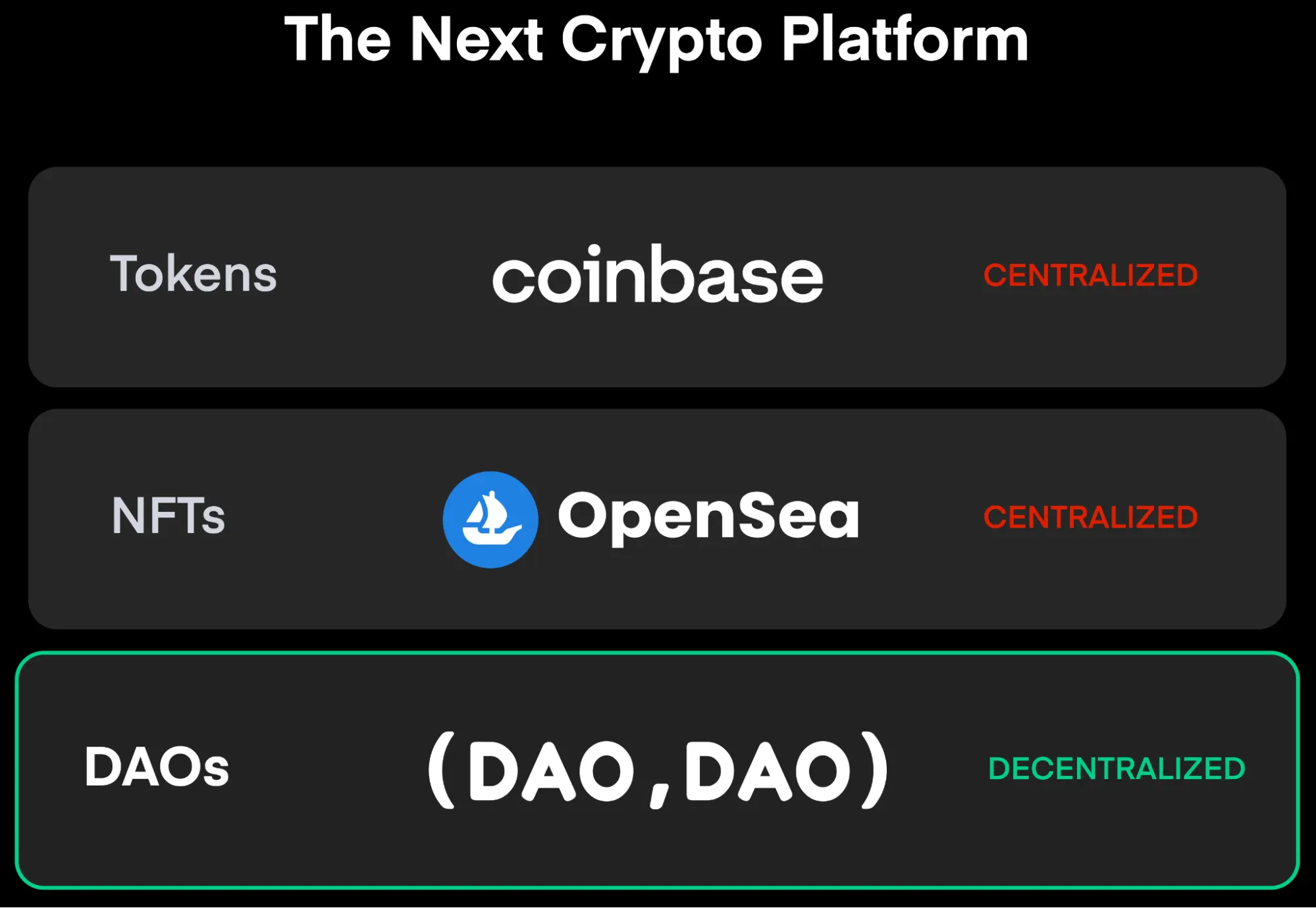

The new organizational structure that DAOs represent is better thought of in the wider context of crypto. Just as cryptocurrencies seek to replace fiat currencies or traditional asset classes like gold, DAOs offer an alternative to traditional business structures.

DAOs are strictly online with no physical HQ, operate on a flat management structure (meaning no c-level executives) and are “token-aligned,” meaning members propose and vote on governance decisions according to their token holdings. Some DAOs automatically enforce decisions, while others take it as a binding decision on the core contributors or paid team members to execute those decisions.

But just as DAOs come with a new ethos, structures, and tooling, they create barriers to entry for those without the appropriate skillset; it’s not easy to start a DAO if you aren't a smart contract whiz.

Nader Al-Naji, founder of social blockchain DeSo, says his team has created a solution for those who need a low-cost, convenient way to launch DAOs to address the current “lack of DAO tooling.” It’s called DAODAO, and as the name suggests, it’s a DAO that wants to give birth to new DAOs.

“DAODAO is for people who want to focus on scaling their ideas rather than fumbling with the tech,” Al-Naji told Decrypt. “With DAODAO you can launch a DAO as easily as creating a social media account.” With mainstream interest in the benefits of DAO structures growing, he added, DAODAO is positioned to be “the keystone for the next chapter of DAO evolution.”

The white-hot trend of DAOs in crypto

DAOs were only a theoretical consideration, a potential use-case, in Vitalik Buterin’ sEthereum whitepaper in 2014. Since then, but especially over the past year, DAOs have become one of the hottest emerging spaces in crypto.

There are all sorts of DAOs, and they all have wildly different origin stories and purposes.

In March 2021, a group of 54 strangers who met each other in a Discord server set up BeetsDAO and raised 300 ETH (more than $500,000 at the time) to buy EulerBeats NFTs in an auction on OpenSea. They’re still going strong as an art investor DAO. Similarly, PleasrDAO, originally formed to buy digital artist pplpleasr’s Uniswap ad NFT, has now morphed into an all-around investor DAO, purchasing everything from Edward Snowden’s first NFT to the only extant copy of the Wu-Tang Clan’s album “Once Upon A Time in Shaolin”.

DAOs gained widespread public attention when ConstitutionDAO raised $45 million in ETH in November 2021 to buy a copy of the U.S. Constitution at auction. Although that endeavor may have failed, the experience shone a spotlight on DAOs, prompting traditional companies across the world also to consider it as an alternative way of structuring themselves.

Some companies have already taken the plunge, such as ShapeShift; having turned into a DAO, as of March 2022 it has no c-level executives.

“ConstitutionDAO is an amazing example of the power of web3 values such as permissionlessness and trustlessness. It’s even more impressive they raised so much because of how clunky current DAO tooling is,” Al-Naji said.

Towards mainstream adoption

One challenge facing both newly-minted DAOs and companies planning to become DAOs is the regulatory complexity surrounding their legality–a potentially massive barrier to mainstream adoption.

Although there’s no law stopping anyone from assembling with others online to pursue a project, things get tricky when money enters the picture—fiat or crypto–and some DAOs necessarily require real-world connections, like bank accounts or the purchase of physical assets.

In this respect, Wyoming has emerged as a global leader for the legal recognition of DAOs. In March 2021, Wyoming lawmakers passed a bill allowing DAOs to be officially registered in the state. The law affords DAOs the same rights as a limited liability company. After the bill came into effect on July 1, 2021, the American CryptoFed DAO, a DAO with a mission to introduce a new monetary system, became the first legally recognized DAO in the U.S.

Most recently, DAOs have gone beyond buying digital art or setting up online projects, to address wider global concerns. UkraineDAO, set up by members of Russian punk band Pussy Riot and others, has raised $1.7 million towards humanitarian efforts in Ukraine, as the country battles the Russian invasion.

U.S. domestic politics is slowly entering the world of DAOs, too. Andrew Yang, a former candidate for U.S. president and New York City mayor, set up the Lobby3 DAO so that “people can see the benefit of these technologies” in the real world.

DAOs, Yang told Decrypt’s gm podcast, "could be a feature of a 21st century democracy... liquid democracy where people are assigning their voting rights on certain issues to other people who might have more expertise or more time.” It could, he argued, present an alternative to “floundering” democratic institutions that are “not truly representative."

There are plenty of other ambitious DAO initiatives with real-world goals. FriesDAO is trying to buy up fast-food franchises, and Kory Spiroff, a former Domino's Pizza VP, has joined its ranks. And some have goals that go quite literally beyond our world: MoonDAO wants to send some of its members to space.

“DAOs work best when they have a single focus and shared vision. You’ll soon see DAOs for just about anything – they’re organizational structures without the typical friction of current corporate structures,” said Al-Naji.

Streamlining DAO creation

But DAOs depend on more than just ambitious and energetic people initiating them and contributing to their success. There’s also technical infrastructure to consider—but the DAO toolbox remains perplexing to newbies, and especially to those without crypto expertise.

As a consequence, even those with decades of experience in coordinating teams can struggle to get a foot in the world of DAOs, if they lack the technical aptitude necessary to set up and maintain one.

That’s where DAODAO comes in. It claims its tools can help onboard those who want to create a DAO in a matter of minutes, opening the door to DAOs going truly mainstream.

DAODAO’s offering is simple. When it launches in May 2022, you’ll be able to type a name for your DAO, indicate a fundraising milestone, and add other key details like specific goals for your DAOs and so on. All of this is recorded on the DeSo blockchain, developed by the team behind DAODAO.

Although DAODAO’s powered by DeSo, it’s cryptocurrency-agnostic: it doesn’t force users to stick with DeSo’s native token DESO and is compatible with major cryptocurrencies, including ETH, BTC, SOL,, USDC and even DOGE.

What if you can buy Twitter with $DOGE?

We’re excited to announce that DAODAO will be the first DAO platform to accept $DOGE

This is a major shift from existing paradigms, where investing in DAOs is usually with $ETH — and marks a compelling new use case for all $DOGE holders! pic.twitter.com/g7tqkrVQav

— (DAO,DAO) (@daodao_io) April 5, 2022

DAODAO isn’t just a launchpad, though. It’s a DAO toolkit complete with messaging and voting platforms. It replaces the dispersed DAO ecosystem of Discord servers and Snapshot votes with an on-chain experience all in one place.

“Essentially what we saw with DeSo was an opportunity to take DAOs, which are inherently social, and have not just the money on-chain but all of the social engagement on-chain as well,” Al-Naji told Decrypt.

Al-Naji explained this was possible because DeSo is custom-built for data-heavy apps like social media. Storing a tweet-sized post would cost anywhere between $0.25 to $1 on popular blockchains like Ethereum and Avalanche, but it’s virtually free on DeSo, he said.

There are already hundreds of social apps on DeSo. Cloutavista, which runs one of the DeSo nodes, has an indexing layer on top, letting users search for anything posted on the blockchain. DAOs created through DAODAO would also be indexed.

Al-Naji wants to take the DAODAO offering a little further and offer legal peace of mind for DAO creators.

“Essentially people can contribute to a DAO and they put funding in and they get coins, and we use an offshore entity that sits in between the contributor and the creator of the DAO,” he told Decrypt. “The entity protects the creator of DAO while also making sure they stay true to their mission.”

This means two things, Al-Naji said: first, it’s highly unlikely that the coins that you're buying would be considered securities under the US law. It also protects the creator from any direct liability to the DAO token holders by having that entity in between.

He said DAODAO is working with a lawyer to craft a memo, and more details will follow closer to DAODAO’s public launch date of May 2022.

Brought to you by DAODAO

Learn More about partnering with Decrypt.