In brief

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$70,301.00

0.92%$2,061.68

-0.53%$1.64

14.25%$630.17

0.67%$0.999836

-0.02%$89.78

4.66%$0.28155

-0.27%$0.114475

17.94%$1.02

-1.32%$52.60

0.78%$558.36

-1.31%$0.297294

6.95%$0.999554

-0.04%$8.40

-2.14%$30.86

-2.51%$9.13

2.15%$346.21

-2.57%$0.9989

0.01%$0.15954

-3.07%$0.182062

8.56%$0.999514

0.02%$304.52

6.09%$0.105238

1.80%$55.71

0.11%$9.59

3.68%$0.0000069

7.89%$0.999749

0.00%$1.026

5.08%$1.47

0.97%$0.00973826

-0.88%$0.081719

0.29%$0.106862

2.89%$5,001.91

0.13%$1.42

4.71%$5,035.23

0.19%$3.58

2.79%$1.31

-5.77%$0.671243

4.36%$0.00000483

26.42%$129.10

3.09%$1.00

0.00%$186.09

-8.44%$0.724048

0.87%$0.997235

0.06%$0.19408

23.22%$80.94

2.02%$2.42

1.53%$1.12

0.00%$0.999748

-0.02%$0.00000171

0.10%$0.067794

-0.81%$0.999723

-0.06%$9.05

4.11%$0.28832

3.95%$1.075

3.97%$2.51

3.69%$0.00230407

8.58%$0.999271

0.01%$0.424316

4.68%$0.110193

7.45%$8.60

1.16%$7.37

2.39%$2.19

2.64%$72.84

-0.33%$0.127642

3.59%$0.01849868

-2.38%$10.99

0.00%$0.058805

3.95%$0.03324775

1.46%$0.099417

2.62%$0.01024721

6.07%$0.857635

0.08%$0.998147

-0.13%$3.52

2.63%$1.49

3.21%$1.41

13.13%$1.24

0.00%$0.00877394

5.10%$0.970521

1.12%$1.003

4.15%$0.03779066

2.56%$1.026

0.00%$114.29

0.00%$0.999899

0.00%$1.11

-0.29%$0.119075

1.94%$0.677305

10.24%$0.00000699

9.99%$0.080052

-0.31%$1.094

0.00%$0.990056

-0.75%$0.999597

-0.04%$0.168036

8.20%$1.00

-0.04%$0.078264

3.63%$0.01291842

0.09%$40.18

1.29%$0.27683

2.06%$0.998318

-0.06%$0.00755986

9.72%$1.093

0.27%$1.18

-0.37%$1.35

3.07%$0.414859

-0.16%$0.667156

0.15%$0.04214709

-0.54%$0.02386725

1.04%$24.23

-2.36%$1.67

3.75%$1.18

2.67%$0.194318

0.68%$0.178134

4.24%$0.22137

5.13%$2.07

-16.73%$165.68

-8.01%$0.99932

-0.02%$0.218832

3.65%$0.262573

3.55%$0.086981

1.60%$1.86

2.10%$0.04163657

-2.09%$17.91

8.45%$0.00000036

3.30%$0.060547

2.77%$134.08

2.21%$0.501913

5.44%$0.00000034

3.17%$0.01767848

3.34%$0.00003401

9.83%$0.057068

8.40%$3.25

2.72%$0.276716

0.49%$0.999617

-0.00%$0.355837

4.03%$0.02889518

2.87%$0.072008

3.48%$0.327808

6.39%$0.331966

5.91%$0.00609223

-2.08%$0.353721

0.14%$1.019

0.02%$0.056991

2.80%$0.993923

-0.07%$2.94

-2.67%$0.081414

2.83%$0.00288464

0.14%$0.990516

-0.26%$17.18

-0.83%$0.050691

1.01%$7.00

1.50%$13.55

-6.95%$0.02318327

1.54%$0.00252458

5.71%$0.02249555

-0.43%$0.092082

3.87%$0.245222

8.12%$1.44

-1.47%$1.46

0.45%$0.998247

-0.16%$0.527364

2.19%$0.999827

-0.00%$0.101568

3.85%$1.074

0.00%$0.988132

-0.08%$0.217568

-0.81%$22.43

12.67%$1.31

2.33%$1.16

2.95%$0.999623

-0.01%$0.0021413

-2.63%$0.00567487

4.72%$0.209422

8.18%$0.107118

4.06%$2.92

1.58%$5,420.20

6.11%$0.00429368

3.20%$22.27

0.00%$0.134364

0.94%$0.00000096

0.31%$0.204113

-1.44%$0.197424

-0.88%$17.79

0.06%$0.050298

1.50%$0.081753

1.71%$0.00003487

3.22%$0.053301

1.71%$1.00

0.00%$0.998

-0.20%$2.38

1.50%$1.48

-2.89%$4.21

58.01%$1.97

-0.14%$0.794674

-0.81%$0.663571

5.22%$1.00

0.00%$0.998667

-0.28%$0.089381

-8.79%$0.05524

1.77%$0.00000853

0.05%$1.82

-0.23%$2.09

-1.18%$0.02291341

-0.10%$0.363362

5.10%$47.98

0.01%$0.997879

-0.02%$1.014

-0.12%$0.995095

-0.02%$1.26

0.08%$5.22

1.13%$0.997731

-0.18%$0.981222

-1.57%$0.419141

0.13%$0.174618

4.31%$0.146687

0.84%$1.86

-0.02%$0.089497

0.91%$0.670175

-4.55%$0.685572

10.70%$0.292167

3.56%$0.310406

-1.83%$0.08717

4.24%$0.098718

1.05%$0.274737

8.63%$2.08

1.60%$0.00439812

0.39%$0.077527

-3.77%$0.00159849

3.36%$0.13324

-4.33%$0.328085

0.07%$0.02319051

-0.99%$8.68

2.33%$1,096.19

0.03%$0.215768

2.32%$0.00246836

1.26%$0.372676

0.74%$0.050281

5.53%$2.51

1.80%$0.135822

3.58%$0.03126597

5.95%$0.281203

3.80%$0.995187

0.04%$0.129436

-1.65%$1.056

-0.00%$2.56

6.82%$0.995596

0.00%$0.211154

3.16%$0.470792

2.14%$0.124214

3.39%

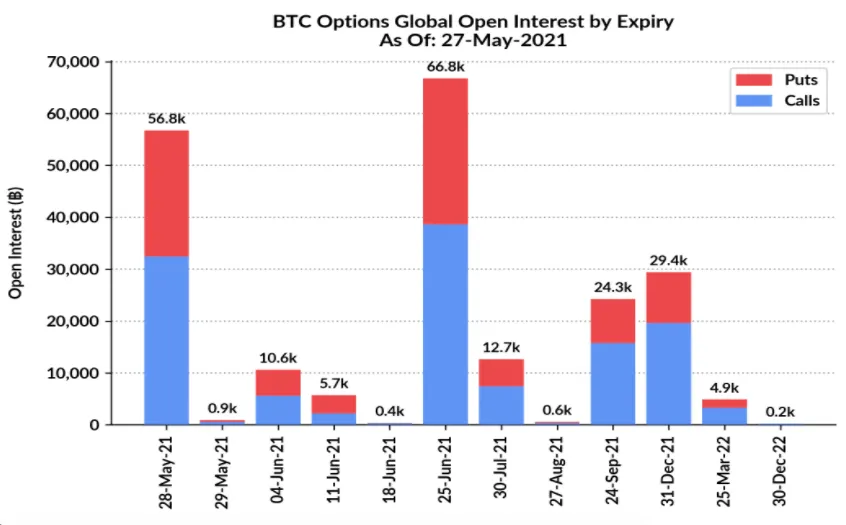

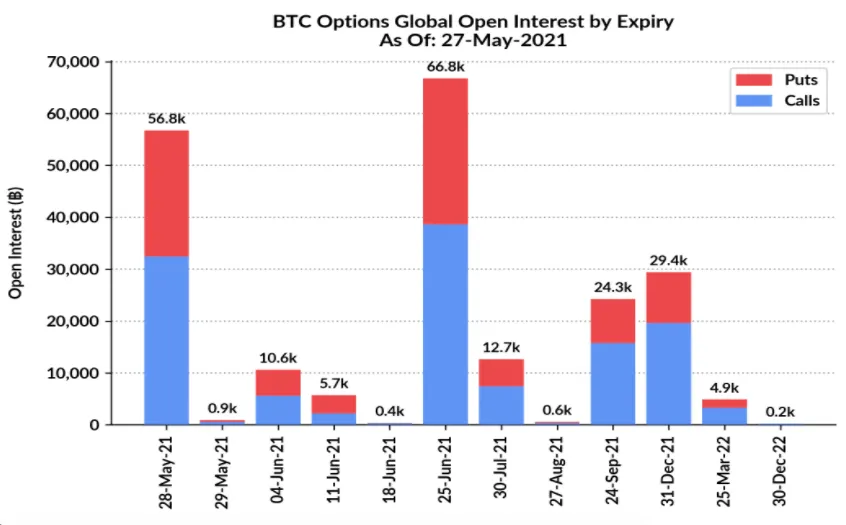

Around $2.1 billion worth of Bitcoin options contracts expired today. Expiry dates of options contracts often bunch up toward the last Friday of the month; Bitcoin’s price, however, has dipped, and May’s final blowout is the quietest of the year so far.

Bitcoin options are derivatives contracts that provide buyers with the right, but not the obligation, to buy Bitcoin at a certain price in the future.

Almost all of this month's option contracts expired at 8:00am UTC today, the designated expiry time on Deribit, the most popular Bitcoin options exchange.

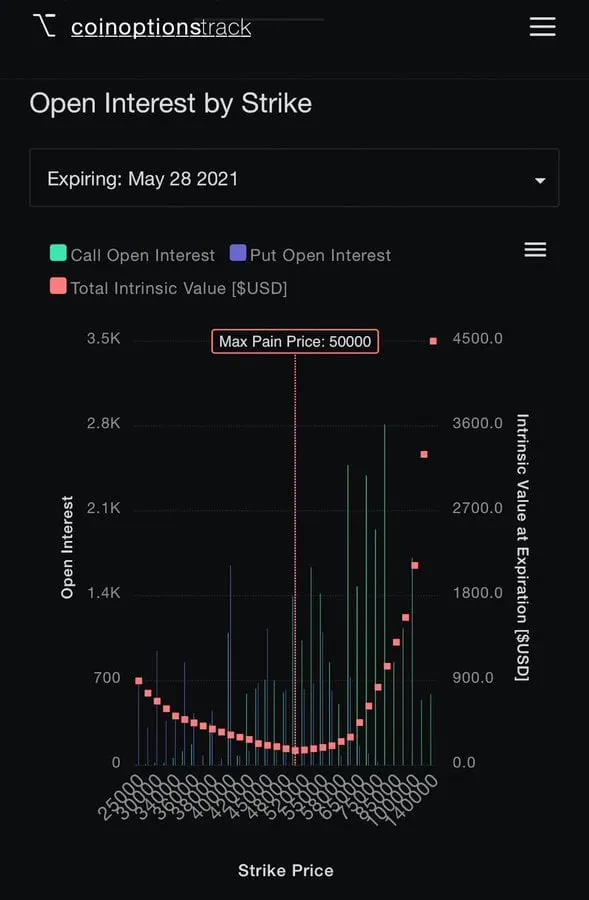

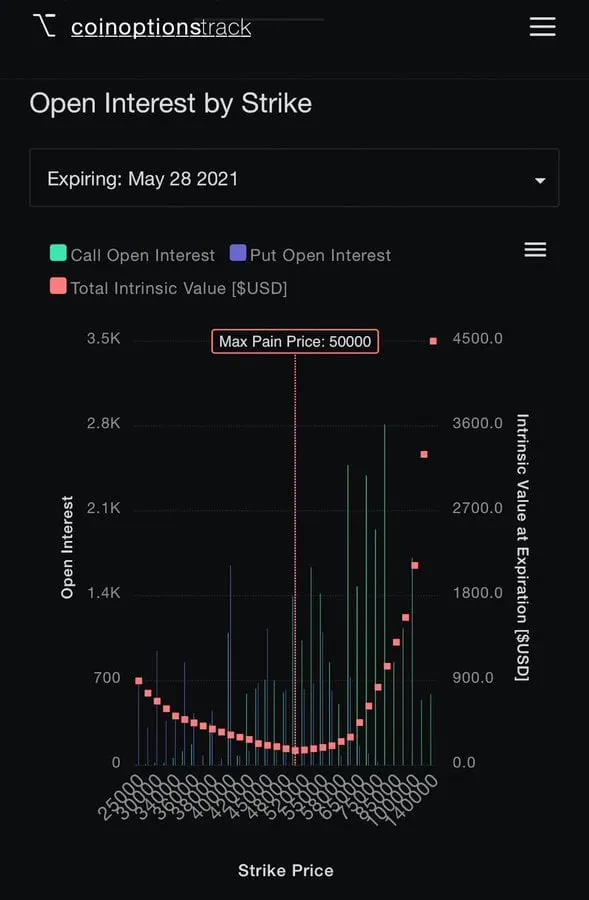

For this month’s options contracts, the max pain—the strike price at which the highest number of contracts expire at no profit—is $50,000. Last month, $3.6 billion in Bitcoin options expired with the max pain price of $54,000.

The monthly event has often coincided with low Bitcoin prices, and today’s crash supports the theory that options contracts depress prices. But Fadi Aboualfa, head of research at crypto custody firm Copper, said that the broader economic data does not suggest that the bulk expiry of options contracts affects the price of Bitcoin. The price of the cryptocurrency, he said, may “move up in the coming weeks,” and today’s dip may prove temporary.

Nathan Cox, Chief Investment Officer at digital asset fund Two Prime, told Decrypt that a number of “timely trades” were placed in the leadup to the massive price crash earlier this month, which halved the price of Bitcoin from highs of $64,000 last month. One buyer purchased huge amounts of options contracts at a strike price of $46,000, “indicating that some traders either knew what was coming or were anticipating a pullback in the market.”

As for the next few months, Cox said that although traders “naturally are still on edge,” there they are relatively aligned in their price predictions and some even anticipate a recovery in September and December. “Whether or not you believe the bull is dead right now, derivative markets still show a lot of conviction that this market can head higher by year-end.”

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.