In brief

- Chainlink has published a whitepaper exploring how its decentralized oracle networks will evolve.

- Co-founder and CEO Sergey Nazarov says Chainlink's hybrid smart contracts will define the future of the industry.

Published today, Chainlink’s new whitepaper reveals the startup’s plans for a "big leap forward" in the evolution of the hybrid smart contracts that co-founder Sergey Nazarov is convinced will come to define the blockchain industry.

“Hybrid smart contracts are about combining blockchain smart contract application capabilities, and the off-chain world’s proof and data and computations,” Nazarov told Decrypt last week, prior to the paper’s publication. “This is a big leap forward because it redefines what people can build.”

Those applications, Nazarov said, include NFTs, stablecoins and the booming decentralized finance (DeFi) industry, which he believes could grow to $500 billion in total value locked this year.

Over the last three years, Chainlink's LINK token has broken into the top five cryptocurrencies by market cap, while its technology has been integrated into over 300 projects to connect blockchains to real-world data. But while the new whitepaper charts that progress, its focus is on over 100 pages of cutting-edge research exploring how the startup will evolve its vision and its technology in the near future.

Chainlink 2.0

Before people started experimenting with financial products, and NFTs, blockchains were basically just token platforms, said Nazarov. “What we're seeing is the start of a redefinition of what the blockchain industry is about, away from just being about Bitcoin, and just being about tokens, to being about many more things.”

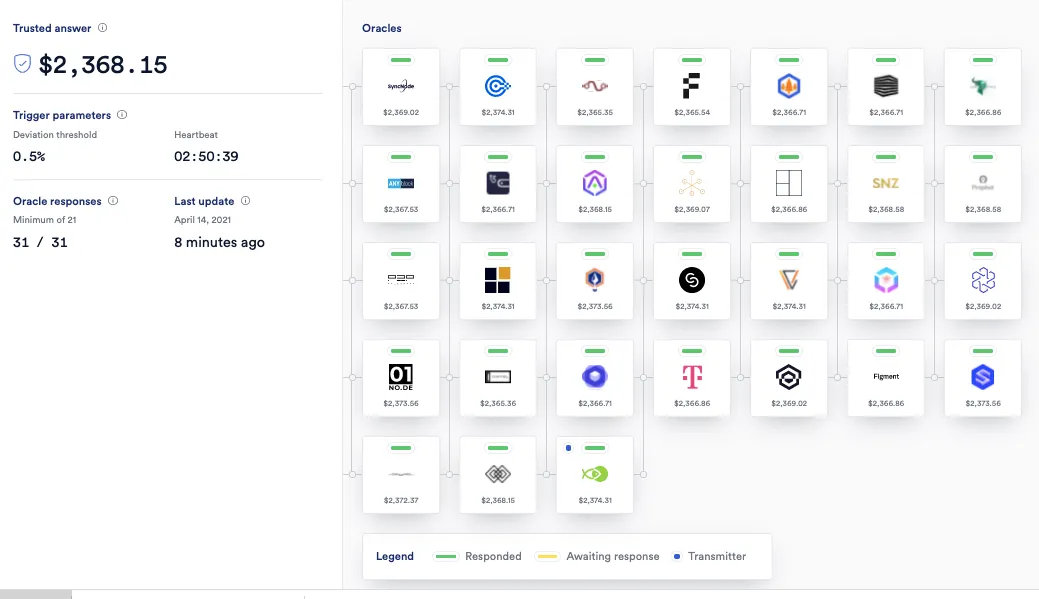

Nazarov believes that oracle networks and hybrid smart contracts are the way forward. In the past two years, Chainlink has emerged as the dominant decentralized oracle provider for Ethereum’s DeFi space, where it connects blockchains to external resources such as price data.

The new whitepaper, titled Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks, builds on the foundation the startup has established to reveal a new “MetaLayer” architecture for hybrid smart contracts; “the place where all of the coordination happens,” said Nazarov.

He said that this coordination would apply to all of the activity across blockchains and off-chain systems. “What’s going to define the new use cases is their ability to coordinate valuable outcomes across blockchains, and everywhere else. And that coordination is what hybrid smart contracts are really about.”

The services Chainlink currently provides include price feeds, which are used by projects to secure billions in value; APIs to connect blockchains to off-chain resources (such as weather data for insurance) and also smart contracts to perform audits verifying proof of reserves—for stablecoins, for instance.

In fact, hybrid smart contracts are already used by a number of DeFi projects, including stablecoin provider Paxos, which uses Chainlink for both price data and proof of reserves., said Nazarov.

“DeFi is a collection of hybrid smart contracts interoperating with each other, and then using oracles to allow themselves to operate properly,” he explained. Chainlink 2.0 will boost the services available to projects, and allow people to build more advanced smart contracts that will enable DeFi to grow.

“We've learned an unbelievable amount about what it takes to build a good hybrid smart contract [and] what it takes to build a good, highly reliable set of oracles into an oracle network,” he added.

Diving Deep into the MetaLayer

Hybrid smart contracts will lead to advanced Decentralized Oracle Networks—which the whitepaper terms “DONs”—that serve as an off-chain computation layer, anchored to blockchains for security. “We're evolving from simpler oracle networks into more advanced Oracle networks called DONs, and then a large collection of DONs will form a MetaLayer,” explained Nazarov.

The MetaLayer—and even its definition—is still a work in progress. But, essentially it’s where hybrid smart contracts connect to a payment network, an ad network, or any other outside system, and coordinate these interactions.

The MetaLayer allows for more off-chain resources; higher-frequency updates for price feeds and better cost-efficiency and security for NFTs and new applications, such as decentralized identity services.

“There's going to be a set of Chainlink identity tools, where users can get identity data into their smart contracts, which is going to allow them to build smart contracts that comply with regulations, and that are usable by enterprises,” said Nazarov.

It will give rise to a new suite of decentralized services for a much broader set of users and use cases not possible or practical today.

This increase in services and users will result in a growing pool of fees, which will, in turn, increase the security of the networks, said Nazarov: “We need an efficient system that is going to be able to provide security but do it in a scalable, efficient way.”

Implicit staking and explicit staking are both powerful cryptoeconomic forces. While Implicit staking creates guarantees about adherence to a protocol generally, explicit staking creates specific guarantees about fulfilling individual contract requests.https://t.co/gTvRNqO6Us pic.twitter.com/0OrDZr6m3d

— Sergey Nazarov (@SergeyNazarov) January 8, 2021

The white paper introduces an idea of how better crypto-economic security can be achieved—a concept called “super-linear staking.” It increases security because, in order to successfully mount an attack on the network, a bad actor would need a budget quadratically greater than the combined security deposits of all oracle nodes.

“Better staking is about being able to efficiently scale that security to match the security needs of the hybrid smart contract, as that hybrid smart contract has more value flow into it,” said Nazarov. “If you don't achieve super-linear staking, you're going to have very large costs for providing crypto-economic security.

He explained how what’s been tentatively called “the alerting award” works: the value to any one node in an oracle network for proving that somebody is misbehaving has been made very large, he said. So all the nodes have a massive incentive to detect a fault. “It makes staking scalable enough to support trillions of dollars in value, which is where the system is going.”

Thousands of oracle networks

The whitepaper is a long-term, multi-year view of changes already being incrementally implemented. But it also speaks to Chainlink's need to outrun competitors who are beginning to make a mark—such as Band Protocol, an oracle service that’s targeting institutions, and is used by the Cosmos blockchain.

Currently, however, LINK has 40 times the market cap of BAND, and the possibilities for hybrid smart contracts powered by multiple oracle networks are exciting.

Chainlink has already laid the ground for their growth. Launched last month, an upgrade implementing On Chain Reporting (OCR) is bringing 10 times more data on-chain to boost DeFi products and services. It means that, now, data aggregation happens entirely off-chain. Nazarov said this has created a 90% reduction in costs because node operators no longer have to pay for multiple transactions to bring data on-chain for aggregation.

Chainlink’s oracles are now also used for emerging applications in insurance, gaming, NFTs, and more. In fact, the use of Chainlink’s verifiable randomness function has “skyrocketed” during the boom in the collectible cryptographic tokens, said Nazarov; projects like Aavegotchi use the service to mint NFTs with provably rare attributes and PoolTogether employs it to fairly select winners in its no-loss lottery.

“Decentralized oracle networks are unbelievably configurable,” said Nazarov. “And that's why—literally right now—we’re at the level of hundreds of oracle networks, and we're going to thousands.”