Why did Bitcoin, Ethereum crash?

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$63,368.00

-3.40%$1,834.81

-2.31%$1.33

-2.23%$592.50

-0.78%$0.999901

0.01%$77.02

-2.19%$0.280956

-2.15%$1.031

1.50%$0.091429

-3.37%$47.52

-3.11%$1.00

0.05%$485.37

-10.19%$0.258296

-2.61%$7.85

-2.32%$26.40

-4.18%$0.161693

0.77%$0.99917

0.02%$8.19

-1.68%$314.25

-2.07%$0.149988

-1.69%$0.999133

-0.01%$0.00928119

-3.61%$1.001

0.09%$0.093919

-1.19%$51.06

-1.67%$233.72

-4.22%$8.31

-2.42%$0.00000595

-1.90%$0.861584

-2.85%$1.33

-1.09%$0.074054

-0.57%$0.106942

-7.02%$5,155.74

0.90%$1.40

0.97%$5,195.64

1.04%$3.32

-1.40%$1.26

-1.20%$1.00

0.00%$0.585494

-0.79%$0.997325

-0.00%$113.69

-0.84%$0.692769

-1.32%$0.00000393

-2.39%$0.99987

-0.00%$169.17

0.66%$1.12

0.00%$0.999892

0.02%$2.20

-1.57%$73.33

-3.22%$0.00000164

-2.11%$0.161725

2.56%$0.063393

2.80%$0.999027

-0.01%$8.18

-1.26%$0.975856

-2.20%$0.24527

-2.47%$11.00

0.01%$6.66

-3.87%$2.05

-0.74%$0.10557

0.08%$8.19

-1.16%$0.369254

-1.60%$0.00177009

-6.44%$2.06

-6.15%$0.01734321

0.86%$0.057299

-1.52%$63.38

-0.85%$0.999662

-0.03%$0.823286

-1.19%$0.02985829

-0.49%$1.23

-0.19%$0.095681

-3.65%$0.00898489

-1.95%$3.27

0.32%$0.754869

7.63%$0.08342

-1.92%$0.999885

-0.01%$114.39

0.02%$1.027

0.04%$1.11

0.47%$1.36

-1.78%$0.03363408

0.52%$0.875845

-2.78%$0.808646

-3.90%$0.00717758

-1.97%$0.08008

0.07%$1.095

0.03%$0.998231

0.34%$1.56

-0.45%$0.091317

-1.71%$0.99969

0.00%$0.02892135

-2.03%$0.01299051

0.47%$0.00000578

-2.83%$0.998928

0.00%$1.086

-0.28%$27.34

5.43%$0.999816

0.01%$1.18

-0.22%$0.141848

-2.38%$0.065405

-2.72%$0.232775

-1.78%$0.228819

-14.81%$31.70

-2.57%$0.0452285

2.84%$166.78

1.40%$1.20

-4.13%$0.368038

-0.08%$0.00628969

-1.50%$0.999006

-0.02%$0.585247

-2.73%$1.006

-3.90%$0.03409301

0.77%$0.152389

-2.09%$1.37

-2.73%$1.02

-0.04%$0.077314

-2.42%$0.999761

0.03%$0.445866

0.47%$0.00000033

-0.42%$0.218637

-3.44%$0.00000033

-1.28%$3.22

-4.72%$0.01642932

-2.02%$118.97

1.15%$0.052936

-1.67%$3.14

-1.74%$1.50

-4.07%$14.91

-2.69%$0.99832

-0.19%$0.04971805

-1.88%$0.307989

1.43%$0.065455

-0.98%$0.02569404

-2.81%$0.0055624

-1.70%$0.992615

0.30%$0.0000278

-2.01%$17.04

-2.09%$1.63

2.56%$0.295132

-1.65%$0.273806

-5.64%$1.36

1.04%$0.295661

-1.73%$0.04825725

-2.58%$0.115979

-5.22%$0.00247941

0.35%$0.132338

-18.92%$0.00250284

-2.96%$0.066759

-2.06%$0.999868

0.06%$0.198118

-5.65%$5.96

-2.67%$0.999997

0.01%$0.988291

-0.00%$0.04001796

-4.15%$0.295723

5.25%$1.075

0.03%$0.02002568

3.27%$0.99966

-0.02%$1.68

2.28%$0.07792

-2.40%$0.100213

-0.33%$22.79

-0.31%$0.49414

-1.49%$1.21

-2.53%$0.00208306

3.33%$0.00000096

0.31%$0.199821

-2.38%$1.19

3.34%$5,179.68

-2.49%$0.00003515

1.03%$1.00

0.00%$0.086242

2.20%$2.63

0.25%$0.051235

-2.22%$0.183849

-2.94%$0.185421

-4.34%$1.00

0.00%$0.075939

-2.87%$0.00471773

-2.33%$0.089781

-3.07%$0.01865989

-1.08%$0.762958

-0.30%$0.114306

-1.27%$0.02343361

3.47%$1.00

-0.02%$0.02037144

3.61%$17.12

-0.49%$1.79

-0.52%$0.0034674

-2.67%$2.04

-3.95%$8.35

1.62%$47.99

0.00%$1.73

-3.23%$0.994545

0.19%$1.25

-0.40%$0.578029

-3.30%$0.04944694

-3.35%$3.50

-6.05%$0.997891

-0.02%$3.24

21.58%$0.150097

-2.98%$0.149954

-5.37%$1.91

-4.65%$1.00

0.15%$1.014

-0.00%$0.02612927

45.16%$0.00000743

-2.23%$0.03918566

-2.21%$0.14201

-9.45%$0.306001

-0.62%$0.312712

-0.76%$0.382946

-1.08%$0.620557

-3.91%$8.65

0.73%$1,097.39

0.03%$12.01

-13.38%$0.153705

-2.61%$0.130555

-0.66%$0.319189

-0.51%$0.073587

-2.18%$0.994986

0.01%$0.077384

-2.20%$0.125474

-1.62%$0.25084

-1.22%$4.25

-1.80%$0.131288

0.52%$0.592894

32.57%$0.575041

2.76%$0.086539

-2.89%$0.12201

-7.81%$0.217432

1.90%$0.276088

-3.00%$0.00144321

-1.54%$1.84

-3.34%$0.348858

-15.45%$1.001

-0.01%$1.01

-0.36%$0.241119

-4.22%$0.999491

-0.03%$0.00383884

-0.78%$12.22

15.72%$0.071963

-1.85%$0.333029

-1.89%$1.45

13.30%$1.00

0.08%$1.062

0.01%$0.999875

0.02%

The prices of Bitcoin (BTC) and Ethereum (ETH) shed 6% and 7%, respectively, over the past 24 hours, wiping out recent gains.

The swift and bearish price action also resulted in roughly $133 million in Bitcoin and Ethereum positions liquidated, according to Coinglass. The majority of these positions were longs.

Currently, Bitcoin is changing hands at $29,587, down 5.85% over the day, according to data from CoinMarketCap.

This also puts the largest cryptocurrency with a market capitalization of $563.33 billion down a whopping 57.06% from its all-time high of $68,789.63 recorded last November.

Ethereum is also struggling to maintain its recent bullish momentum. The second-largest cryptocurrency has shed 7.42% over the past 24 hours and currently trades at $1,764.

The current bearish action puts Ethereum down 64.02% from its all-time high of $4,891.70, recorded in November 2021, according to data from CoinMarketCap.

According to Crypto Fear & Greed Index, a way to gauge crypto market movements and whether cryptocurrencies are fairly priced is down (15 out of 100) indicating “extreme fear” in the markets.

One of the likely reasons behind today’s bearish action is reduced DeFi activity on Ethereum and a slump in Bitcoin trading activity.

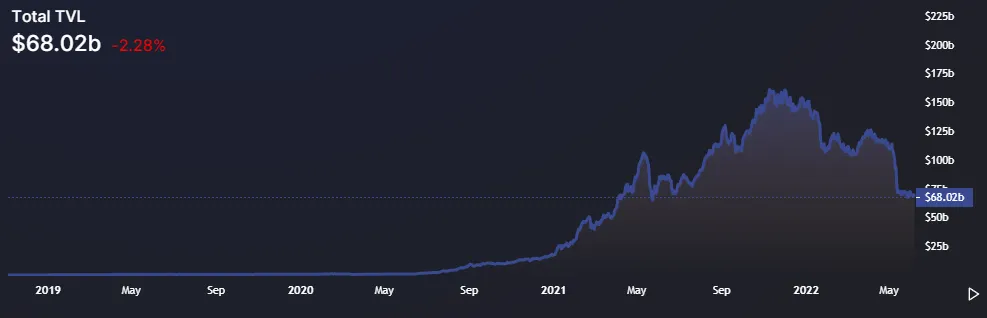

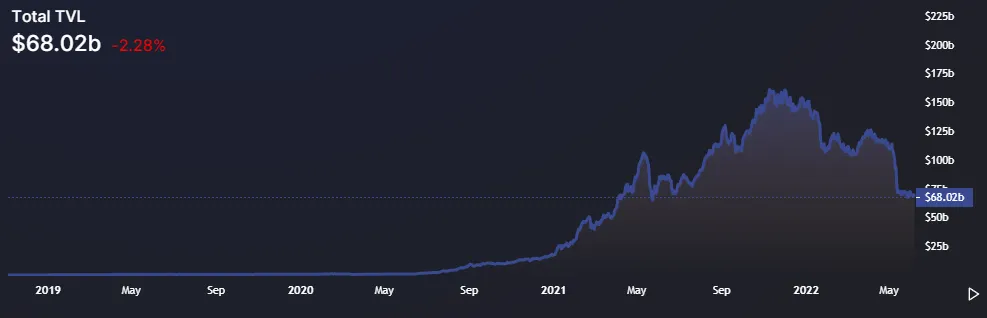

Total Value Locked (TVL) across different protocols in Ethereum fell from $88.67 billion to $68.02 billion over the past 24-hours, according to data from DefiLlama.

TVL on Aave, the largest DeFi protocol on Ethereum, lost 15% over the past month.

Other blue-chip projects like MakerDAO, Curve Finance, Lido, and Uniswap also lost double-digits of TVL over the same period.

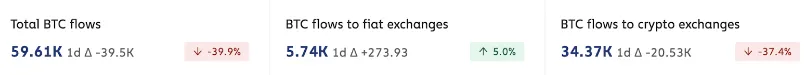

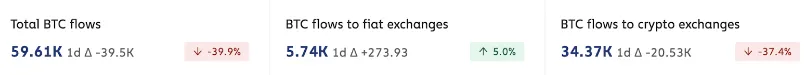

Elsewhere, Bitcoin’s flow to fiat exchanges (where people can sell Bitcoin to cash) is up 5% over the past 24-hours, suggesting a sell-off of Bitcoin to cash.

The flow of Bitcoin to crypto exchanges is down 37.4%, indicating reduced demand for BTC among investors, according to data from Chainalysis

Still, the daily transaction volumes on Ethereum and Bitcoin remain stable over a period of time.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.