It’s been a wild two weeks in Cryptoland, and nothing has been more dissected than the collapse of Terra’s algorithmic stablecoin UST, now trading at about 6 cents. But as the dust settles, how are things looking for other stablecoins?

Circle’s USDC appears to have come out as a key winner among the top stablecoins. According to data from CoinMarketCap, the market’s second-largest stablecoin jumped from a market capitalization of roughly $48 billion on May 11 to more than $53 billion today. (Though supply and market caps aren’t the same things, there’s very little deviation between them because USDC held on to its peg throughout last week’s volatility. For reference, there are currently 52.99 billion USDC in circulation.)

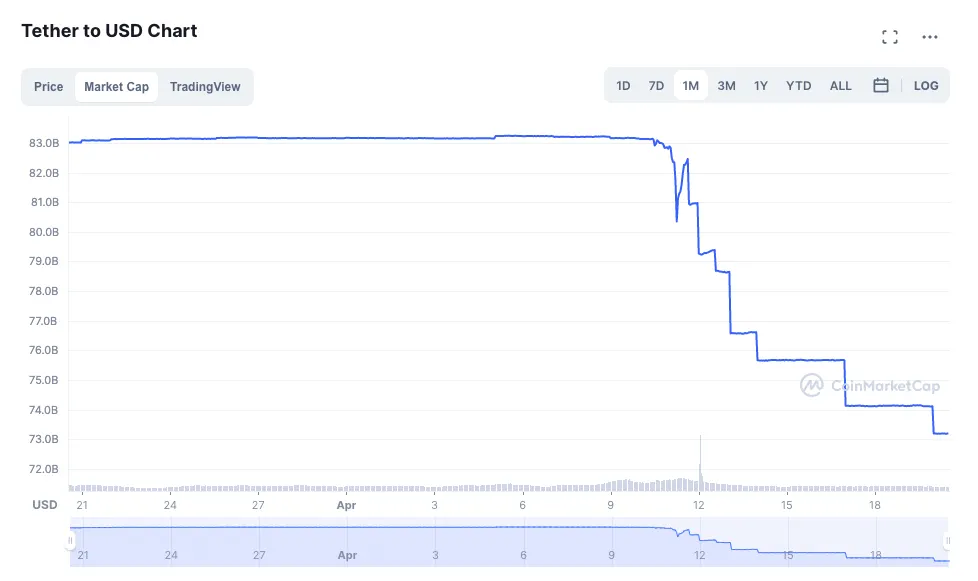

The story is different for stablecoin market leader Tether (USDT).

Over the same period, USDT’s market cap plummeted from just over $83 billion down to $73.19 billion, according to CoinMarketCap. There are currently 73.28 billion USDT in circulation.

For a brief moment, USDT also lost its dollar peg, dropping as low as $0.95. This, and perhaps the ticker’s possibility for confusion with Terra’s UST, contributed to billions of dollars in redemptions—hence the steep drop in the token’s market cap. Redemptions refer to any time a USDT holder requests to swap their holdings for traditional dollars. Tons of investors were eager to do exactly this. Tether’s CTO Paolo Ardoino said on May 17 that the firm "redeemed [$7 billion] in 48 hours, without the blink of an eye."

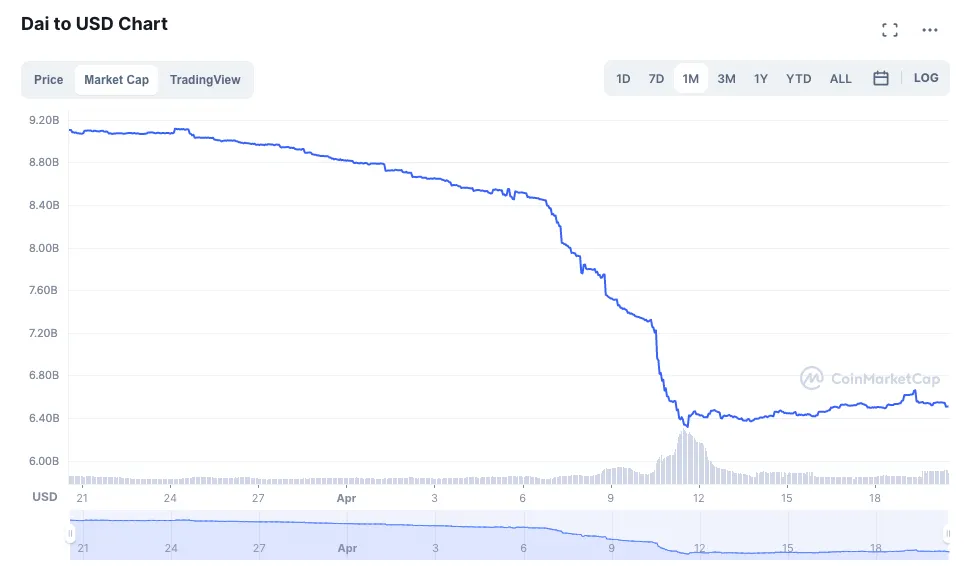

Still, as the centralized stablecoin titans duke it out, what about decentralized solutions like MakerDAO’s DAI? After all, prior to UST’s stellar rise, DAI was the market’s first and largest decentralized stablecoin.

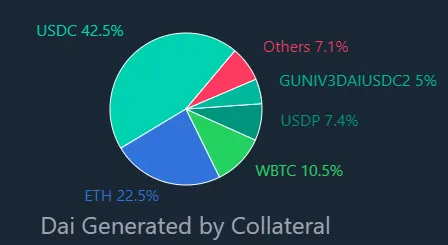

Unlike USDT and USDC, which are managed by centralized companies and allegedly collateralized by traditional financial assets, DAI is backed by a combination of various cryptocurrencies, including Ethereum, Wrapped Bitcoin, USDC (yes, it’s controversial), and other crypto assets.

The Maker protocol, which manages DAI, also leverages smart contracts that automatically liquidate debt positions that fall below their loan-to-value ratio.

For every $1 of DAI you mint on Maker, you need to deposit $1.70 worth of ETH; if this ratio comes out of whack due to a swift price drop in the ETH deposited, then you need to top up your collateral position or risk getting liquidated.

For an interesting read on how these liquidations happen and what they mean, check out the story of 7 Siblings, a large MakerDAO user.

Thus, for the Maker protocol and its DAI token, there’s a lot going on.

Technically it's algorithmic (like UST), but it’s also collateralized (like USDT and USDC). Still, and despite the mechanism's ability to safely navigate market volatility and 257 liquidations over the last two weeks, it wasn’t a top choice for investors last week.

The following chart clearly shows a steep drop-off akin to USDT’s move, but DAI has since found a floor of sorts.

Another key piece of data does, however, indicate that at least some investors were buying up tons of DAI: a premium emerged amid the collapse of Terra’s UST.

USDC, Binance’s BUSD stablecoin and DAI all enjoyed a 1% to 2% premium as demand for each of these tokens rose dramatically.

But while everyone is sounding the death knell on algorithmic stablecoins, DAI survived. It didn’t fall apart during what was an extreme bout of volatility, and even behaved like a safety net for some investors.