Wearied by the ups and prolonged downs of crypto trading? Depressed by diminishing block rewards? Why not join an expanding segment of the cryptosphere that’s been increasingly investing in a process known as staking.

Generally speaking, “staking” means using coins as collateral to make a decentralized network more secure, in exchange for token rewards. It’s a counterpoint to mining, where one uses energy—computing, powered by electricity—to earn coins (as well as dirty looks from environmentalists.)

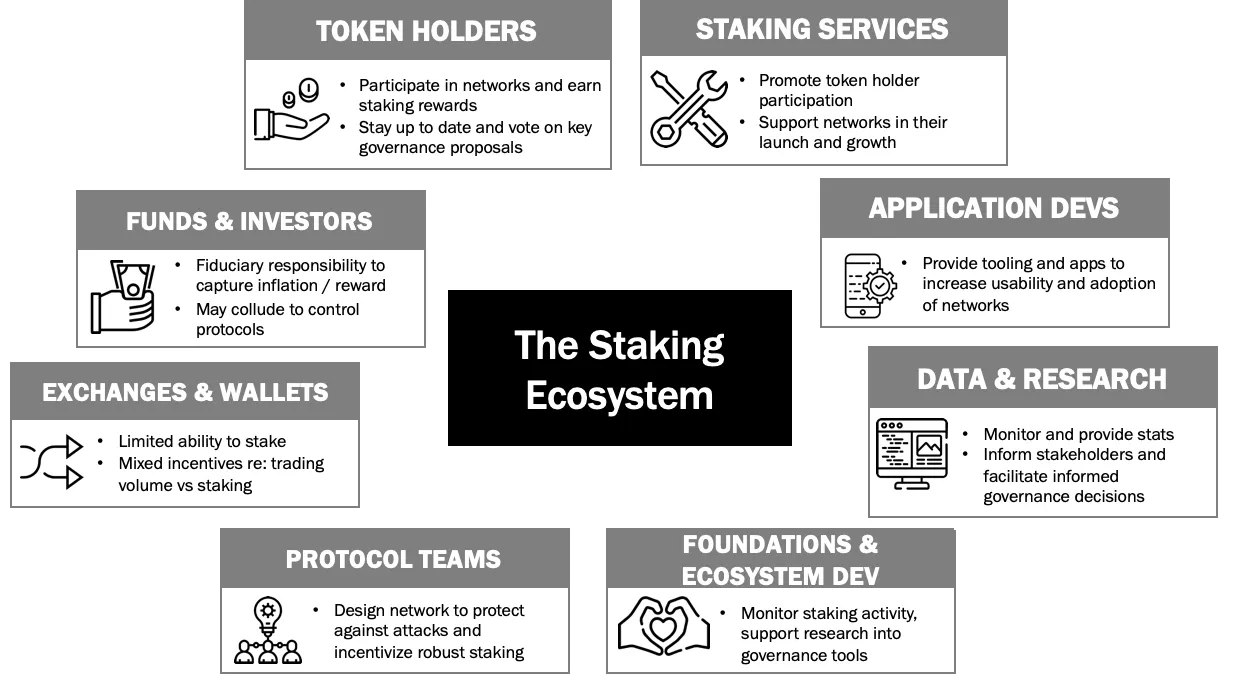

Many see staking as a natural evolution of blockchain, and dozens, if not hundreds, of new staking-related services are springing up, aiming to develop, commercialize and advance the practice. And that’s generating some concern among purists who point out that the trend toward third parties providing “staking-as-a-service”—and the pooling of tokens for greater leverage, as well as custody and exchange functions—is starting to look a lot like traditional banking.

Decrypt recently sat down with Meltem Demirors, chief strategy officer at crypto research and investment provider, CoinShares. Demirors was educated at MIT and Rice. She is a guest lecturer at Cambridge and, before getting into crypto, worked as a consultant at Deloitte among other things. She’s now one of crypto’s foremost influencers and co-host of the Crypto Springs annual conference (with Lightning Labs’ Elizabeth Stark and Keiser Report co-presenter Stacey Herbert.)

Demirors recently organized the Inaugural Staking Summit, She's steeped in staking knowledge, as both an investor in various projects and an advisor to Tezos, one of the big five proof-of-stake (PoS) protocols, and to staking-as-a-service startup Battlestar Capital.

Staking as a service is a “multibillion-dollar industry,” she said.

“There are a lot of existential questions about the future of staking: what does control mean? And will exchanges or other aggregators end up becoming control points? Or will there be a separation of interests—from staking to secure the network, versus staking for governance? It's a really ripe field for experimentation, innovation.”

The staking landscape

EOS, Tezos, Dash, Decred and NEM are the five biggest staking protocols, but staking is possible with all cryptocurrencies that use PoS consensus. By the end of the year, over $1 billion is expected to be paid out in stake rewards. Several multi-billion dollar networks—including Binance’s BNB token, Cardano and, eventually, Ethereum—are expected to shift to PoS, while other networks are expected to launch with the consensus mechanism. The value of these future PoS networks is estimated to exceed $8 billion.

The nitty gritty of staking means that users lock up their tokens to secure a blockchain network; the coins are used to “vote,” validating transactions, and producing new blocks. As these new blocks are “found,” the stakers are compensated with a reward, which can range from around 5 percent to 25 percent annually, depending on the network and the level of participation.

That’s all well and good, said Demirors, but few people, or funds, have the desire, let alone expertise, to roll up their sleeves and actually learn, track, and participate in all the elaborate rituals associated with staking across numerous protocols. Likewise, in a perfect world, the functions tokens perform make investors fiduciaries; if they’re long an asset (i.e. plan to hold it for a while,) they should be earning inflation to preserve their pro-rata share of the network.

Staking-as-a-service players, such as Battlestar Capital, solve both problems, said Demirors. Indeed, Battlestar promises to pay customers an annual return of up to 30 percent on idle cryptocurrency holdings.

Exchanges and custodial wallets are the natural coin aggregators, and therefore the key players in the staking landscape, said Demirors. “It’s basically like a central depository for stocks and management of rights.”

These type of services have equivalents in the traditional finance world. There, most savings reside securely in interest-generating bank accounts, or are pooled into funds and managed by third parties.

Many people find this arrangement convenient and effective. A crypto utopia in which “everyone is their own bank,” with complete control over their private keys, may be desirable from a decentralization and security perspective, but pooling monetary power with others, and delegating the business of investing and managing the funds, has been popular for generations.

With this in mind, and in line with the trend, leading exchange, Coinbase announced, at the end of March, that it will start to offer staking services for institutional clients that hold XTZ, the native token of the Tezos blockchain. After fees are deducted, the service promises to earn stakers a return of over 6 percent—a handsome return compared to something like U.S.Treasury Bonds—and, as competitors emerge, returns will become more attractive.

Staking for governance

The more coins you have, the more powerful a staker (and creator/validator) you are. So those in the know not only want to stake coins on behalf of other people (they charge 10 to 40 percent for this, since they are returning block rewards) they are also looking to influence voting, and the direction of the network.

The process works differently depending on the protocol. In EOS, coin holders vote for block producers (which some say is little more than a glorified popularity contest.) In Tezos, there’s something called “delegation.”

Currently, anyone who holds 10,000 units—approximately $10,000—in XTZ, can participate in the blockchain building process, which Tezos calls “baking.” But it’s a technical affair that requires running a software node. As a result, many XTZ holders prefer to sit on their currency rather than deploy it in the baking process.

“People are starting to form alliances across different protocols. You’re starting to see a lot of formalization now that people realize there’s so much money there.”

Demirors, as a Tezos investor, is also part of a Tezos-delegation service called Tezzigators. She said she’s seeing clear signs that major XTZ holders, such VC firm Polychain Capital, which owns about 10 percent of the network, are building partnerships or acquiring other delegation services, with the objective of gaining further influence. “People are starting to form alliances across different protocols,” she said. “You're starting to see a lot of formalization now that people realize there's so much money there.”

Staking a claim for representative democracy

Clearly, developments such as staking-as-service and the growth of powerful cartels risk centralization of power and oligopolistic behavior, where a few large parties become wealthier.

Even without these risks, many question whether staking results in equitable distribution of power. The ICO model has resulted in protocols where, in some cases, large investors can hold as much as 80 to 90 percent of the coins, said Demirors. Often “there are five or six funds which ‘won’ 50 per cent, and those people are effectively running the network, because they're earning all the staking rewards. And moreover they are participating in governance decisions and they own a quorum majority.”

And there’s more at stake (to coin, umm... a phrase.) Reserves that accumulate with large aggregators—such as exchanges— become centralized honeypots, and are ripe targets for for hackers to exploit.

Avoiding these situations is the subject of much debate, and protocols such as Cosmos have made moves to actively remove cartels from their system.

Solutions include quadratic voting and progressive taxes, where the larger your staking operation, the less your vote counts. Such systems are efforts to roll out representative democracies. But Demirors warned that this may also result in too much complexity in governance. “This is not to say these things can’t work, but I think we need a healthy dose of data-driven realism.”

And she also believes that, because most protocols were developed by technologists with minimal input from, say, political scientists, behavioral economists and ethicists, “many of these systems are really ripe for abuse.”

Staking a vote

The crux of the problem is that correcting governance issues can be hard once a project has completed its ICO. And in some cases, the system that’s been cooked up constitutes nothing like a representative democracy.

Take EOS, for instance, said Demirors. It’s effectively a plutarchy, with only 25 percent of the people who hold EOS tokens actually voting, and one project, Block.one, owns 10 percent of all EOS tokens. “So there are a lot of questions around control. A small group of insiders, who own the majority of the token, gets to decide what happens.”

She pointed too, to lack of incentive as a reason for poor voter turnout. A recent vote on the Aragon blockchain, attracted only 0.3 percent of token holders.

One reason put forward, was that the only incentive to participate is to “govern.” But Demirors believes that there are ways, such as a proxy voting tool, that protocols can employ to persuade token holders to perform their fiduciary responsibilities.

Staking an evolution

(Here’s where the Romans come in. Or a Roman, anyway.)

Staking, said Demirors, is fundamentally entwined with thorny issues of governance. She cited a Roman historian, Polybius, who argued that politicians and governing bodies should not accept money to make decision.

“You cannot pay people exorbitant amounts to govern,” said Demirors.

Decisions made about the recipients of payments and grants by those that control protocols are one of the main reasons. These are criticisms that pertain to a number of protocols, from Decred with its decentralized treasury to the recent $5 million grant Ethereum made to developer Parity, which is also working on a rival blockchain, Polkadot.

Added Demirors: “Really, the problem we're trying to design for is one that's is as old as human, social organization: It's who gets to decide what happens next.”