In brief

- Crypto derivatives exchange BitMEX has announced that it starts 2021 with “a fully verified active user base.”

- The completion of its User Verification Programme comes on the heels of various charges filed by the CFTC in October.

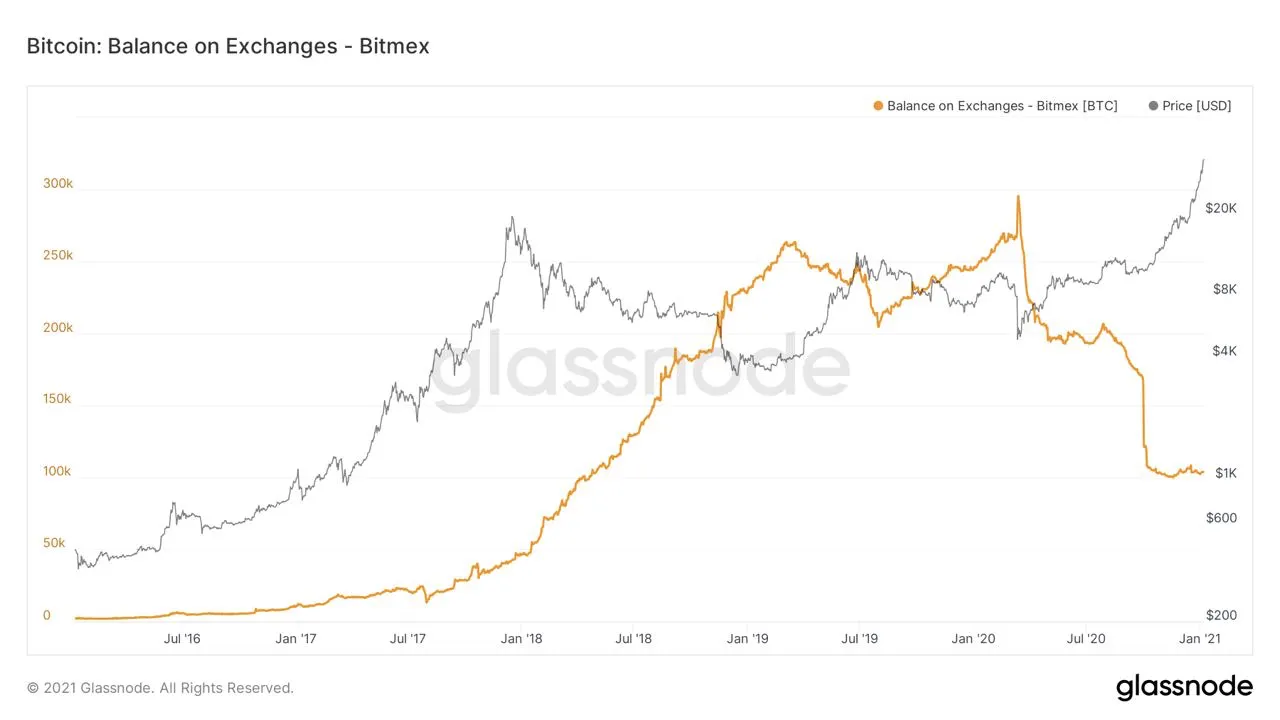

- Meanwhile, BitMEX users' Bitcoin balances have decreased by two-thirds in 2020.

Crypto derivatives exchange BitMEX has announced the completion of its “User Verification Programme,” claiming to start 2021 with “a fully verified active user base.”

“We’re pleased to confirm that our User Verification Programme has been successfully implemented, making BitMEX one of the largest crypto derivatives exchanges in the world with a fully verified active user base,” said the announcement.

As Decrypt reported, BitMEX ramped up the rollout of its know-your-customers (KYC) program on October 21—after the Commodity Futures Trading Commission (CFTC) filed money-laundering and other civil charges against it.

“The completion of our User Verification Programme [...] places us in an advantageous position to capitalise on the surge of users – both retail and institutional – who are seeking a platform on which to trade crypto derivatives confidently without sacrificing security, liquidity, or performance,” added Alexander Höptner, CEO of 100x Group, the holding structure for BitMEX.

While users may be ostensibly flowing in, the exchange has been seeing an outflow of Bitcoin (BTC) from its users’ accounts—and that process accelerated greatly after CFTC filed the charges.

During the course of 2020, BTC balances on BitMEX shrunk by roughly two-thirds in total—from nearly 300,000 BTC ($11.55 billion at current prices) to just over 100,000 BTC ($3.85 billion), according to crypto analytics firm Glassnode.

Meanwhile, it’s not that users had any choice but to complete their KYC procedures—not if they wanted to get their crypto back, anyway. According to BitMEX’s initial announcement, all its customers who remained unverified by December 4 would’ve lost the ability to deposit, trade, and withdraw their funds.

“With remaining open positions from unverified accounts closed and the scheduled expiry of the December 2020 futures on 25 December complete, 100 percent of volume on the BitMEX platform is now fully verified,” the announcement said today, adding, “Over 100 billion USD equivalent volume has been traded following the 4 December verification deadline.”

In mid-November, BitMEX partnered with Eventus Systems to additionally support its “trade surveillance and anti-money laundering transaction capabilities.”

Looks like it has truly turned over a new leaf.