Hold onto your hats, tech enthusiasts, because Goldman Sachs has just thrown a curveball in the ongoing saga of generative AI. In their latest report, the investment powerhouse seems to have changed its phrasing from cautious optimism to a more skeptical outlook on the immediate benefits of AI investments.

The global investment banking firm’s June 2024 report, “Gen AI: Too Much Spend, Too Little Benefit?” provides a reality check for those bullish on AI. Despite the tech industry's exuberance and a staggering $1 trillion that’s forecasted to be spent on AI infrastructure, the report highlights the sobering view of MIT’s Daron Acemoglu and Goldman Sachs' own Jim Covello.

Acemoglu estimates that AI will automate less than 5% of tasks in the next decade, contributing a meager 0.9% to GDP growth. Covello goes even further, arguing that the current AI tech isn’t equipped to solve complex problems cost-effectively—at least not one that’s worth investing $1 trillion dollars on.

“AI bulls seem to just trust that use cases will proliferate as the technology evolves,” he said in an interview cited by the report, “but eighteen months after the introduction of generative AI to the world, not one truly transformative—let alone cost-effective—application has been found.”

For Jim Covello, this issue has some level of resemblance to the dotcom bubble (and for us, crypto). However, the impact of a future AI winter will depend on the real use cases that the technology can offer.

“If AI technology ends up having fewer use cases and lower adoption than consensus currently expects, it’s hard to imagine that [a bust of the AI bubble] won’t be problematic for many companies spending on the technology today,” he said.

Covello believes the AI hype could last for another 18 months before investors start to lose interest due to the lack of truly meaningful advances.

This issue of the markets being in a bubble has been touched on before by even major voices inside the AI community. Just one year ago, Emad Mostaque, now former CEO of Stability AI, warned about generative AI being an overhyped technology. "I think this will be the biggest bubble of all time," Mostaque said in a conversation with UBS analysts. "I call it the 'dot AI' bubble, and it hasn't even started yet."

But there is also room for some long-term bullishness. Rash Rangan, a U.S. software analyst cited in the report, argues that AI companies today are building the foundations of a next-gen profitable industry.

"The AI cycle is still very much in the infrastructure buildout phase, so finding the killer application will take more time, but I believe we’ll get there," Rangan said. That said, he is not super bullish in the short term and also believes the clock is ticking for AI startups.

“I could become more concerned if scaled consumer applications don’t emerge over the next 6 to 18 months,” he added.

Profitability is in the eye of the beholder

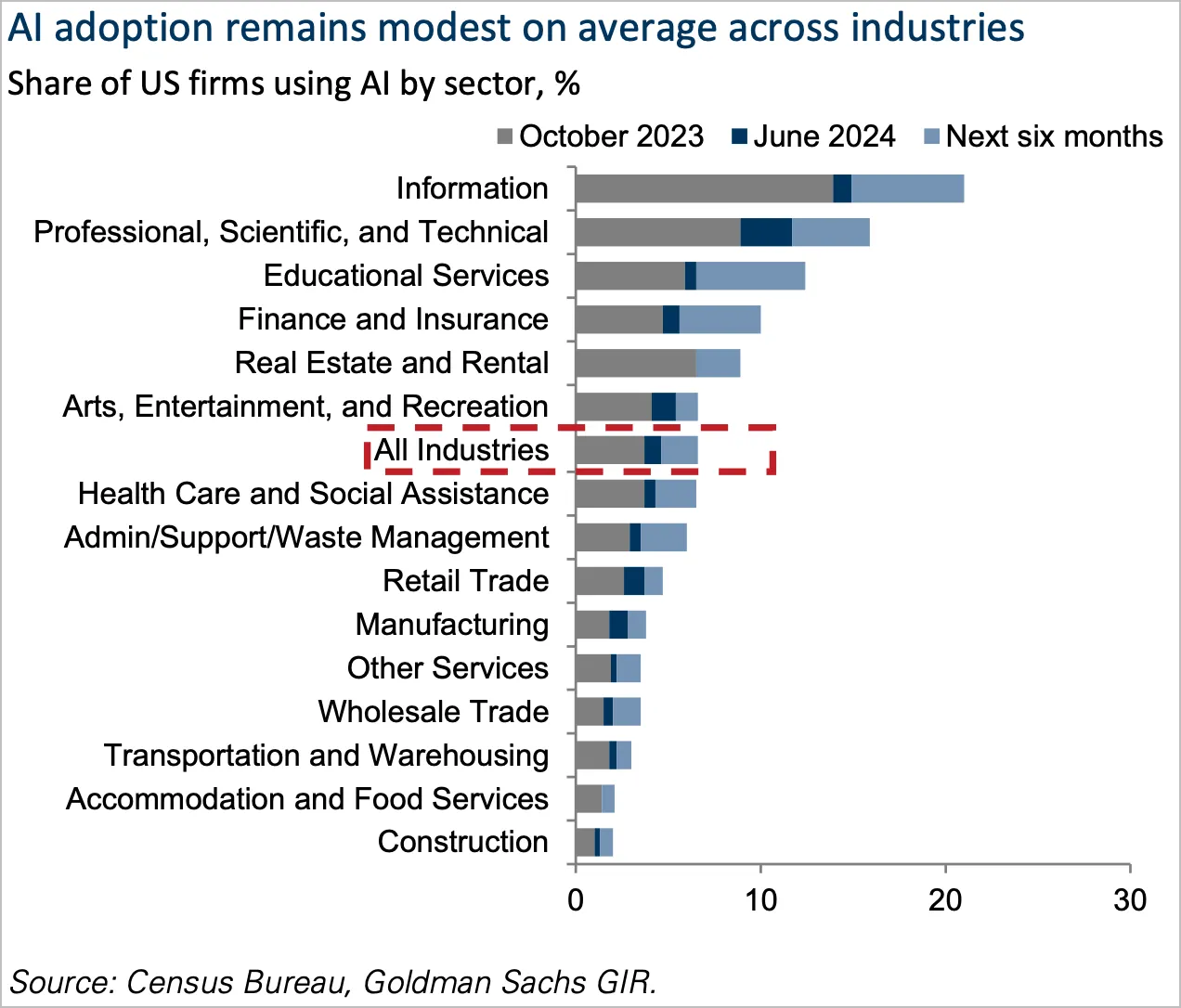

Contrast that with Goldman Sachs’ own May 2024 report, which despite its cautious tone, was practically lyrical about AI’s potential. The report, led by Joseph Briggs, predicted generative AI would eventually boost U.S. productivity by 9% and GDP by 6.1% over ten years. It painted a rosy picture of AI laying the groundwork for future efficiency gains and economic growth, emphasizing early positive signals from AI adoption in specific sectors.

“The early signals of future productivity gains look very, very positive,” Briggs wrote. The report pointed out that generative AI, if proven profitable, would begin providing a meaningful impact on the economy in 2027 at the latest.

This was also mimicking JP Morgan’s outlook for the whole AI industry, which said, “Wall Street thinks today’s AI leaders will deliver better earnings growth than it expected from dot-com leaders even as the AI stocks trade at much lower prices as measured by the P/E ratio.”

For JP Morgan, AI could have a major impact in industries like logistics or finance, in what they called the transition to “AI 2.0.”

So, why the sudden change in tune? The June report pointed out the high costs, slow returns, and significant infrastructure challenges that could throttle AI’s growth.

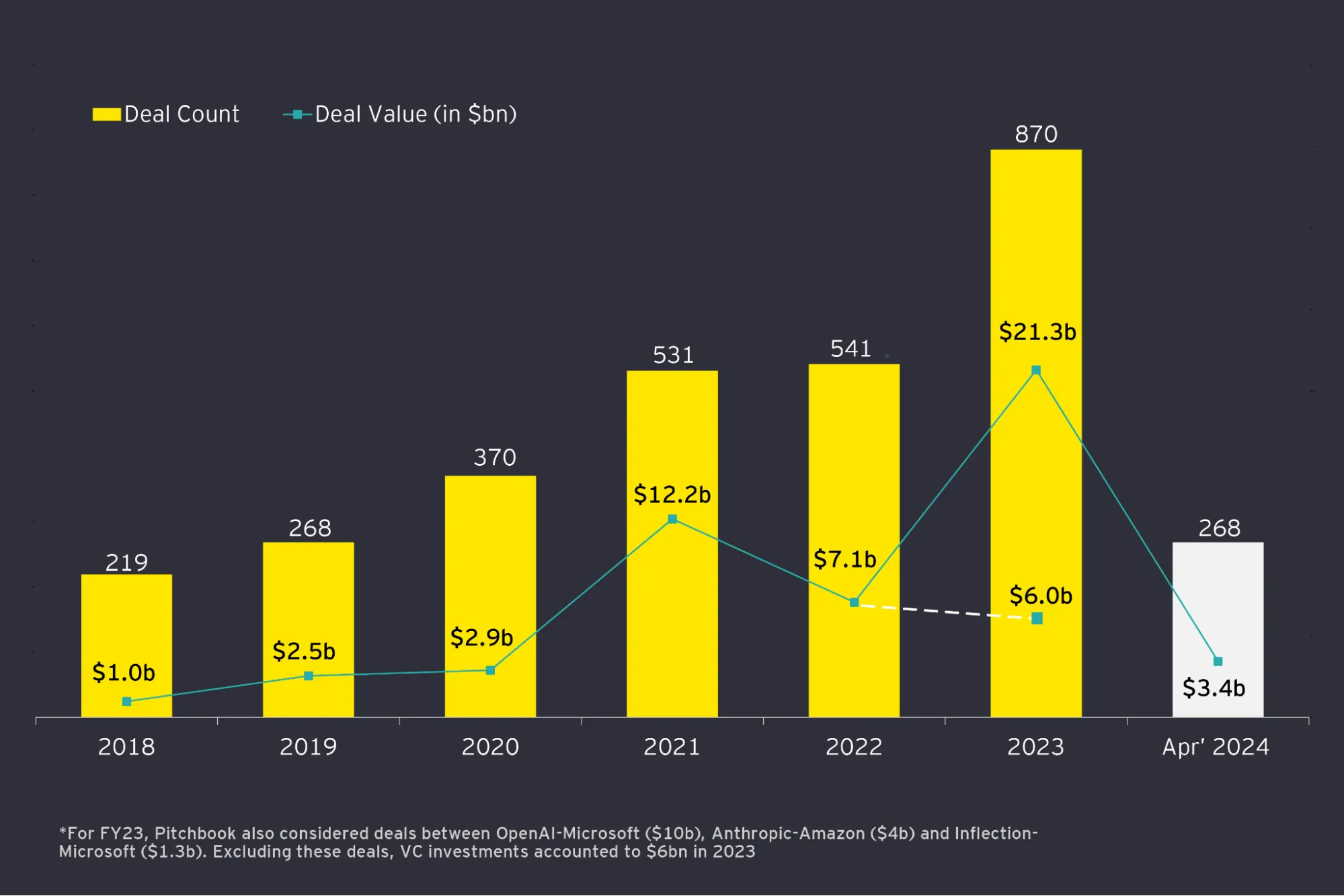

Last year, private investment in generative AI reached more than $20 billion, according to Stanford University, but in 2024 investment significantly dropped with Ernst and Young estimating that around $12 billion will find its way into AI this year.

Not surprisingly, analysts are expecting to see a downward correction in AI-related equities. So, bubble or not, most predictors indicate that the AI market is experiencing a slowdown.

The next few quarters will likely prove crucial in determining whether generative AI can deliver on its promises, or if the industry is indeed headed for a cooling period. This could leave many high-powered GPUs—once crucial for generative AI startups to create all those cute cat pictures and anime waifus– sitting idle as markets recalibrate their expectations.