In brief

- Bitcoin's hash rate has fallen.

- That makes it more susceptible to a 51% attack.

- But analysts say the blockchain is still secure

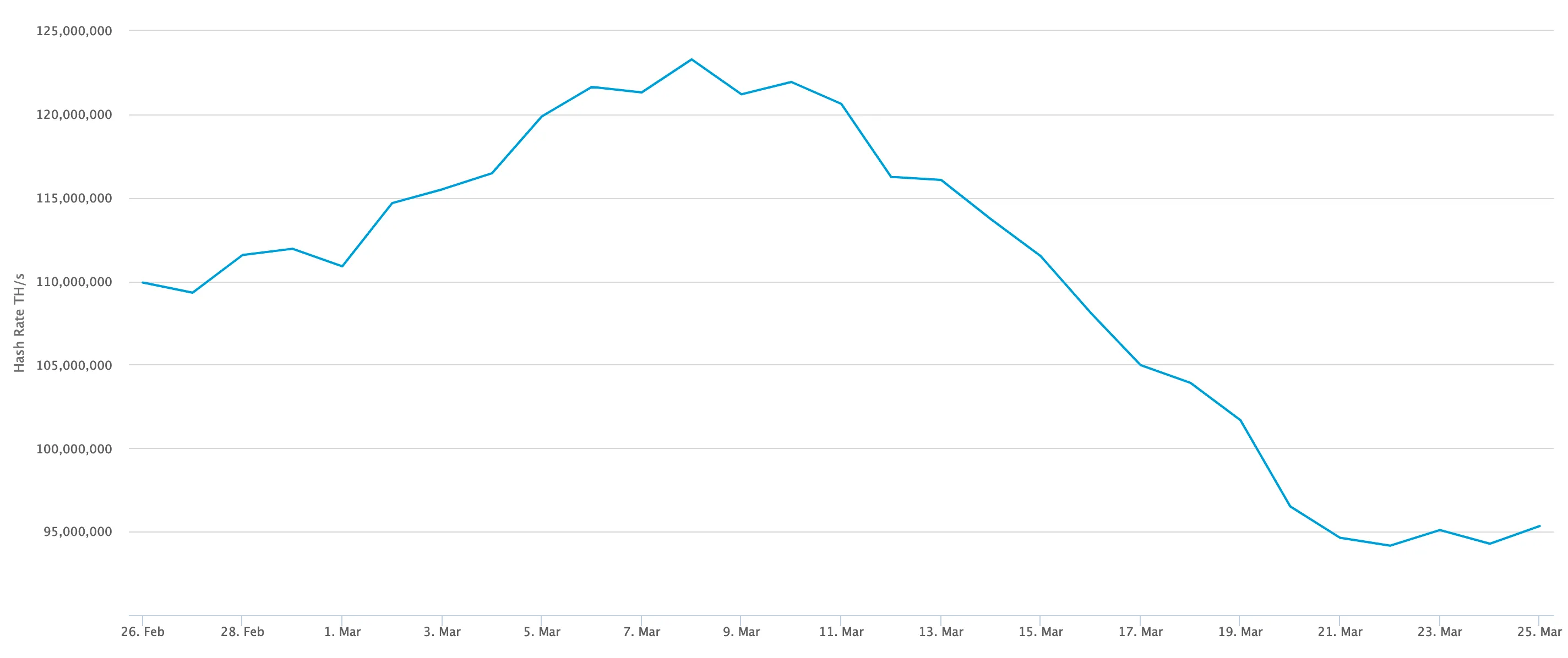

The hash power securing Bitcoin’s network dropped by 16% overnight, and has fallen almost 45% since January.

That means that overpowering the Bitcoin blockchain now could require just $10 million worth of hashpower—a trivial amount of money for a network with a market cap of $121 billion. Such an attack is now $11 million cheaper than it was in January.

Armed with $10 million worth of hashpower—the computational power of mining machines, which are used to secure the Bitcoin network—anyone could launch a 51% attack for a day, according to data from Messari Pro. This attack could lead to recent transactions being reversed and others censored.

Messari extrapolates the cost of a 51% attack based on how much it would cost to rent that amount of hash power on NiceHash, a crypto mining marketplace.

According to Johnson Xu, mining analyst at TokenInsight, a digital token rating and research agency, the drop in difficulty occured “due to the recent market downturn”—when the crypto market crashed along with global markets amid panic caused by the coronavirus pandemic.

Xu told Decrypt that this was made worse by the upcoming Bitcoin halving, where the supply of Bitcoins issued as mining rewards will be cut in half. “The recent market downturn resulted in some miners to close shop or shut down miners temporarily,” said Xu, since it wasn’t profitable to keep running outdated, less powerful Bitcoin mining machines.

Bitcoin is still safe, for now

But according to Xu, even though it’s now cheaper to attack the Bitcoin network, there’s no reason to be worried.

First, “this is a theoretical cost,” he said. Only 0.3% of all hash power is available to rent on NiceHash, according to Messari’s data, so it’s not as easy as simply forking up the money, an attacker would need to get hold of some mining machines.

Second, the prices on NiceHash change over time, so figures are subject to the whims of the crypto market. “As the Bitcoin network adjusts itself and the market stabilises, we will see the theoretical costs stabilise or increase once more.”

But most importantly: “It is practically impossible to perform a 51% attack on the Bitcoin network, as the attacker can not solicit enough hash power to perform this,” said Xu. That’s because nobody will sell enough hash power for anyone to mount a 51% attack.

Bitcoin mining rigs are constantly sold out, and most of the hash power in the market is already used by other miners, he said. Nobody would be willing to give up that amount of hash power just for the sake of a 51% attack, said Xu, because doing so would probably crash the market, which would “provide no benefit” to miners.

And though a staggering 54% of hash power is controlled by Chinese miners alone, according to a December 2019 report by CoinShares, Xu said it’s impractical for mining farmers to coordinate together. In any case, operators of mining pools, which rent out hash power, “do not control that hash power.”

A bigger attack is needed

According to Eric Wall, CIO of Arcane Assets, It would be “completely wrong” to take much meaning from Messari’s stats. “You need ASICs worth billions to pull this off,” Wall told Decrypt.

That’s because those ASICs—specialized Bitcoin miners—”have future value,” the amount of money they could generate if you didn’t attack. That’s why mining companies like Bitmain are worth billions, said Wall.

So, since the value of Bitcoin would likely plummet as a result of the attack, “you'd basically need to own an operation like that and decide to destroy it,” he said.

But, since the hash rate has dropped by nearly half, does that mean there’s enough mining equipment on the market to carry out such an attack?

Even though many farmers have switched many miners off in the past few months, they’re unlikely to sell straight away, Wall said. “If the difficulty drops a little bit they could become profitable again,” he said, and they’d be switched right back on.

And for a determined attacker who’d press on, Wall said it’d be difficult to buy so many miners at once, as it’d be clear that your intentions would be to crash the network. “Miners talk with each other and they would pretty soon figure out what's going on, and they would decide to maybe not sell to you because they know what you're trying to do,” said Wall.

For the sake of the Bitcoin network, let’s hope Wall and Xu’s analyses are on the money.