Notable crypto talking heads are calling it: there's now only one way things can go.

“I believe that the supply of stables has bottomed and will be Up Only from here,” tweeted Nic Carter.

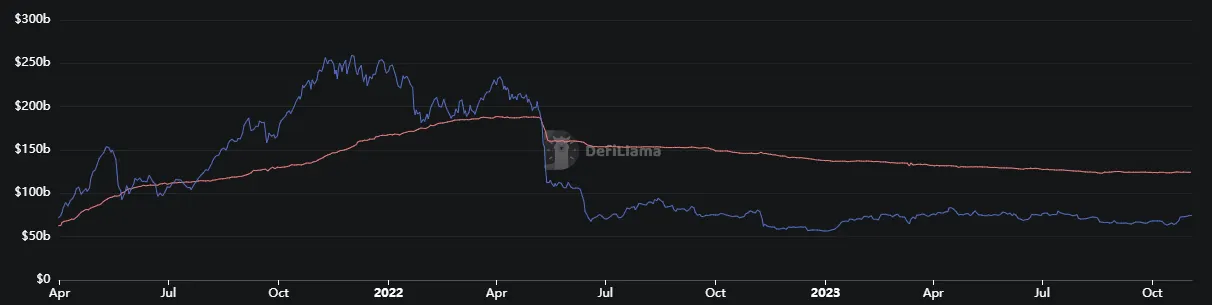

After dropping for most of 2023, the total supply of all stablecoins appears to have stalled. But why?

Instead of stablecoin holders pulling their digital dollars from the market (and redeeming real dollars), they’re doing the opposite.

“For the first time in two years, we are actually seeing inflows,” wrote Twitter personality Pentoshi.

This, as the crypto bulls would have you believe, is a good omen. It’s supposed to mean that more dry powder is getting ready to plow into Bitcoin or your favorite altcoin.

That’s because it’s easier and faster to get your money onto crypto rails ahead of time, slowly building a position ahead of some kind of mega rally.

“It’s a fairly reliable indicator of sentiment as it tracks how much new capital is entering the system,” Ethena Labs head of research Conor Ryder told Decrypt. “As the majority of stablecoins today pay zero yield, it is safe to assume that investors mint stablecoins with the goal of transacting, like buying other crypto assets.”

Still, the narrative comes coated with some serious grains of salt (like much of crypto).

“I think there's too much nuance for it to be directly relevant,” head of research at Delphi Digital Ashwath Balakrishnan told Decrypt. “It's not always so straightforward as USDC is being minted therefore Bitcoin demand is coming.”

The data is equally unclear, too. Though the steady decline of all stablecoins does appear to have slowed some, the slowing isn’t evenly distributed.

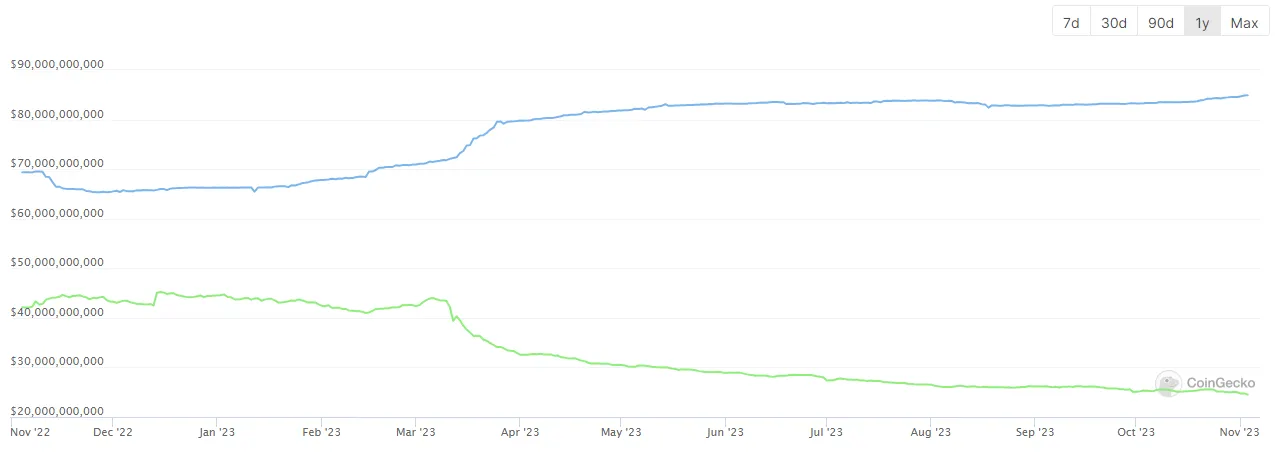

For example, Circle’s USDC continues to plummet from its high of some $56 billion to $24 billion today, while Tether’s USDT has just hit a new high in market cap, arriving at $85 billion this week.

USDC falling further and further behind USDT, by the way, is indicative of more of the market leaving the United States, Ethena Labs’ Ryder told Decrypt.

If it’s not to pump bags, why would the stablecoin supply be picking back up?

Those dollar coins “could be going into the primary market,” Balakrishnan said. “Many deals are settled in stablecoins now. A lot of stuff is happening in USDT and USDC these days.”

Basically, instead of funding rounds for smaller crypto projects and DAOs being done in cross-border wires, they’re now being done in stablecoins. It’s not quite the catalyst yet for the niche, but it offers an alternative to the Twitterati influencers pumping new hopium into the market.

Stablecoin supply isn’t the only metric one should look at either. The co-founder of Bluechip, a non-profit stablecoin ranking firm, Garrett Jones told Decrypt that we should look more closely at transaction volumes.

"Stablecoin supply can only tell us so much,” he told Decrypt. “When technology can change so quickly—not to mention the views of regulators—we really need to look at transaction volume to make sense of how much stablecoins are shaping the market."

Ultimately, it’s a nuanced metric for determining the market’s health. Or at least one that you shouldn’t bet the house on.