Last week I alluded to dY/dX, a platform for margin trading—think of this as trading with coins that you don’t own. So this week seemed like it would be good to go deeper into the mysteries of margin trading.

From an outsider’s perspective dY/dX is likely a cryptic name. It’s mathematics— “dY/dX” is notation for the "derivative of Y with respect to X." Now that we know that, it probably comes as no surprise that dY/dX handles derivatives products, but it’s DeFi.

More specifically, dY/dX offers margin trading, for ETH, DAI and USDC.

What, exactly, is margin trading? It means that you can borrow money to trade from.

Who do I borrow from? People lending.

Why do they lend? To make money from people borrowing.

That sounds risky, can’t I lose a lot of money? Yes.

Now that we’ve got that sorted, let’s take a look at the platform.

A tour of dYdX

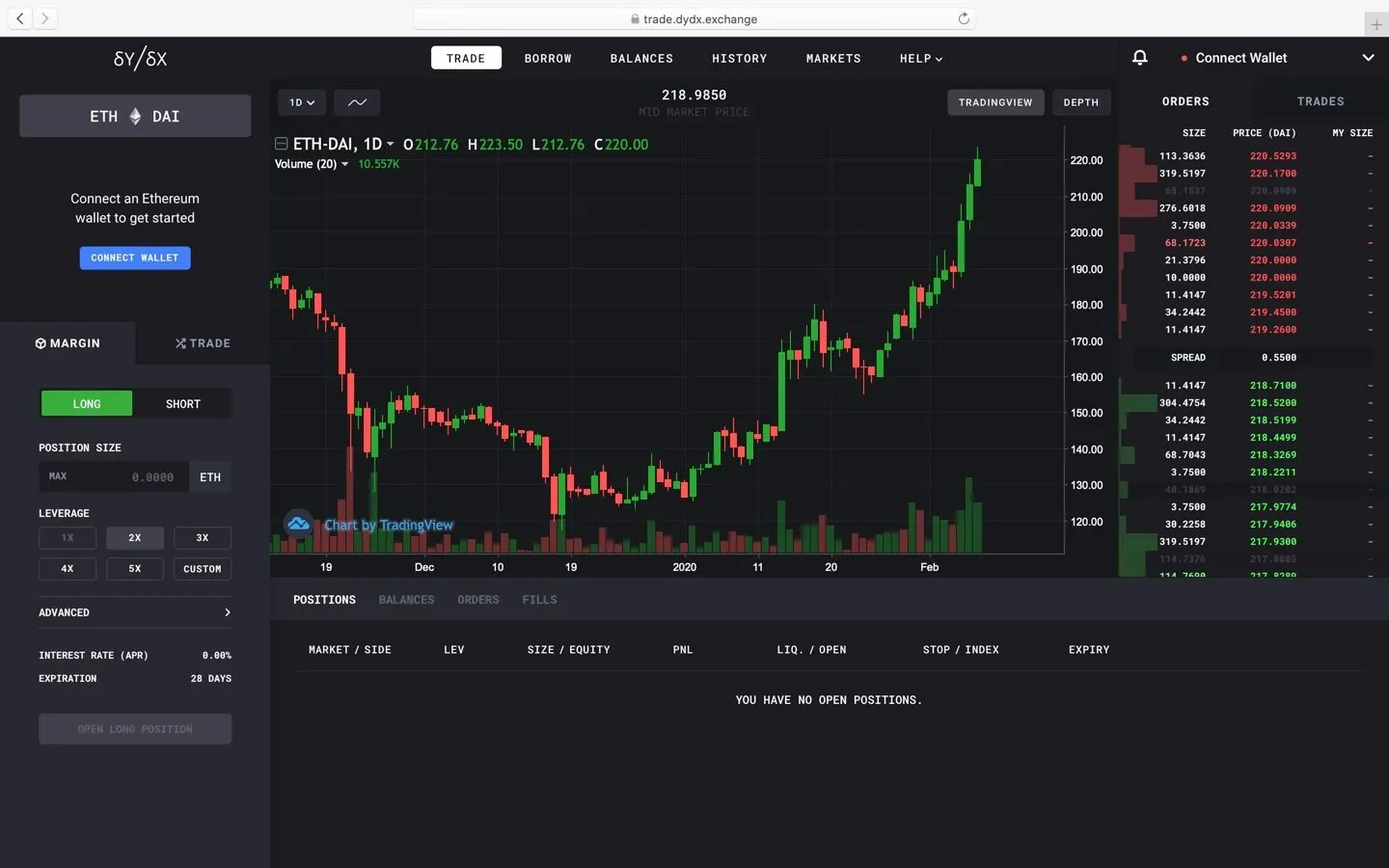

After arriving on the landing page, we take zero time to read the marketing gibberish and just head over to the trading section, where we arrive at a familiar screen. Price charts with “central limit order books” (see my Uniswap tutorial on this, here), like an oasis for a degenerate crypto gambler.

Buying Ethereum on margin

But this is more than just a basic exchange. dY/dX, as we said, is a margin-trading platform. That allows you to run a negative balance (borrow) to buy and sell things.

Now you see the risk.

From our last adventure with the dumpster fire that is Synthetix, I had already moved some money into dY/dX. This was smart planning on my part because, not only is ETH mooning, but Ethereum gas prices (the cost to make a transaction of that blockchain) are too.

Wait, isn’t dY/dX also on Ethereum? Don’t you also need to pay gas fees on it Colin?

Good question, but no. The friendly people over at dY/dX pay them for me. Yes—they actually pay your gas fees. Why? I suppose it’s to help get new users, think of it a bit like those free drinks casinos give you when you gamble in Las Vegas. Regardless of their reason, no gas fees means rather than worrying about little things you can spend more time betting on the price of coins.

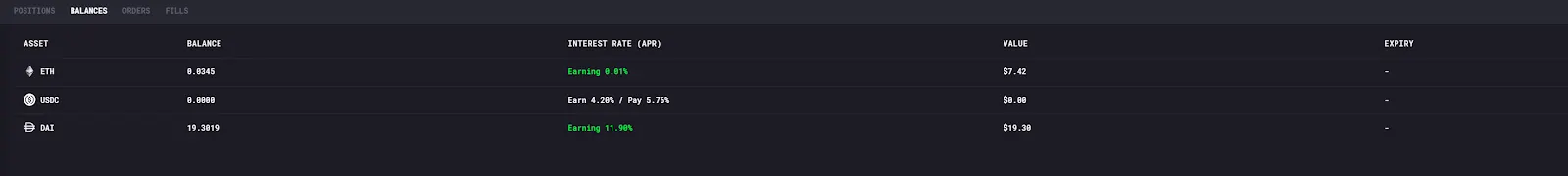

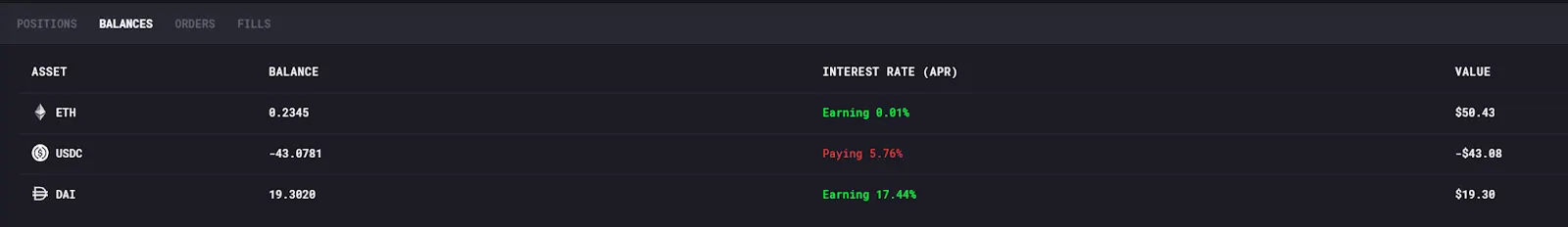

Let’s give it a go. If you have eagle-eyes, you’ll notice from my previous screenshot that I’ve already got a bit of ETH and some DAI in there. The DAI are earning a hefty rate of interest, but USDC (another stablecoin) has cheaper rates.

What’s this mean? It means that people want to earn a higher interest rate in order to lend DAI than they require for USDC. This then has a knock-on effect for borrowing rates for both.

How the margin transaction works

So what was I on about again? Oh right, ETH is mooning and I want to FOMO buy some more.

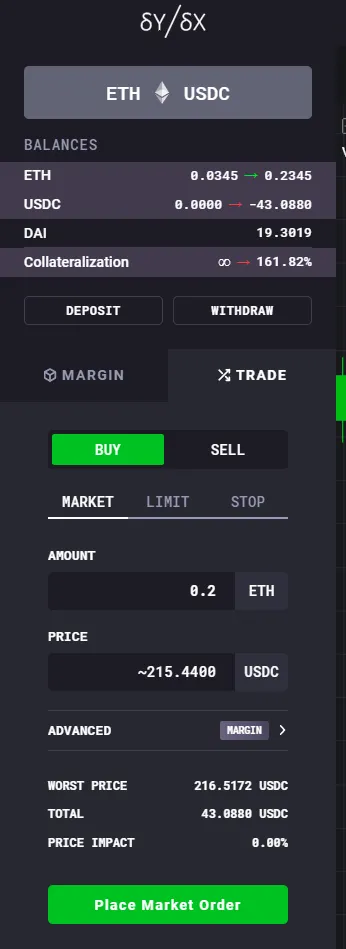

As I don’t have much money floating around, I need to borrow a stablecoin (because I need to pay for my ETH with something.) My options are either to borrow DAI, or USDC. Given the interest rates, I should borrow USDC (paying about 5.76% annually to buy ETH, vs about 13% for DAI).

We navigate over to the order box for ETH/USDC and setup to “market buy” 0.2 ETH, meaning we’re going to buy it at the cheapest price available to me right now. At the top, in red, this shows two important things: the estimated balance in USDC that I’ll owe, and the collateralization. Just as we saw with MakerDAO before, this is how many assets I have sitting on dY/dX that it can use to secure my investment in case I fail to meet a margin call.

The knife that cuts both ways

Ah, margin calls. A knife that can cut in both directions. The thing that can make any margin trader wake up in a cold sweat. Much like that time you took out a loan from a bookie to make that genius buy Tesla shares at $970 and the market swiftly drops to $880, leaving you utterly rekt and your kneecaps are already worried...

Undeterred, I placed the order and signed the transaction. In the background, dY/dX did everything else, and paid the charge to ETH miners for me. Thanks dY/dX, big kisses.

Naturally, immediately after I placed that buy order, the market moved against me. Damn.

But at 5.76%, this is a reasonably inexpensive position to hold on to, and I am into hopium, so I’ll let it ride.

Nearly 6% doesn’t sound cheap to you? Well consider the cost of actually getting ~$45 wired to an exchange, and then paying for transactions. All said and done it is likely to cost at least a few dollars, so the roughly $2.60 that this would cost me to hold this position for a year (assuming that rates don’t move, which is a fanciful assumption) this isn’t too bad. I fully expect that as soon as I turn this column in, and Decrypt signs off my expenses, I should have closed the position.

But just as we saw that I can pay to borrow money, we can also notice that I left about $20 in DAI sitting in there. At last look, I’m making about 17% annualized interest on that. Even if you don’t like to trade, sometimes dY/dX is an interesting option to just allow others borrow from you and pay those interest rates to you.

The bottom line on dY/Dx

None of this, of course, is without risk. Earning high double digits of interest on DAI introduces at a minimum a risk that DAI might be worth less than 1 USD, or that interest rates could fall, or that dY/dX could get hacked, or lose the ability to allow you to withdraw your funds.

While the platform is slick, and I appreciate the little touches that make it look cleaner, the whole thing is still pretty risky, and has minimal clear warnings to users about the risks they are taking, as well as the kneecaps they stand to lose. This platform, while super interesting, will likely make a lot of people lose a lot of money at some point, and is a great example of why we have financial regulators. But it's also a great example of why so many people are bullish on DeFi. Caveat emptor.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.