MakerDAO has a lot of skeptics. While most of these critics never bothered to actually try it, they’re all too happy to tell people that it’s “too complicated.” With the DAI Savings Rate moving up to 6% annually this week, some people are even calling it a Ponzi scheme, and worse. Classy.

Maybe they’re too harsh, so let’s get to the bottom of this.

Pawning the family jewels

For anyone that has never pawned anything in their privileged lives, here’s how you do it. Let’s say you’ve got something of value, such as your spouse’s great Auntie Sylvestre’s gold necklace, lying around doing nothing. And say you want to find some cash to invest in that token that will finally bring global adoption to the blockchain. So you take the necklace into that pawnshop you’ve walked past a million times, and the owner tells you that he can give you $500 for it. You need to pay the load back, at 15% interest, but no questions asked. Score!

Assuming your degenerate gambling works out for you, your token moons, you pay back that loan, and return the necklace to the attic before your spouse even notices. But if it doesn’t and you fail to pay back the pawnshop, it gets to sell your great Auntie’s necklace. That will make the next family Christmas dinner super awkward.

MakerDAO allows you to do much the same thing, without having to hock the family jewels.

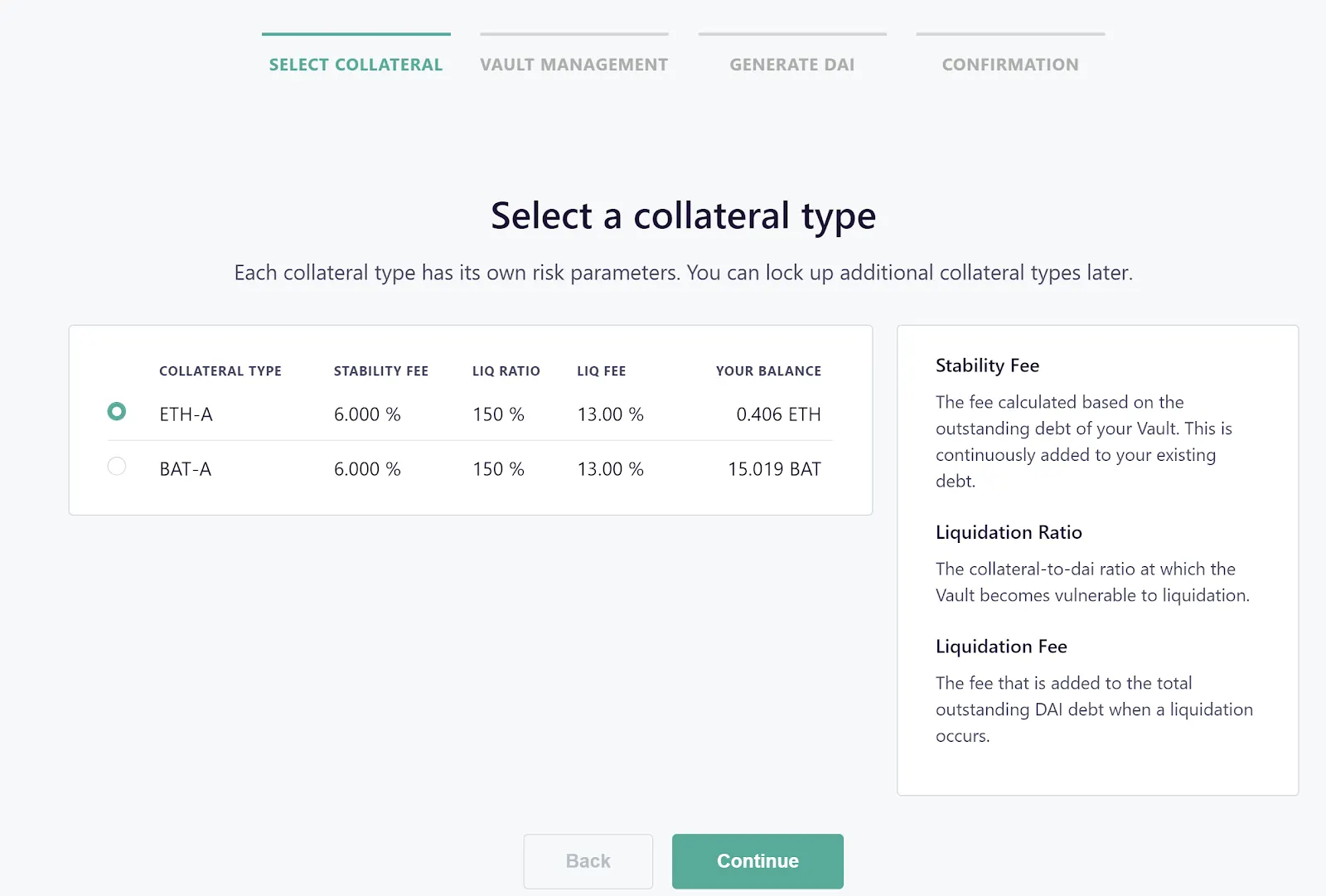

Instead of pawning jewelry, with MakerDAO, you use ETH and BAT. You don’t get dollars for your crypto, but Maker can give you a stablecoin, called DAI.

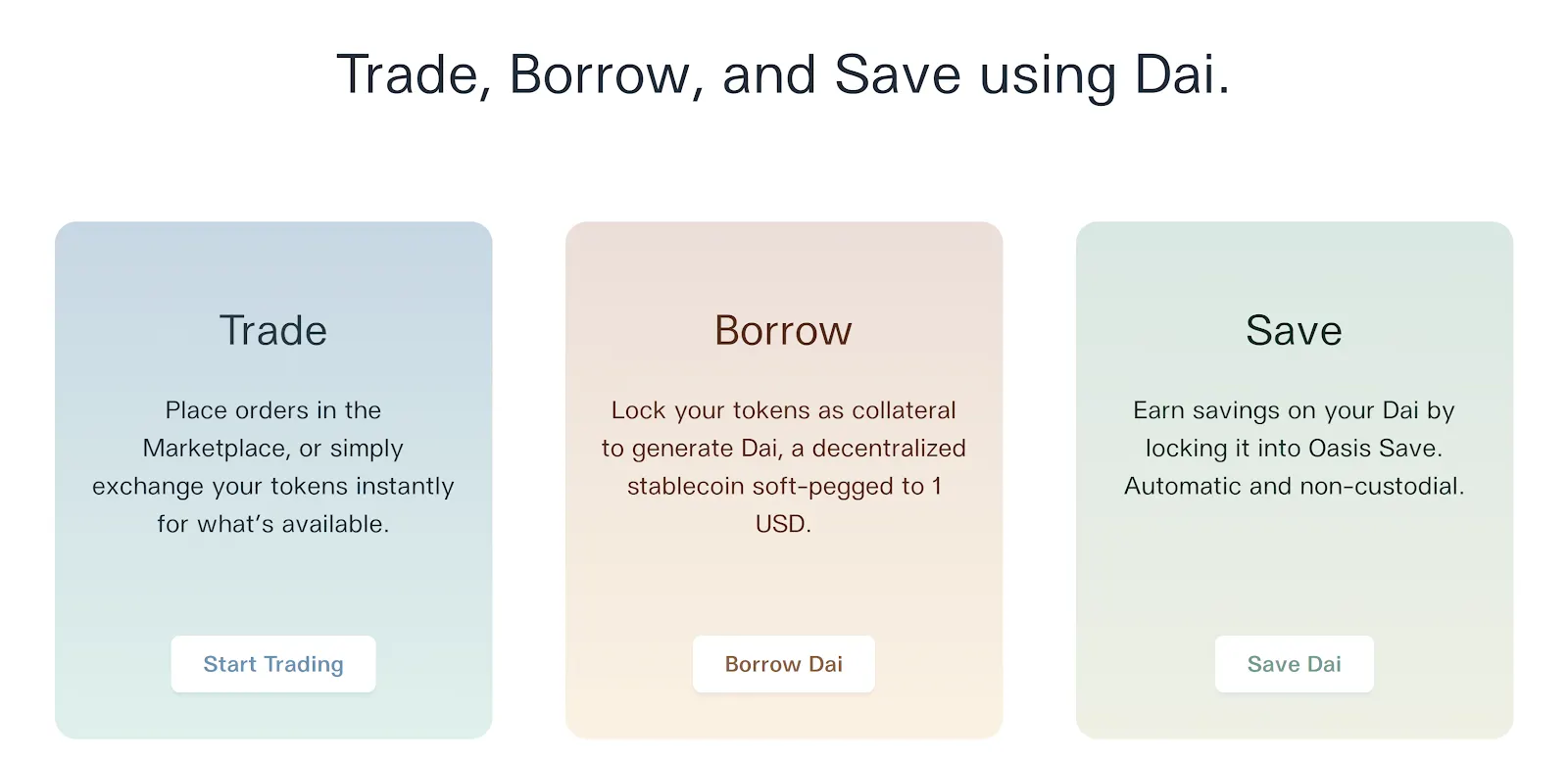

While most DeFi applications can be accessed directly through an Ethereum client using a command line interface, let’s not kid ourselves, we’re not going to do that. Instead, we’ll head over to the one-stop-shop, web app for everything MakerDAO, which is so easy even I can understand how to do it: Oasis.

Getting started

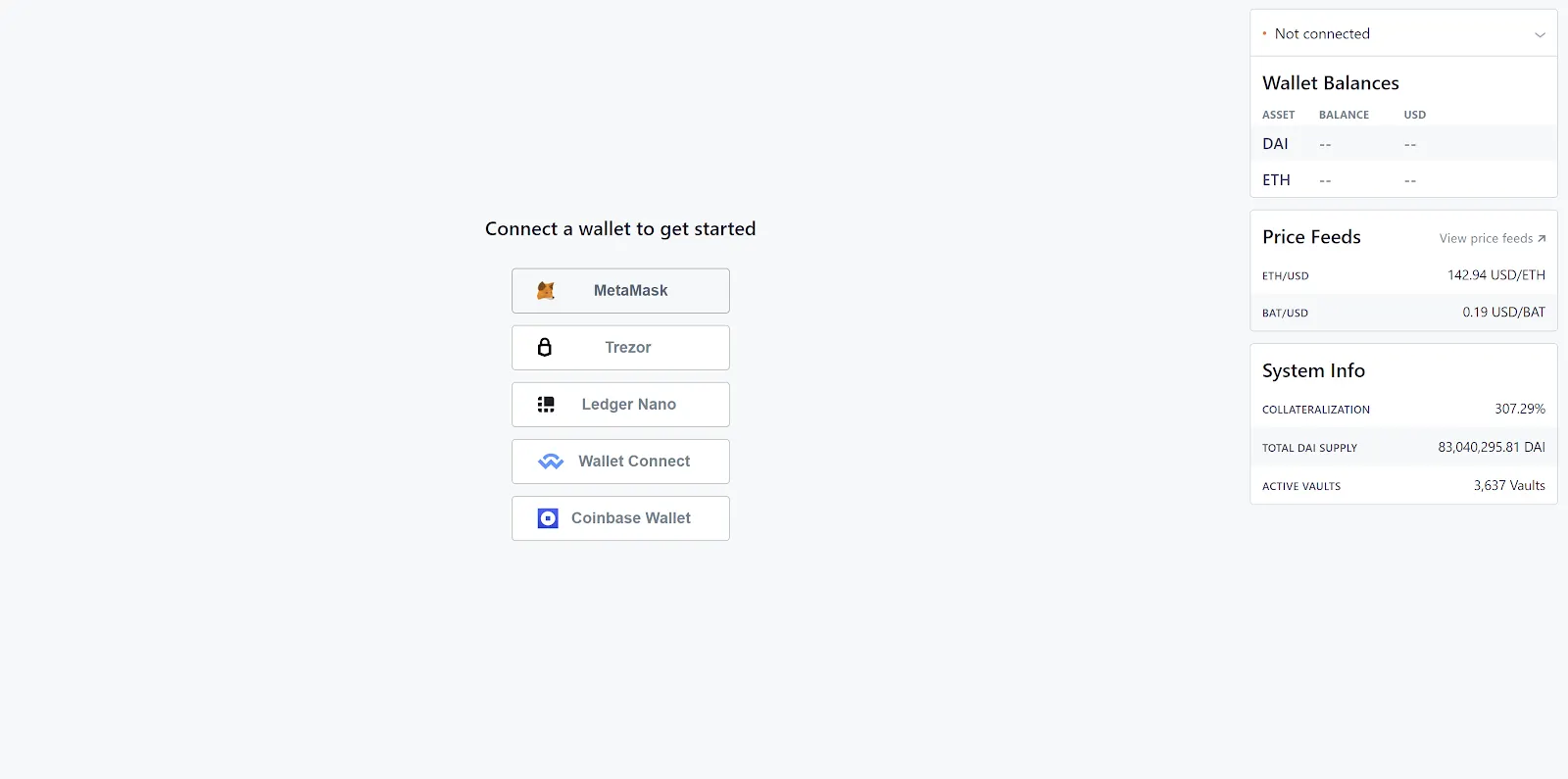

First things, first. In order to borrow some DAI, we’ll need some paraphernalia, including collateral (ETH or BAT) and to help make our lives easier, a wallet to store your tokens. (I use MetaMask, but there are others.)

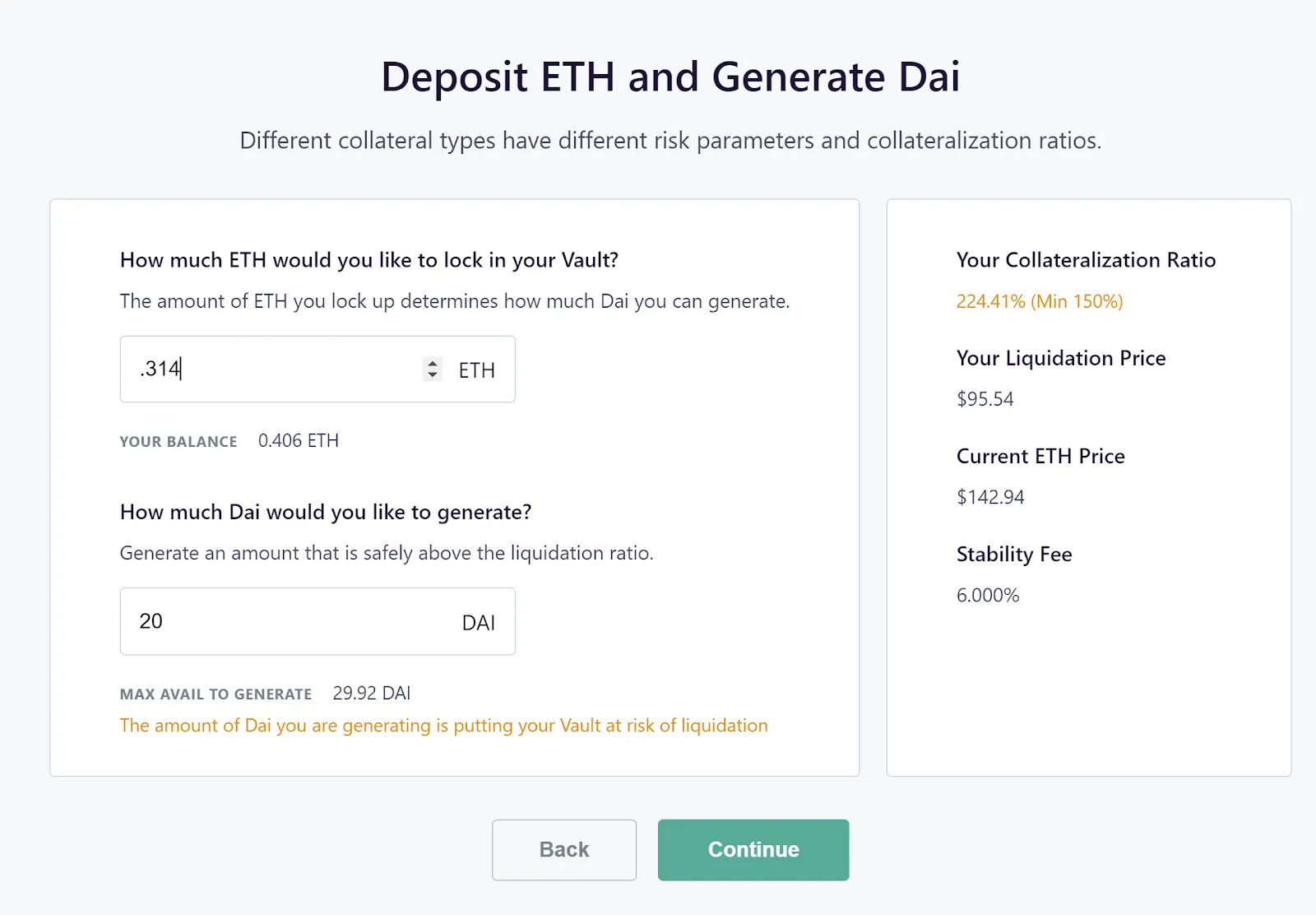

Given the relatively high volatility of token prices, and in order to protect the pawnshopDAO, borrowers are required to post considerably more collateral (in dollars) than they borrow. The minimum acceptable ratio of collateral-to-DAI at the time of writing this was 150% (i.e. for every $30 of ETH or BAT held, the borrower can withdraw up to a maximum of 20 DAI). There’s a poorly documented rule, that I discovered through trial-and-error, that you have to borrow at least 20 DAI, may change in the future, but for now thems the rulz. I don’t have enough BAT to do anything useful with, so I’ll give it a go with ETH.

Should the value of the ETH/BAT held as collateral fall below the value of the DAI borrowed, MakerDAO can claim the ETH/BAT, sell it to satisfy the debt, interest and penalty fees, then return any remaining value leftover to the borrower. See, not a Ponzi, there is something backing it! (There are some other dynamics involving a third token, “MKR,” which we’ll cover in a future piece, but for now let’s keep things straightforward).

Obviously having your bags sold out from under you is a bad thing, so you try to avoid it happening. Therefore, it’s generally smart planning to have more than $150 ETH/BAT worth of value for every 100 DAI taken out, then add or subtract more collateral as the price of ETH and BAT move ups and down. When you setup your Vault (that’s where you stash your collateral), the Oasis app tells you the expected collateral-to-dai ratio, and warns you if it will be below 225%. Pretty conservative.

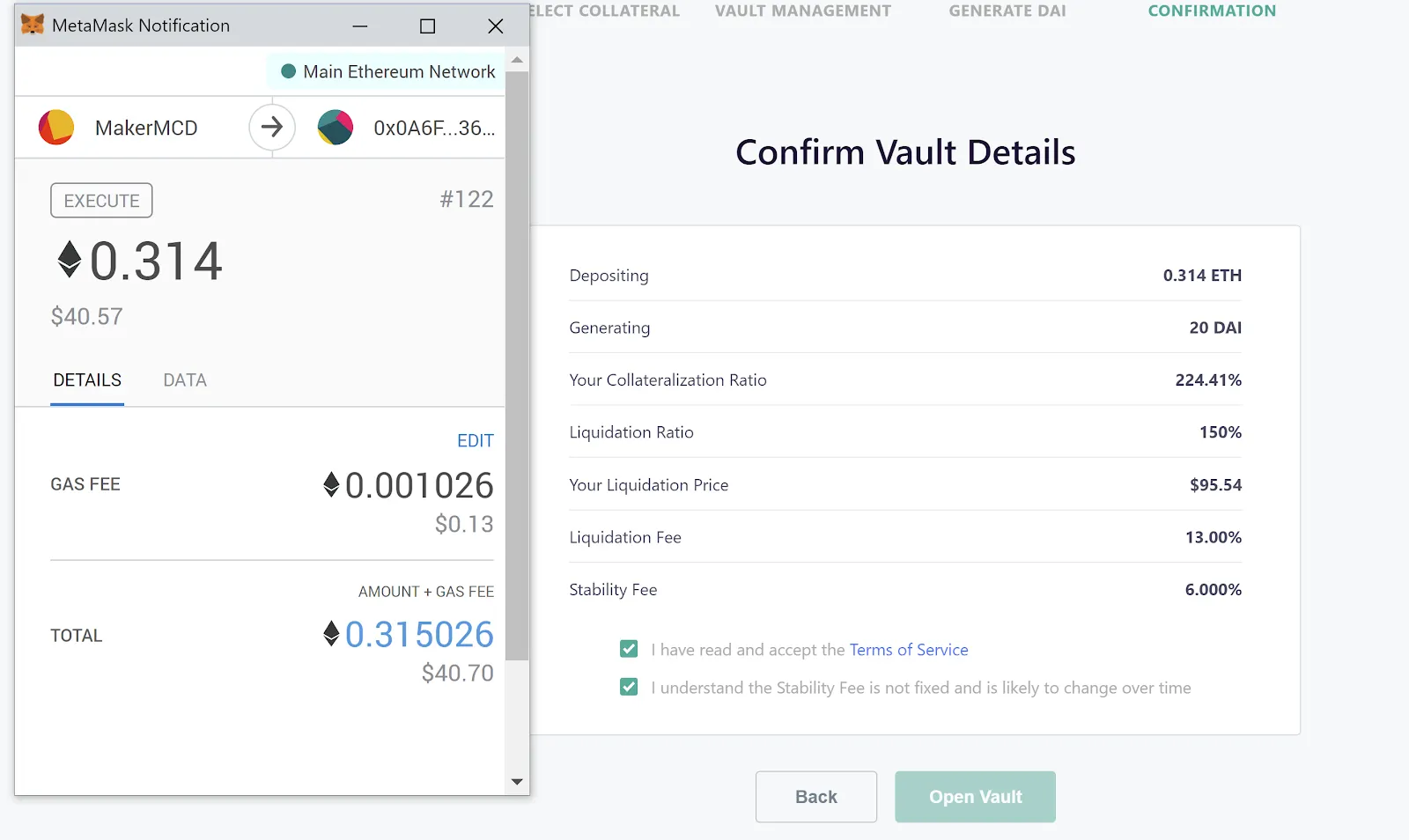

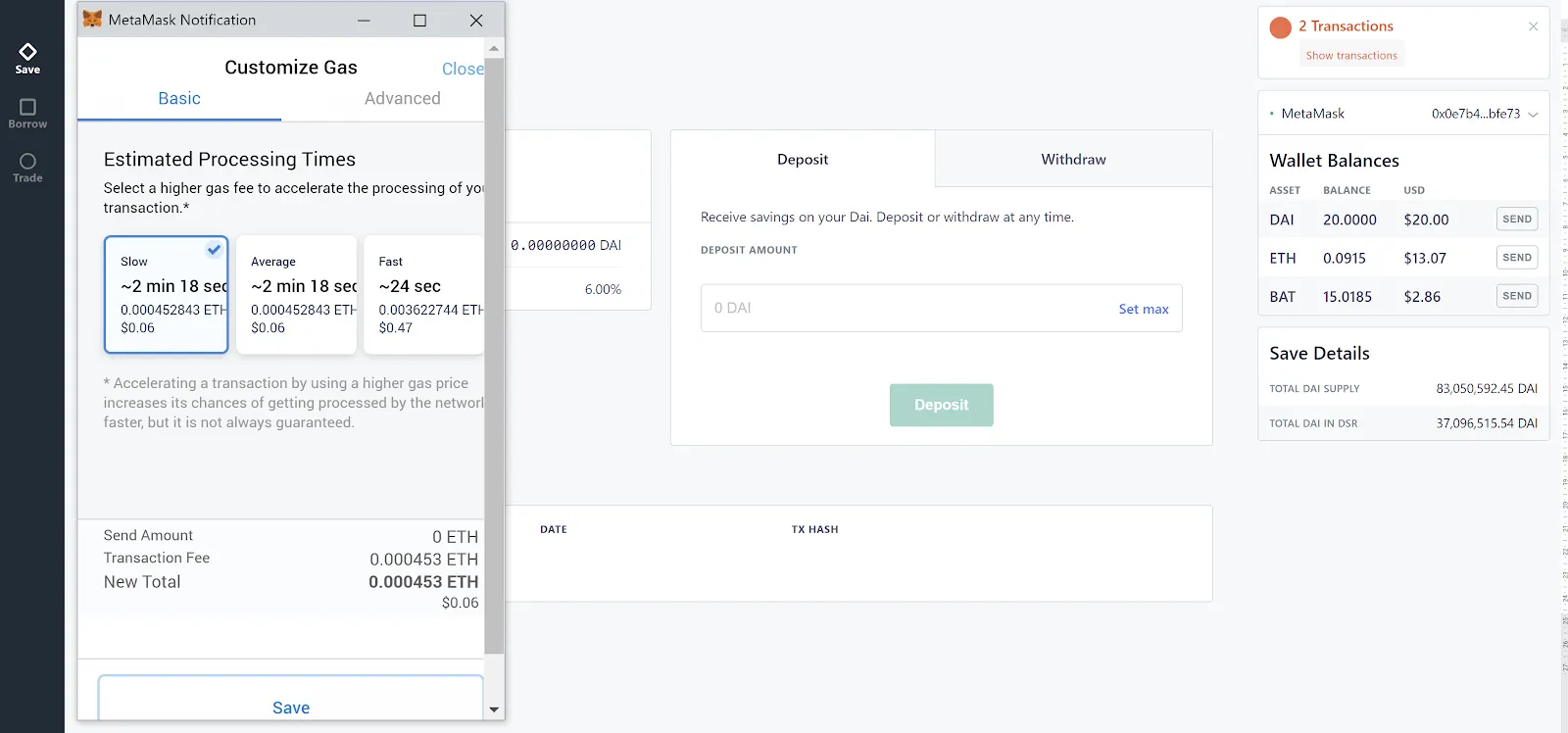

Setting up the transaction

Then it’s time to setup the transaction through Metamask, and on the Ethereum blockchain! I’m cheap so I didn’t pay for the suggested “fast” transaction which would have cost me north of $1 in gas, so I clicked the edit button to “slow,” only paying $0.13, or about 0.5% of my 20 DAI loan… Anyway, it was confirmed in the next block.

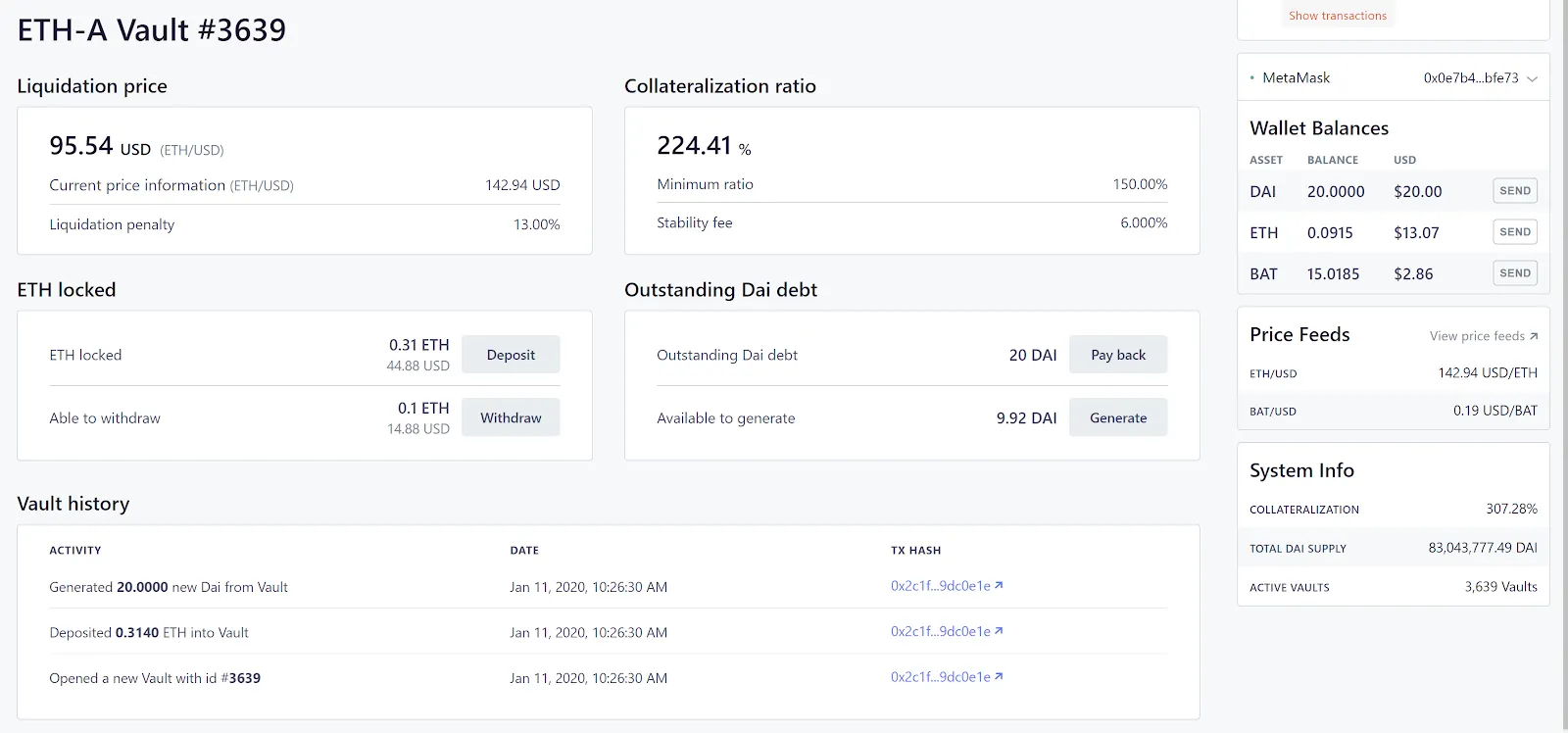

I then exited and returned to my amazeballs dashboard, that shows me more info than the cockpit of a 747.

So now that we know how to squeeze DAI out of ETH, let’s talk about that interest rate.

Explaining stability fees

In the case of MakerDAO, we call this interest charge a “stability fee.” Stability fees are paid by the people that pawned their ETH/BAT to borrow DAI. Currently it’s 6% per year, but rates can go up or down. MakerDAO redirects this money to DAI holders, meaning that if you hold DAI you could be entitled to receive interest (DAI savings rate, or “DSR”). Ka-ching!

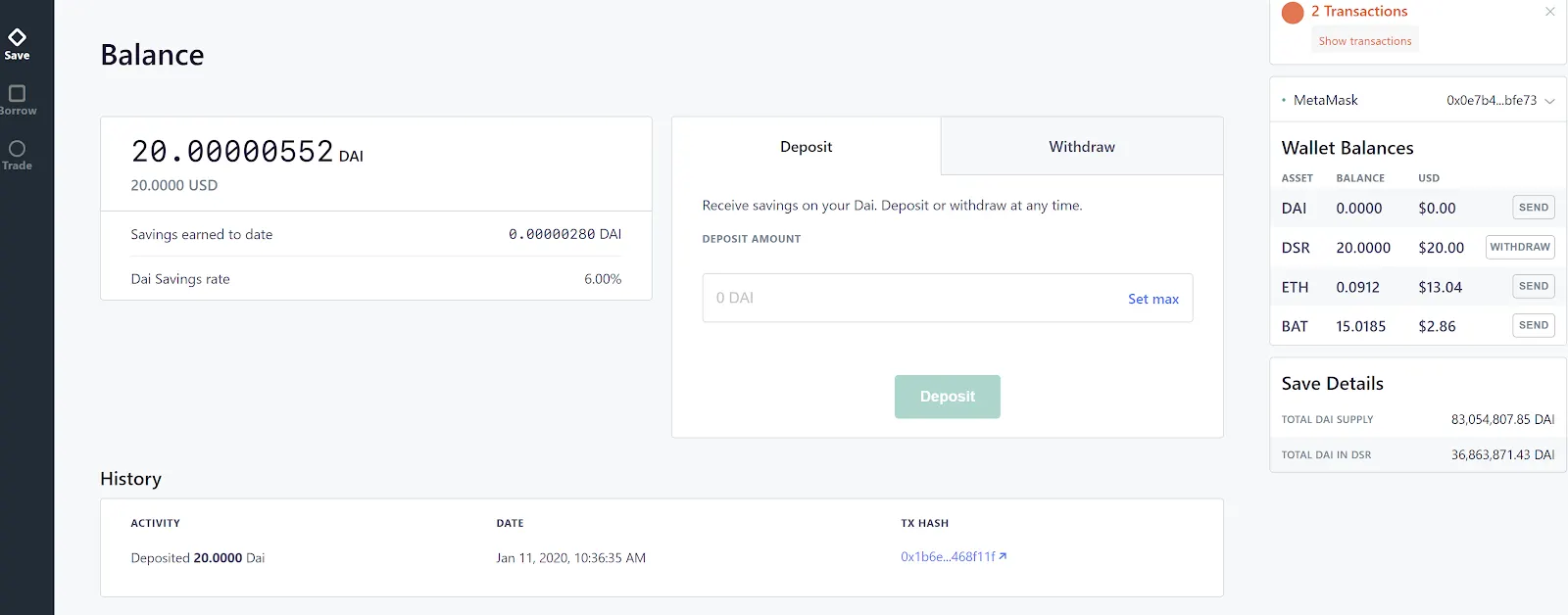

Note that it isn’t automatic, and DAI holders need to do some work, too. This is like the difference between cash and a savings account. DAI floating around are like cash—you don’t receive interest. In order to receive the DSR, you must deposit your DAI into a smart contract. Like a savings account, money kept in these contracts must be taken out to be freely spendable. This attracts transaction (gas) fees that are paid to Ethereum miners, on a bad day this will eat away at earned interest.

Again, Oasis is the easiest way to manage this, but some projects (such as CHAI) have also created a way to allow you to earn savings while giving you the continued ability to freely transact as you would with any other Ethereum ERC20 token. (Decrypt editor Josh is telling me that this piece is already long enough, so we’ll stick with using the Oasis method.)

Again, Oasis defaults to suggest a fast transaction, which would cost me $0.47 in transaction fees. I don’t have that kind of money, so I take the slow train, and pay a max of $0.06 (or about the DSR income that I'll earn over the next 19 days). It seems that no one is using Ethereum today, so again that went through right away, and I can see my DSR reward adding up in real time on the Oasis dashboard, success!

While it’s clear why someone would want to receive interest on their stablecoin, a common question is, who would want to borrow at 6% interest, while at the same time putting up more than 150% of the amount borrowed at risk?

What's the use case for MakerDAO?

One immediate use case is for large ETH/BAT holders who believe that the value of their token will go up over time (i.e. more than 6% per year), but would like to have cash to spend today (perhaps to buy more ETH and/or BAT).

Depending on where the borrower is based, it may not be a taxable event, and is therefore a great way to stick it to the Man. If this is the particular case of a would-be borrower, who got in early (well before you had even heard of ETH), buying ETH when it was less than $1 and who believes that the value of their tokens will stay roughly the same over time. They would, however, like to have cash to spend on a Lambo or invest in whatever token you’ll inevitably be FOMOing into this summer, taking a loan out in DAI may be more tax efficient than selling a portion of their token holdings.

Although it remains to be seen if MakerDAO is truly sustainable over the long term, or whether the market for lending based on crypto holdings (willingness to hold DAI) will fail to match the demand for borrowing based on crypto holdings (willingness to create DAI), for the time being, MakerDAO and DAI occupy a relatively warm place in our hearts as our community’s crypto pawnshop. That said, risks, both technical and economic, still abound and anyone considering borrowing or lending through MakerDAO, or transacting in DAI should consider the potential pitfalls.

[Note: This piece is intended to be a review and explainer of MakerDAO. It is neither an endorsement of it or the other services mentioned in the story, nor is it meant to be financial advice.]