Investment firm Blockchain Capital has released its annual "State of Crypto" report, comprising all the highlights from 2019. Luckily for you, Decrypt has swept through the 74-page document and lined up the most compelling takeaways.

We are near the end of 2019 and what a ride it's been for the cryptocurrency industry. This year, bitcoin—the reigning king of crypto—proved its supremacy in the cryptocurrency markets and beyond. Bakkt finally launched leading to a range of emotions from disappointment to excitement then cries of gotcha! And a wide array of central banks and nations are now creating their own cryptocurrencies—spurred on by none other than Facebook.

But that's not all: Here are Blockchain Capital's biggest focal points for crypto in 2019 and what’s next for the industry.

The crypto market in review

Of course, it wouldn't be a report on crypto in 2019 if it didn't mention the (brief) market recovery. Back in early April, the collective crypto hivemind started using a phrase that hadn't been uttered since late 2017: “parabola.”

In May, the price of bitcoin flew up, catalyzing a massive growth spurt from the multitude of altcoins. The total cryptocurrency market cap grew an extensive 167% from $130 billion in January, reaching a peak of $348 billion come late June.

Despite the downturn which followed, the market still cites a reasonable 36% year-to-date market cap growth.

However, not everyone made it out alive. Per the report, small to mid-cap index performance has left a great deal to be desired. The Bitwise Large Cap 10 index (which tracks ten coins) outdid mid-small cap indices by quite some magnitude—which is perhaps no surprise given bitcoin's 20% rise in market dominance this year.

Speaking of dominance, Tether currently stands at a whopping 80% over the total stablecoin market. Moreover, the stablecoin market has been the subject of mass growth, adding $1.4 billion to its coffers in 2019.

The ICO saw a brief revival with the “Initial Exchange Offering” or IEO. These coins also got swept up in the mid-year boom, only to come crashing back down again. As a pioneer of the concept, Binance is one of the only IEO exchanges citing decent average year-to-date returns of 150%. Meanwhile, the rest of the exchanges that supported IEOs are either in the red or treading water.

Prices may be down, but adoption is skyrocketing:

Despite many investors spending most of the year trying to avoid looking at their crypto wallets, adoption is very much on the rise.

This is manifesting as institutional as well as governmental involvement. Big hitters such as Fidelity, Bakkt, JPMorgan, and TD Ameritrade have all announced crypto-based financial products. Just the other day, Fidelity decided to expand its bitcoin arm to Europe.

However, in terms of demographics, bitcoin still resonates broadly with millennials and Gen-Z. The report relays that 50% of 18-34-year-olds “strongly/somewhat agree” that most people will be using Bitcoin in the next ten years.

This is particularly notable in the face of a generational transfer of wealth, of which there is expected to be $15 trillion by 2030. Interestingly, most of this capital will head to millennials who would prefer to own $1,000 of BTC over stocks or gold, the report claims.

Of course, there could be no mention of adoption without highlighting Facebook's own cryptocurrency. In fact, a litter of cryptocurrencies from social media giants have been announced this year. This included Telegram's $1.7 billion in-app currency TON, as well as the inescapable Libra cryptocurrency—both yet to be released.

Following these social media giants was a plethora of central banks exploring or—in some cases—even creating their own cryptocurrencies. Most prominently, China declared its plans to build a digital Renminbi, which looks and acts like a cryptocurrency, without any of that pesky decentralization or censorship resistance.

A boost for technical developments

Meanwhile, technical developments continue to advance. The Lightning Network has grown nearly three timex from January, boasting 5,000 nodes, 30,000 channels, and a current network capacity of around $6 million.

As for Ethereum, the second biggest coin by market cap, progress towards its next iteration has been slow. But despite this—and its falling price—usage of the Ethereum network has shot up this year.

DeFi is developing at an exponential rate.

One of the most exciting tools to come out of the blockchain bubble is that of decentralized finance (DeFi) and it’s beginning to expand—massively.

Over $600 million worth of ETH is now locked in open finance smart contracts, 84% of which secured in Maker, Compound, and Synthetix, the report pointed out.

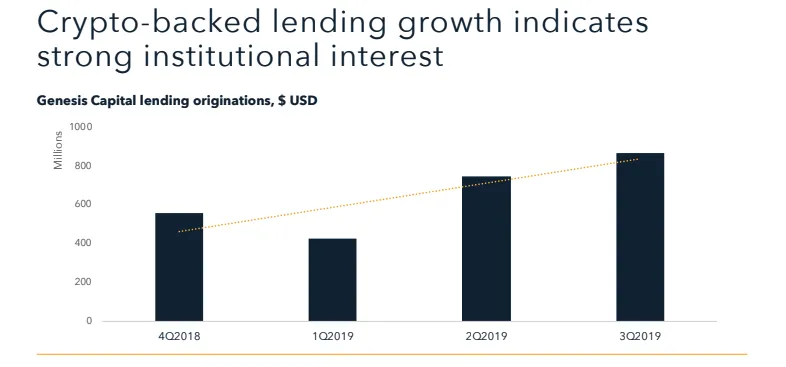

Lending platforms advanced a massive $648 million this year, marking a 28X increase from the meager $22 million lent out at the start of 2019. Moreover, according to statistics from Genesis Capital, this growth appears to indicate a sizeable institutional appetite in crypto-collateralized loans. Something to keep your eyes on.

In 2020 and beyond

Far from a simple retrospective, the report offers its own premonitions for 2020 and it’s very bullish.

It reckons that the value locked in DeFi will hit $5 billion in 2020. This would be a big jump up from its current levels. But, DeFi is becoming a growing trend.

On top of this, Blockchain Capital argues that the demand for Bitcoin transactions will drive fees to exceed $100. This might be due to the anticipated fall in mining rewards (as the halving comes closer) which will put more of an emphasis on bitcoin transaction fees to keep miners securing the network.

And the report gave its own price prediction. It predicts the price of bitcoin "blows past" its all-time high of $20,000. But will it get the call right?