Dovey Wan, partner at Primitive Ventures, said, in a speech yesterday, that China’s upcoming digital currency efforts are putting it ahead of the US in the competition for global financial dominance.

Speaking at Coindesk Invest 2019, Wan said that China is taking the lead on blockchain technology by investing in the technology, and creating its own digital currency. It will then use that edge to gain greater control over its economics—as China President Xi Jinping highlighted in his speech on blockchain. That will help China to continue growing while positioning the Renminbi in a position to become the global reserve currency.

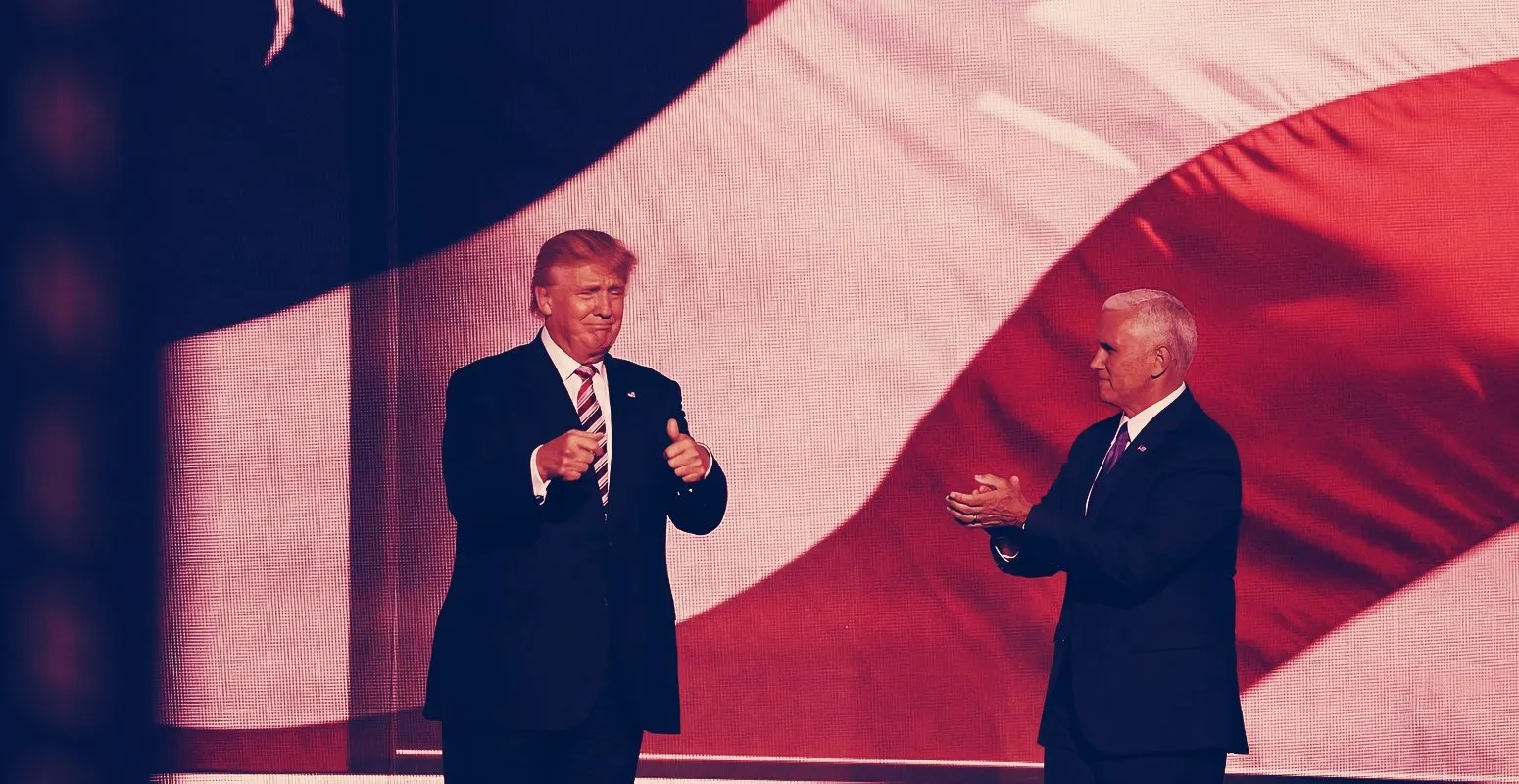

And who’s most helping these efforts? The President of the United States, she claimed.

“Trump is going to make China great again,” Wan said, onstage. “A lot of the policy Trump has pushed out has become a forcing function for China to accelerate this internal development and economic and political reform.”

Wan said that the issue really kicked off on October 23, two days before Xi’s speech on blockchain. On that day, Mark Zuckerberg, told Congress: “If America doesn’t innovate, our financial leadership is not guaranteed.”

His comments were later echoed by Xi, who said blockchain technology is important for economic freedom, and suggested that China should take the lead on it. “I don’t think it was a direct response, but the timing was very interesting,” Wan said yesterday.

Wan noted how unusual it was for Xi to make such a strong speech at that particular meeting. “This is a very important [Communist Party of China] internal meeting. Normally they would talk about state planning, strategy—things like that,” she said.

She pointed out that Xi didn’t mention Bitcoin or cryptocurrencies, focusing instead on blockchain technology. She said this was unsurprising, given that China has always been fixated on infrastructure investment, from high-speed rail to metropolitan infrastructure.

“Now for the last three decades, China’s GDP has been growing at 10% every year. [Xi] has to think about the next growth potential, the next growth topic. He handpicked three main technology infrastructures: AI, 5G—and blockchain,” she said.

At the same time, his speech also prepared the country for the digital Renminbi, she added.

Solving shadow banking

The digital Renminbi is where it gets really interesting for China. “China has a huge problem: Its shadow banking industry, worth $10 trillion,” she said, noting that there are two benefits to having a digital Renminbi. First, it could provide visibility—and help to crack down—on this shadow banking industry, by restoring control of the money supply to the People's Bank of China. Second, it could allow China to program the new digital Renminbi to flow into a certain market sector, thereby exercising iron-clad, precision control over monetary policy.

“Right now, we are in this fractional banking reserve system. They can only have an indirect impact on monetary policy. But what if they can program it? That would be extremely powerful,” she said.

Wan pointed out that the US has been on the fence about cryptocurrency and largely dismissed the idea of launching its own digital fiat. By contrast, China is leading the way, which could boost its global financial dominance. “China could help other countries build their own digital fiat,” Wan said. “This would further get rid of the US dollar dominance and help to boost Renminbi global liquidity.”

That could lead to a greater divide between East and West.

“The new version of this cold war is not going to be a space race, it’s going to be an economic race. There’s going to be a huge partition. We have seen [how] the Internet has been partitioned. China has this great firewall and the US doesn’t know what’s going on in China. Chinese citizens don’t know what’s going on outside,” she said, adding, “There will be this currency partition too.”

She noted that China is racing ahead with its ambitious currency plan. The country is well on its way to becoming a cashless state—even beggars use QR codes, she claimed. The majority of all payments are made through mobile apps, such as WeChat Pay or Alipay. “It makes things much easier for the central government to roll out this digital Renminbi.”

The wild card in all this, however, is Bitcoin, Wan said. While the digital Renminbi is, “trying to gain market share, awareness and win over... Bitcoin, Bitcoin is the money of the people.”

She concluded, “Bitcoin is the red pill, digital fiat is the blue pill. [The] choice is on us.”