Last Tuesday, Coinbase CEO Brian Armstrong said that the crypto exchange's 2022 revenue will be 50% or less than that of the prior year.

By Monday’s open this week, COIN had fallen to $39.65—its lowest price ever.

The figure represents a 60% drop from $98 in early August, when the exchange experienced a brief rally on news of its partnership with BlackRock. At the time, the asset management giant began offering institutional access to Bitcoin trading and custody to users of its Aladdin platform, with support from Coinbase Prime.

Besides that, Coinbase’s year has been a slow bleed, now down 83% over the past 12 months.

Its troubles are quite familiar to the rest of the crypto industry, which has collectively suffered alongside a sinking crypto market and macroeconomic headwinds.

Fintech bank Silvergate is trading at $21 as of December 12, down 86% from $139 this time last year. Meanwhile, Core Scientific—a public Bitcoin mining firm that traded for over $10 last year—has plummeted to $0.13 after revealing its near-insolvency in late October.

Many such firms have also been forced to enact mass layoffs to stay above water during the bear market, including Coinbase (18% of staff), OpenSea (20%), and most recently, Kraken (30%).

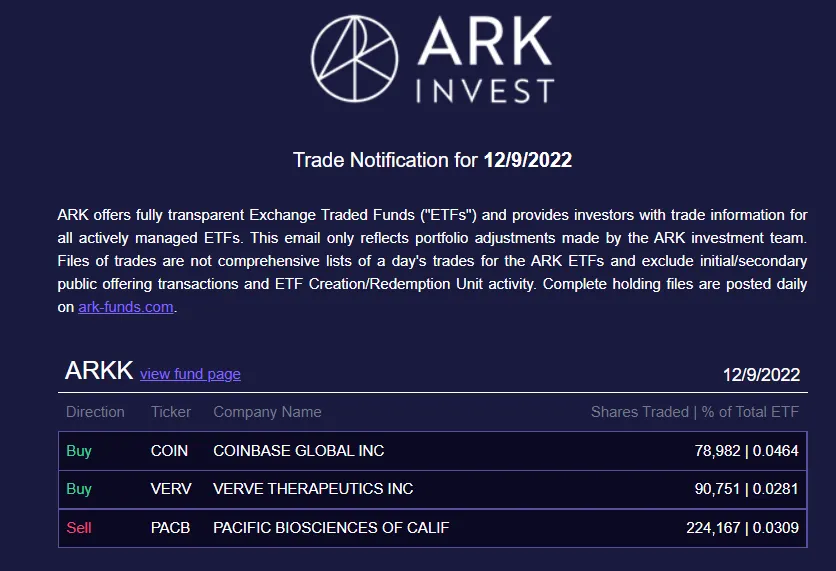

Nevertheless, one crypto-bullish company seems eager to catch knives amid the chaos: Cathie Wood’s ARK Invest.

The tech-focused investment manager bought 78,982 COIN shares last week for roughly $40 apiece. That brings its total holdings up to 5.7 million shares.

The company also scooped up another $1.4 million in shares of the Grayscale Bitcoin Trust (GBTC) late last month, as the fund reached another record-low discount against its underlying Bitcoin holdings.