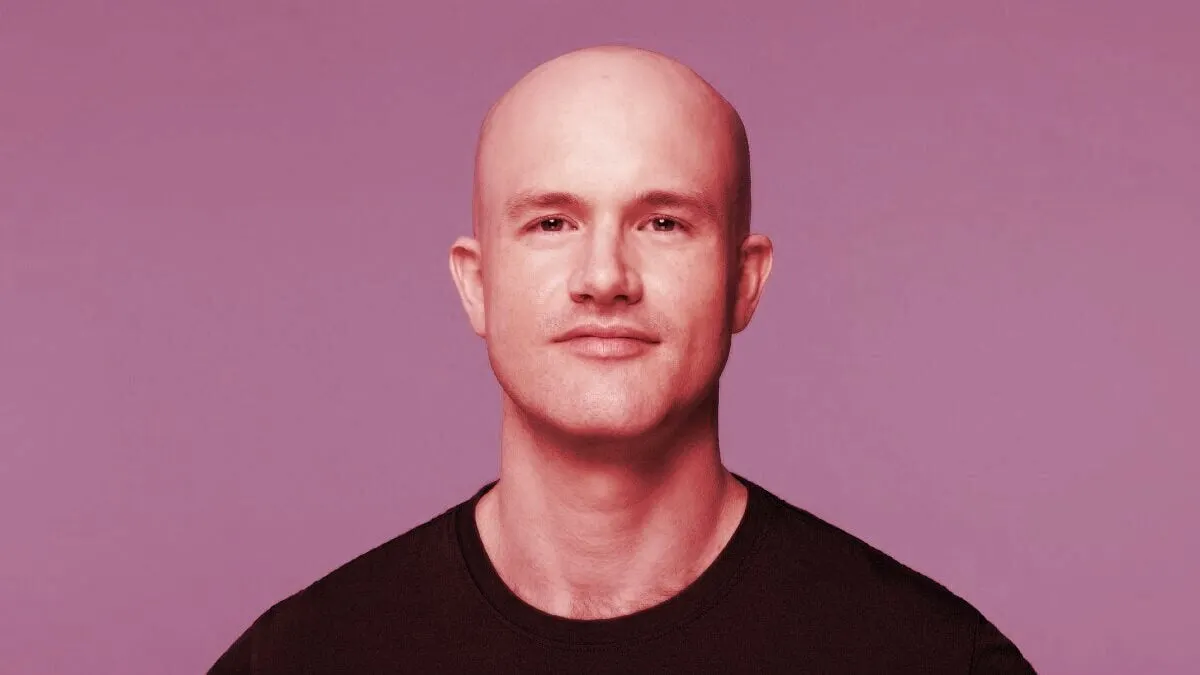

Coinbase CEO Brian Armstrong took to Twitter to address concerns about his firm's exposure to FTX in light of the announced acquisition of FTX by Binance, saying first that he has a lot of sympathy for everyone involved in the current situation with FTX.

"Second," he continued, "Coinbase doesn't have any material exposure to FTX or FTT (and no exposure to Alameda)."

Yesterday, before news broke of Binance's acquisition of FTX, Binance CEO Changpeng Zhao (CZ) turned down an offer to sell its FTT holdings to Alameda Research in an OTC deal.

Founded in 2017 by FTX CEO Sam Bankman-Fried, Alameda Research is a quantitative trading firm that provides liquidity in digital assets markets. In July, bankrupt crypto broker, Voyager Digital, revealed in a court filing that Alameda owed the firm $377 million. In September, Alameda agreed to pay Voyager $200 million of an outstanding crypto loan.

"I think it's important to reinforce what differentiates Coinbase in a moment like this," Armstrong said. "This event appears to be the result of risky business practices, including conflicts of interest between deeply intertwined entities, and mis-use of customer funds."

These are behaviors that Armstrong says Coinbase does not engage in, adding that the firm doesn't do anything with customer funds unless directed by the customer and that customers can withdraw their funds at any time.

In April 2021, Coinbase became a publicly traded company. Armstrong says that as a publicly listed company incorporated in the United States, the company believes transparency and trust are essential.

"Every investor and customer can see our public audited financials," he said. "Which shows how we hold customer funds."

"We've never issued an exchange token," Armstong said, a reference to the native token of the FTX exchange, FTT, which serves as collateral for futures positions, discounts on trading fees, and OTC rebates.

The FTT Token is currently trading at $5.41, according to CoinGecko, down 75% from $22.09 in the last 24 hours.

Armstrong says that the issue with cryptocurrency exchanges is that regulators have been more focused "onshore" while customers have moved offshore to companies with murkier and riskier business practices.

"To take the US as an example, 95%+ of crypto trading has developed overseas because crypto regulation in the US has been hard to navigate," he said. "That's bad for the US and Americans are still losing money in these overseas blowups."

It should be noted that while Binance is in the process of acquiring FTX, the deal does not include either firm's U.S. subsidiaries, Binance US and FTX US.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.