Ethereum 2.0 stakers are feeling the full weight of the ongoing bear market, with the vast majority of them now being “firmly underwater” on their positions, according to a new report from blockchain analytics firm Glassnode.

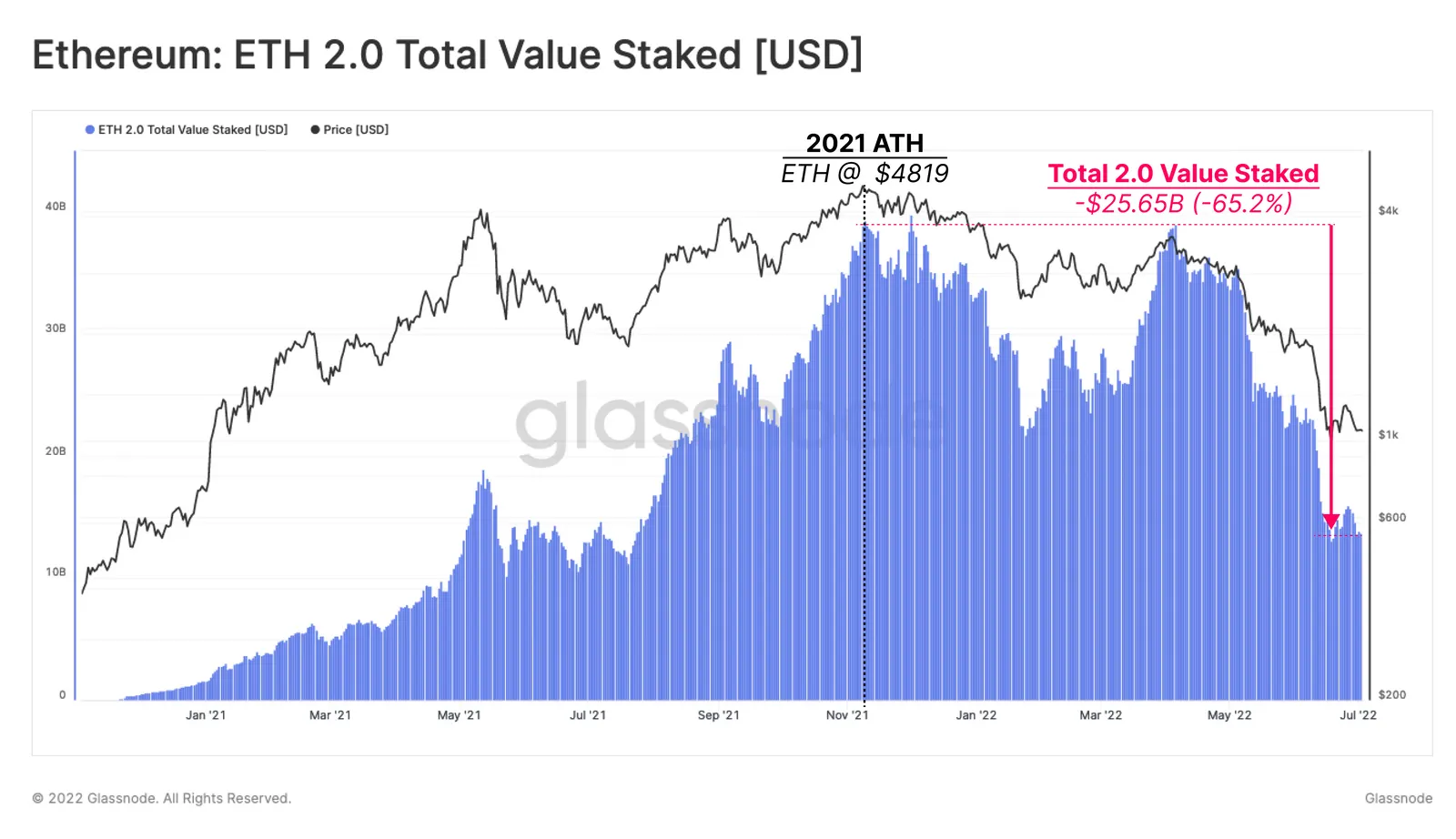

With the second-largest cryptocurrency hitting an all-time high of $4,891 in November last year, the total dollar value of staked Ethereum back then reached an impressive $39.7 billion.

However, as the prolonged crypto rout brought Ethereum to the current levels of around $1,1000, the value in the Ethereum 2.0 smart contract plunged to about $25.65 billion, putting it 65.2% lower than nine months ago.

This is despite an additional inflow of nearly 5 million ETH since the November peak, as pointed out by the researchers.

“With ETH prices collapsing over 78%, and coins unable to be withdrawn, only 17% of staked ETH is now in profit,” said the report.

This also means that Ethereum 2.0 stakers on average are holding at a loss of about 55%.

Per the report, “if we compare this to the Realized Price for the entire ETH supply, 2.0 stakers are currently shouldering 36.5% larger losses compared to the general Ethereum market.”

According to Glassnode, 62% of all staked Ethereum have been deposited before the November all-time high.

Ethereum, the Merge and stakers

Among many other improvements, the much anticipated Ethereum’s transition from a proof-of-work (PoW) to proof-of-stake (PoS) consensus mechanism via The Merge upgrade will also change the way transactions on the network are validated.

Currently, Ethereum relies on energy-intensive operations similar to those used by Bitcoin miners; however, following the transition, transactions will be added to blocks by stakers—addresses that have pledged a minimum of 32 Ethereum to a smart contract.

Ethereum already has a PoS-based chain called the Beacon Chain, which was launched in December 2020 and is running in parallel with the network’s current mainnet.

Since then, investors have been depositing their coins to operate as validators, with the amount of staked ETH reaching an impressive 12.98 million coins as of Wednesday, or approximately 11% of Ethereum’s circulating supply.

Notably, the number of deposits into the ETH 2.0 contract has fallen in recent months.

“Throughout 2020 and 2021, it was common to see between 500 to 1,000 new deposits of 32 ETH per day. Currently, the weekly average number of deposits has dropped to just 122 per day, which is the lowest it has been to date,” added the report.