Last week, Juno Network, a Cosmos-based blockchain that lets different smart contracts interact with one another, was faced with a rather controversial decision.

It's not a large or super well-known project, but this specific decision has already made ripples throughout DeFi.

Proposal 16 asked the community of JUNO token holders whether the wallet of one community member should have a large chunk of its token holdings removed (and returned to the community pool or destroyed entirely).

The specific amount they wanted to take back was 3,103,947 JUNO tokens, worth $117,205,038 at press time.

The reason? The address in question allegedly gamed a recent airdrop (well, technically, a "stake drop") within the Juno Network. And in so doing, the address accumulated an exorbitant amount of JUNO tokens, which, like almost all DeFi tokens these days, come with voting powers.

The risks of not passing this proposal, according to the proposer, were myriad.

First, the proposer indicated that the fact that there was a single wallet in the ecosystem that "already has half of quorum" needed to pass votes should have been a significant cause of concern.

Second, with that amount of tokens, the holder could have also "single-handedly [wiped] out the entire DEX liquidity in 10 minutes or less." This basically means this one JUNO whale could completely destabilize various crypto markets trading the JUNO token.

Third, the whale had considerable power to bribe validators (crypto speak for entities verifying and validating transactions on the network) to behave fraudulently.

And finally, if it wasn't already clear, the proposer said that the current situation created "fear in the community."

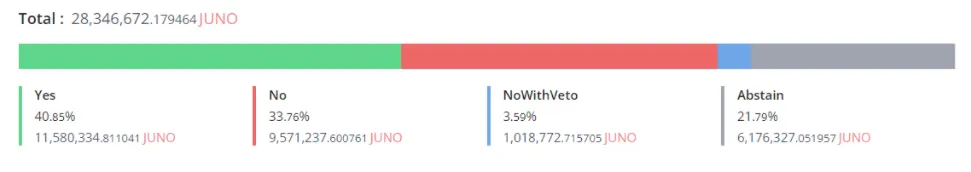

These arguments appear to have persuaded much of the Juno community. On Tuesday, the "yes" votes won. But the vote was close.

Digging into the Twitterverse, specifically those with skin in the game, the polarizing effects were very clear.

One Juno ambassador wrote a massive thread describing the entity as a "ticking time bomb" and "a worse version of a VC."

Elsewhere, opposing voices penned threads describing the vote as setting "a dangerous precedent."

Though distinct from the Juno vote, DAO members using their tokens to boot members is increasingly common. Following a controversial tweet by Brantly Millegan, a developer for the Ethereum Name Service (ENS), the ENS DAO voted to have him removed from the project's non-profit arm as well as remove his title as a steward to the DAO. In another DeFi vote on human conduct, MakerDAO voted to fire the project's content team due to a lack of transparency and poor performance.

On March 14, before the vote, the entity in question had come forward to explain themselves. They wrote the following in a now-deleted Medium post: "In the case that Prop 16 is rejected, we will proceed with returning all assets to users while giving utmost consideration to not impacting the market."

Essentially, the whale promised the Juno community that they would give back all of their holdings to the community if they rejected the proposal. They were not given a chance to keep their promise.

With the vote passed, the Juno team will revoke a majority of the whale's tokens, shrinking his bag down to 50,000 JUNO from 3.1 million, though it remains to be seen how that will happen functionally on-chain. Perhaps the DAO will fork the chain with a new ledger and a new balance for the larger Juno address. There's now even a draft proposal on these next steps here.

In the meantime, the Twitterati and crypto media can mull over the various implications of this vote.

For one, taking money away from someone clever enough (or cynical enough, depending on your position on airdrops) to grab those tokens via group vote sounds very anti-crypto.

On the other hand, a community is perfectly entitled to do whatever it pleases with its members (and funds), right?

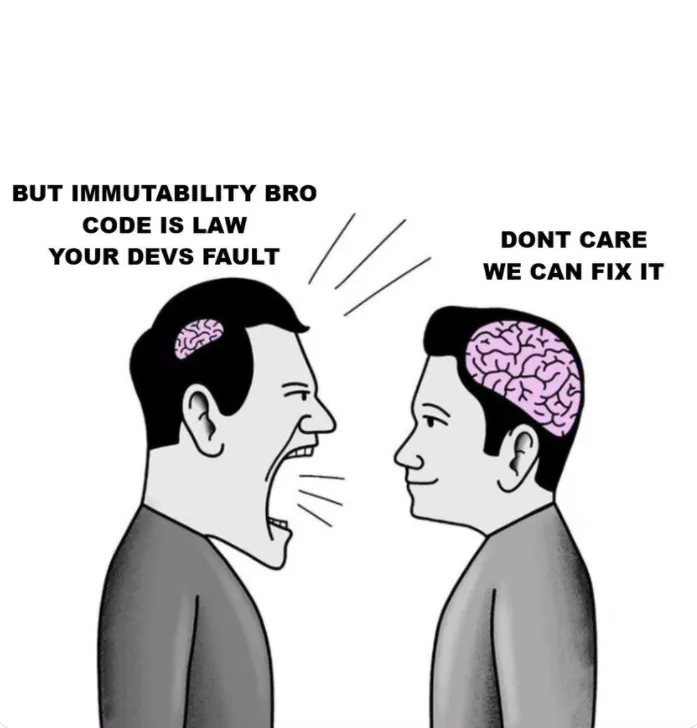

Above all this sits the popular crypto ethos that code is law and the blockchain is immutable.

As soon as you start meddling with the un-modifiable, you turn the coldly efficient computing power of blockchain into fallible human Discord and Twitter communities.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay first, before it goes on the site. Subscribe here.