In brief

- Coinbase blew away expected revenue figures.

- The company posted record user numbers, reversing an earlier decline.

- Coinbase also showed signs it is diversifying its revenue base.

Coinbase defied analyst predictions on Thursday by announcing it made nearly $2.5 billion in revenue last quarter, while its monthly active user base swelled to 11.4 million.

The revenue figure was the highest ever for Coinbase, coming in well above the $1.97 billion consensus estimate, while the user figure, also a record, reversed a recent decline that saw the company's user base drop to 7.4 million in Q3.

Coinbase posted of profits of $840 million last quarter, which was double the previous one, but shy of the record $1.6 billion it made in the second quarter of last year.

The impressive numbers were driven no doubt by record high crypto prices last October and November, when Bitcoin nearly hit $70,000, and the frantic trading that ensued. They are unlikely to be repeated given the bear market that has characterized 2022 so far.

Thursday's earnings announcement does not appear to have helped boost Coinbase's share price, which has been trading near its all-time low in recent weeks. In after hours trading, COIN shares were down slightly at around $169—a far cry from prices of over $400 shortly after the stock debuted last year.

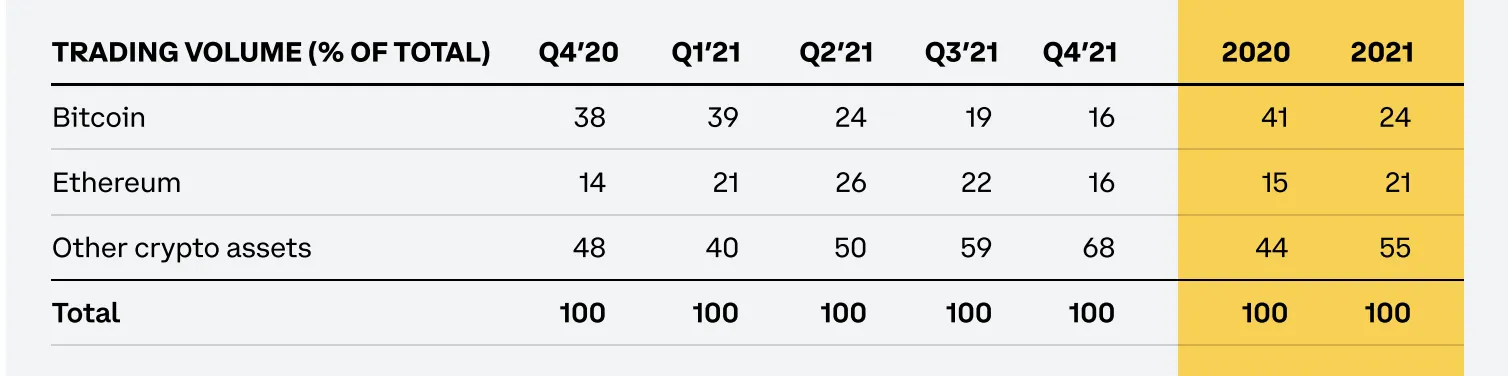

The Coinbase earnings also showed that the share of trading volume from Ethereum, which had eclipsed Bitcoin, had fallen to 16% last quarter. Meanwhile, the volume coming from other assets—such as Dogecoin, Shiba Inu, and so on—grew from 59% to 68%.

Also notable in the Coinbase earnings is that over $200 million of the company's revenue came from non-trading sources such as staking and lending. While that still amounts to less than 10% of Coinbase's overall revenue, it suggests the company is finally diversifying away from the trading fees on which it has long relied—and which many believe are under pressure as a result of commission free platforms like Robinhood.

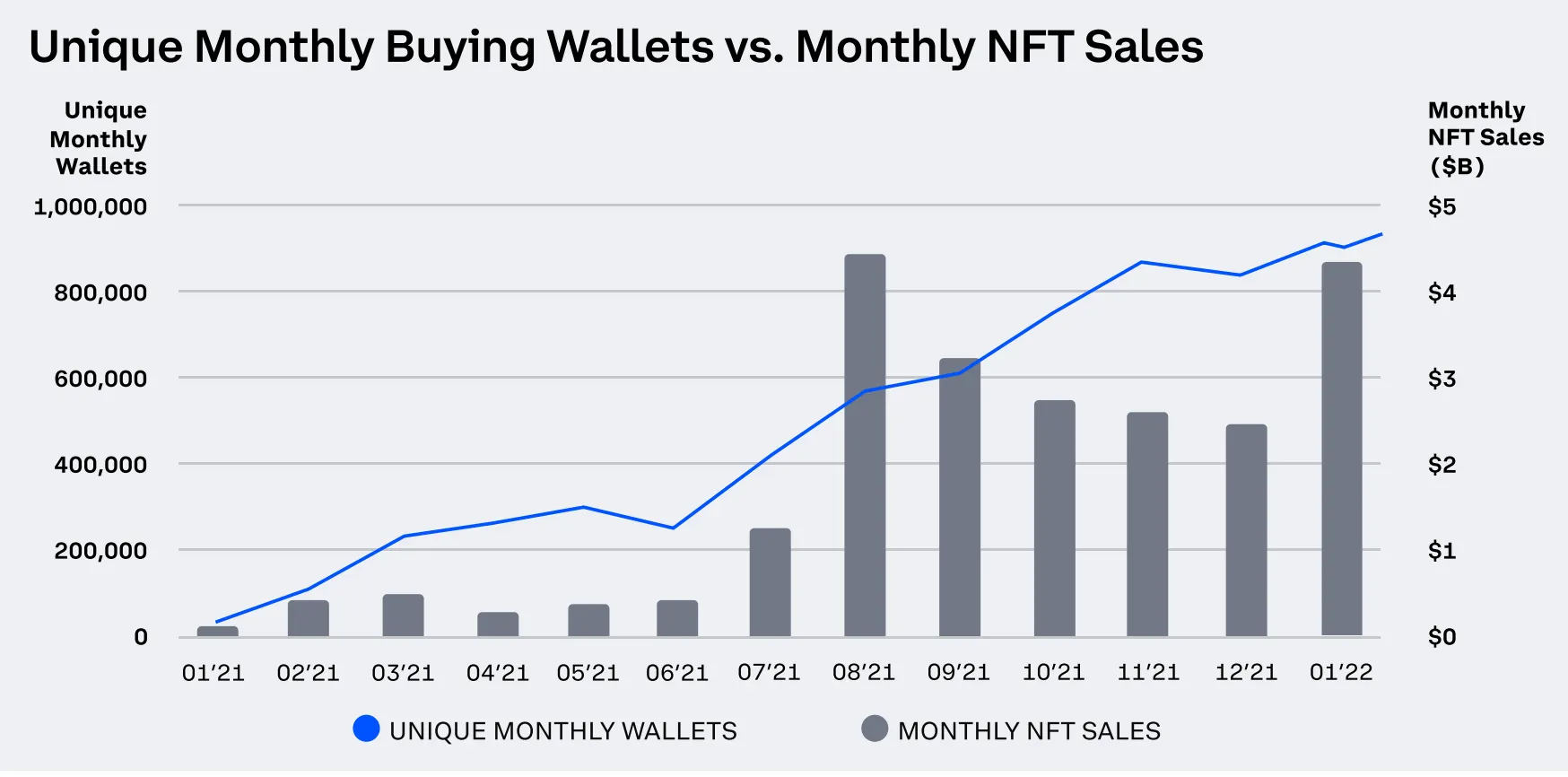

In its letter to shareholders, Coinbase touted the growth of Web3, DeFi, and NFTs, suggesting they will help power further growth for the company and the overall crypto industry. The letter included a graphic showing the rapid growth of self-hosted wallet and the NFT market:

Coinbase also used the earnings announcement to tout a host of new products it has unveiled in the last few months, including a tax center and a payroll center. The company has talked up plans to launch an NFT marketplace with social media features since last fall, but the service has yet to launch.

Coinbase executives will host an earnings call at 5:30pm ET on Thursday where they may address questions posted in an investor forum on topics such as the slumping share price and plans to diversify revenue.