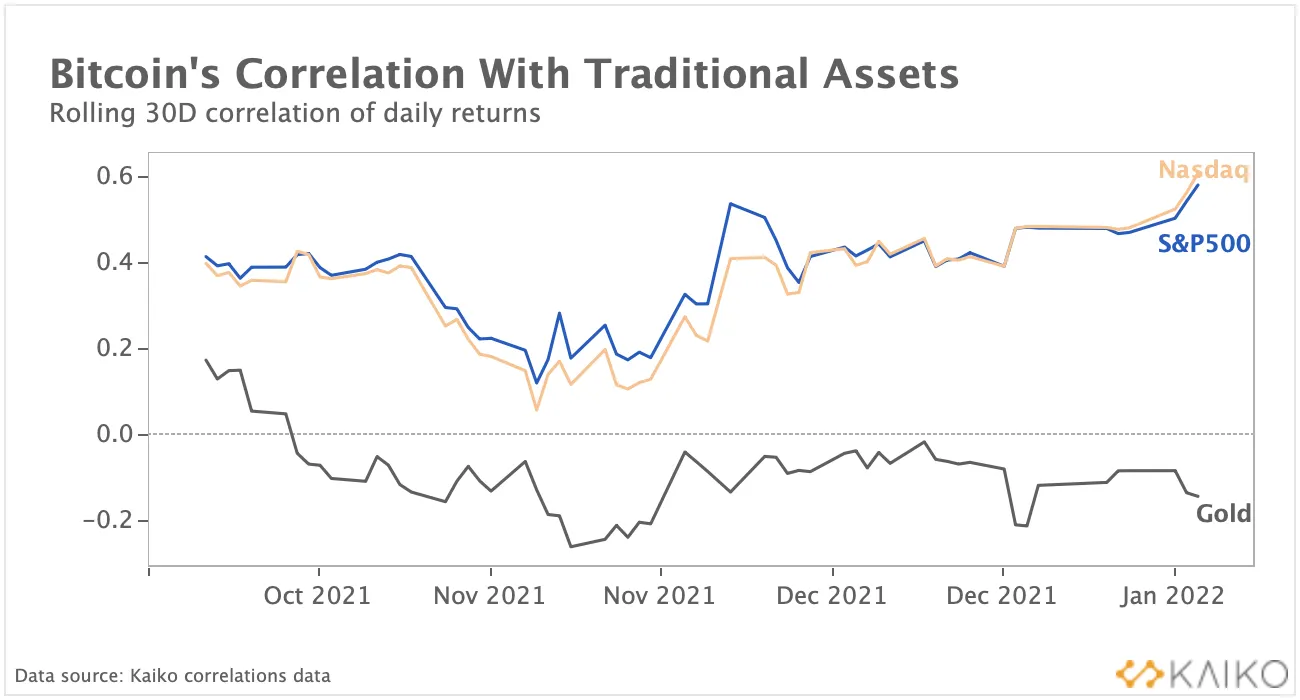

Historically, Bitcoin has maintained a relatively low correlation to traditional asset classes, including equity indices and commodities like gold.

However, in recent weeks, the leading cryptocurrency's correlation to two major indices—the S&P 500 and Nasdaq—has been on the rise.

Yesterday, it reached its highest correlation since July 2020, at 0.61 and 0.58, respectively, according to a new report from digital assets market data provider Kaiko.

The correlation coefficient is usually given as a number between -1 and 1.

The closer it is to -1, the stronger the negative correlation (i.e., the price of Bitcoin and stocks tend to move in opposite directions). The closer to 1, the stronger the positive correlation (the two variables tend to move in the same direction, meaning that Bitcoin is following stocks closely).

Bitcoin, equities, and the Fed

There may be different reasons for the high correlation. Kaiko points explicitly to last week's events after minutes from the U.S. Federal Reserve's December meeting was released.

The minutes revealed that the central bank is considering hiking interest rates as soon as mid-March.

"The Federal Reserve's December meeting had a strong impact on global financial markets, with traders reacting swiftly to the prospect of monetary tightening," the Kaiko report reads.

The S&P 500 is down 2.63% since the start of the year, while the tech-focused Nasdaq lost 5.62% of its value over the span.

At the same time, Bitcoin, which briefly dipped below $40,000 on Monday, is down 9.79% since the start of the year, trading at $41,830 at press time, data from CoinGecko shows.

According to the report, during the recent volatility, "Bitcoin behaved strongly like a risk asset," even though its correlation with gold, described as a safe haven among investors by Kaiko, remained negative since September last year.

It remains to be seen whether this trend will hold, however.