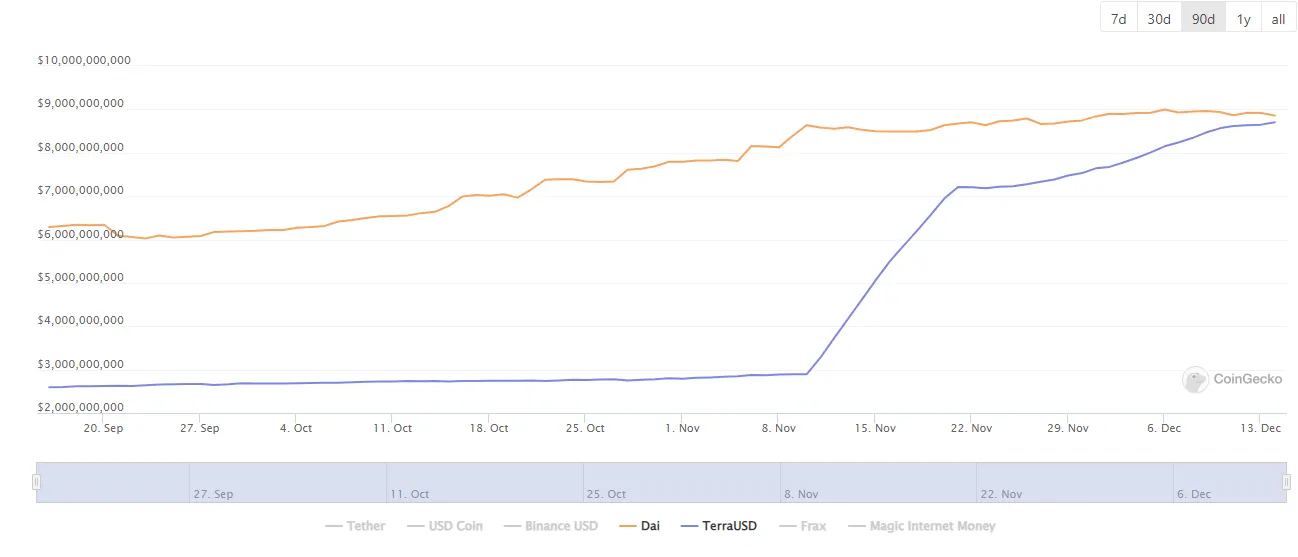

The stablecoin for the Terra ecosystem is a hair’s breadth away from flipping Maker’s DAI to become the fourth-biggest stablecoin by market capitalization, according to data from CoinGecko.

TerraUSD (UST) currently has a market cap of $8.78 billion, whereas DAI corners $8.82 billion of the market. In terms of growth, though, UST has enjoyed impressive upwards momentum of late.

In the last thirty days, the market cap of Terra’s UST stablecoin has grown by over 90%.

Compare that to DAI’s 3% growth and it's conceivable that a flipping is imminent.

What is Terra and UST?

Terra is a stablecoin creator. This means you can use the platform to mint any fiat-pegged stablecoin, and there are many, including TerraGBP and TerraEUR.

The blockchain is built using the software developer kit from Cosmos, another interoperable blockchain. It’s currently the fifth-largest layer 1 smart-contract enabled network, behind Polkadot, Cardano, Solana, and Ethereum.

Terra’s stablecoins are not backed by typical methods. Unlike the two leading stablecoins, Tether and USDC, which are reportedly backed by cash reserves, all of Terra’s stablecoins are tied to LUNA.

Whenever users want to mint UST, they have to burn the equivalent of a dollar in LUNA. The same mechanism is at play whenever users want to mint LUNA; they first need to burn UST.

Maker’s DAI, on the other hand, is backed by over-collateralization. To create DAI, users have to lock up more than 100% of the value of DAI they want to create using other cryptocurrencies, like Ethereum or USDC.

Terra’s propitious market performance isn’t just a product of UST’s success as a reliable stablecoin. The stablecoin issuer’s native LUNA currency has also exploded recently.

At the beginning of the month, LUNA charged into the top 10 cryptocurrencies with overnight price hikes mounting as high as 58%.

One of the primary reasons behind both tokens’ respective rises, comes from a doubling-down on the network’s burn mechanism.

The first initiative was a protocol upgrade called Columbus-5 which moved to permanently destroy LUNA burned when minting UST. Previously, this LUNA was moved to a pool to fund different Terra developments. Second, a proposal was made by the project’s founder Do Kwon to destroy the remaining LUNA (in exchange for UST) in the fund which was gathered prior to Columbus-5.

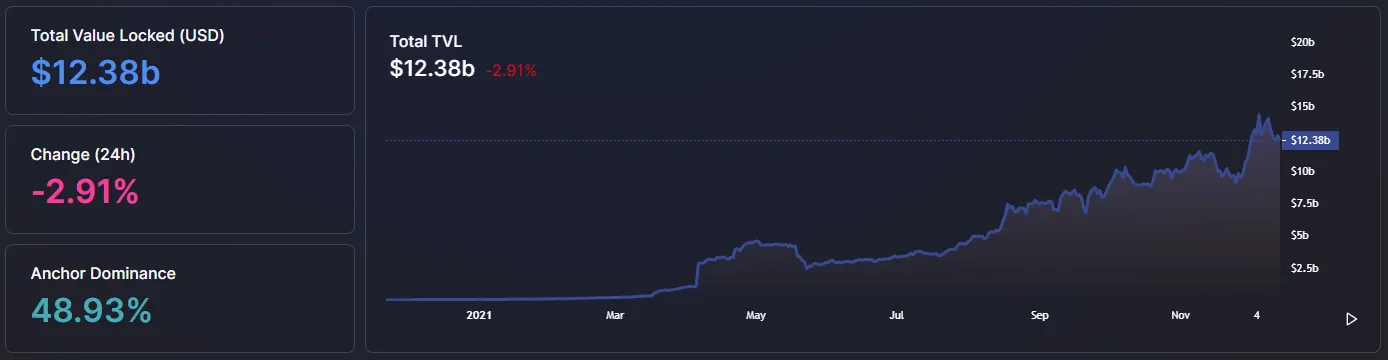

Alongside this mass LUNA burning, DeFi protocols on Terra are popping up left and right. And like Ethereum, stablecoins are the lifeblood of DeFi, creating even more demand for UST. Around $12.3 billion of Terra is already locked up in just ten DeFi protocols.

Couple that with the rate at which UST is being minted, and it’s fair to say that Terra’s stablecoins are becoming a solid mainstay in DeFi and the wider crypto market.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.