Graphics card manufacturer Nvidia launched a dedicated line of Crypto Mining Processor (CMP) cards at the start of the year—but sales of CMPs have slumped by 60% in the last quarter.

Sales revenue from Nvidia's crypto mining products dropped from $266 million in the second quarter of the year to $105 million in the third quarter, according to the company's Q3 earnings report.

CMP sales have performed below expectations for much of the year; although they started the year strong, with Nvidia raising its first-quarter revenue estimate to $150 million, its Q2 sales revenues fell far short of its initial rosy estimate of $400 million.

Over the course of the product's lifetime, sales revenues from CMPs have totaled $526 million—just 3% of the company's total revenues of $19.27 billion during the same period. According to Nvidia's CFO Colette Kress, the company expects its CMP product to "decline quarter-on-quarter to very negligible levels in Q4."

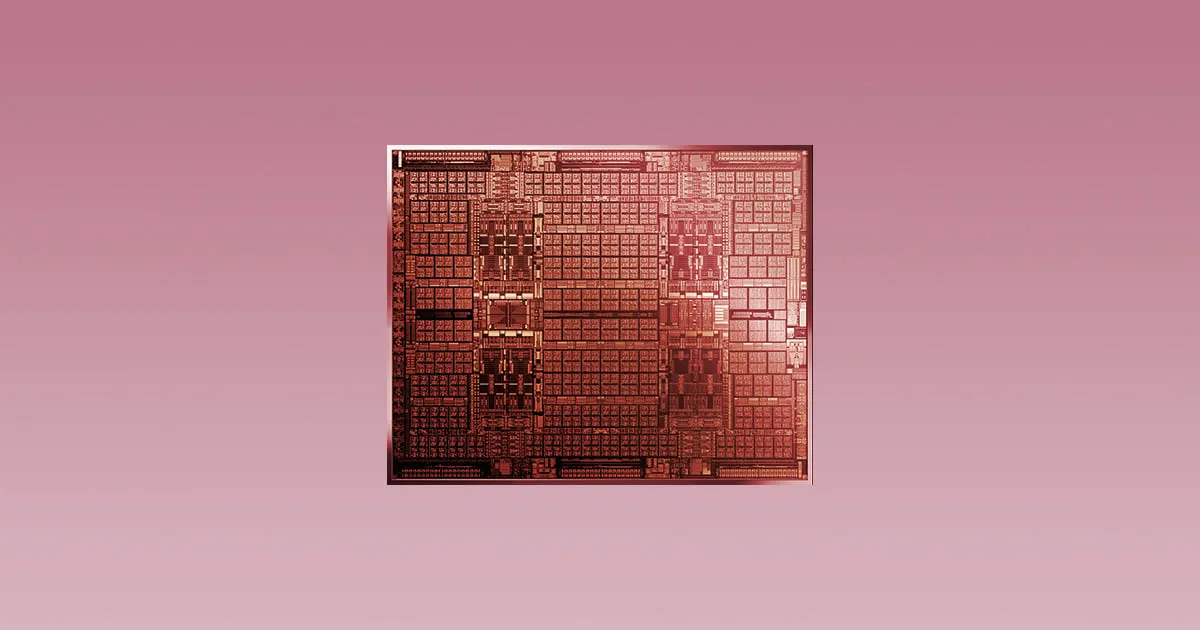

Nvidia's cryptocurrency play

Nvidia launched the CMP in response to the use of its graphics cards for mining cryptocurrencies such as Ethereum. With its core audience of PC gamers up in arms over GPU supply shortages, Nvidia attempted to make its graphics cards "less desirable" to crypto miners by throttling the cards' hash rates.

In contrast, other graphics card manufacturers including AMD and Intel have announced that they won't throttle crypto mining on their core line of products.

PC gamers may not have to wait long before miners move on, in any case. Ethereum, one of the main cryptocurrencies mined on GPUs, is moving from a proof of work consensus mechanism secured by miners, to a proof of stake model with its forthcoming Ethereum 2.0 upgrade.