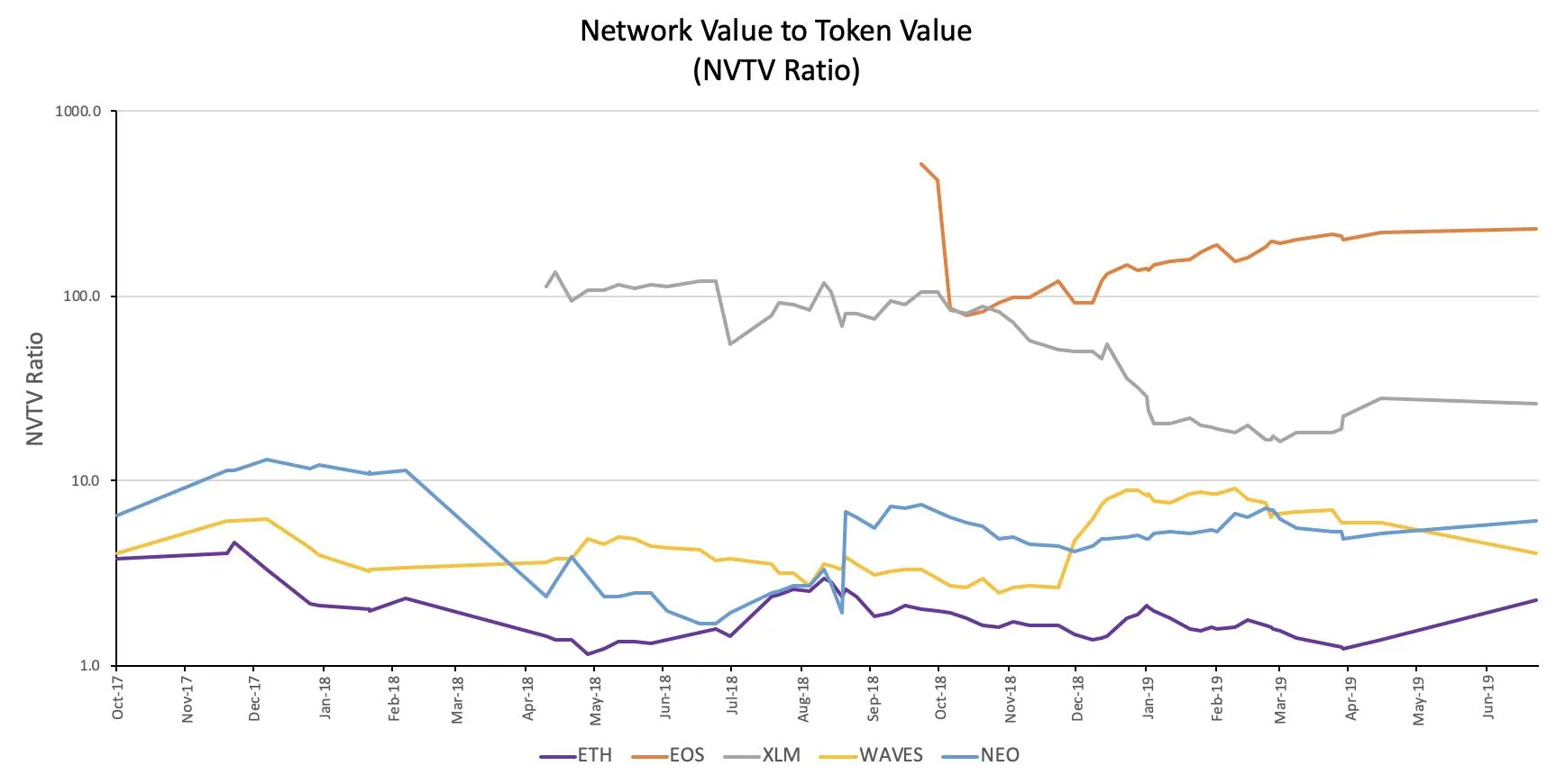

Venture capital firm Placeholder has created a metric designed to measure the value of smart contract platforms. It takes the value of a smart contract platform's network (e.g. Ethereum's market cap) and compares it to the value of the tokens issued on the platform. The underlying thinking here is that if a network is operating as the base for more valuable tokens, but isn't worth very much, then it may be undervalued. In contrast, if it is far more valuable than the sum of its tokens, it may be overvalued.

According to the metric, dubbed “Network Value to Token Value Ratio” (NVTV), Ethereum has the highest ratio and is, therefore, the most undervalued compared to other platforms, such as Stellar, Waves and NEO.

On the other end of the scale is EOS, which, according to the NVTV ratio, is trading at 234x times the value of its tokens, suggesting it is overvalued. Ethereum, meanwhile, is only double the value of the tokens built upon it. In fact, all of the networks studied are more valuable than the sum total of the tokens built upon them.

But with crypto full of manipulation and fake trading volume, any new metric has to be taken with a pinch of salt. Chris Burniske, partner at Placeholder, acknowledged the problem of fake transaction volumes but argued that comparing market caps should result in a more genuine metric. He said, "The ratio has its own flaws, but our thinking is the market price of assets is the most 'efficient metric' crypto has."