In brief

- Goldfinch's protocol lets investors lend out pools of stablecoins to lenders in the developing world.

- The startup is backed by blue chip investors like Andreessen Horowitz.

The field of decentralized finance, or DeFi, is one of the hottest sectors in crypto. But despite a recent burst of interest in DeFi—a Lego-like stack of financial services run by semi-autonomous software—two Coinbase veterans believe its true potential is just emerging.

That's why Mike Sall and Blake West started Goldfinch, which announced on Wednesday that it's raised $11 million from Andreessen Horowitz and other blue chip investment firms. The duo say that, while at Coinbase, they saw how DeFi could transform finance and lending markets if it could expand beyond its core customer base—a base that is composed almost entirely of professional crypto traders.

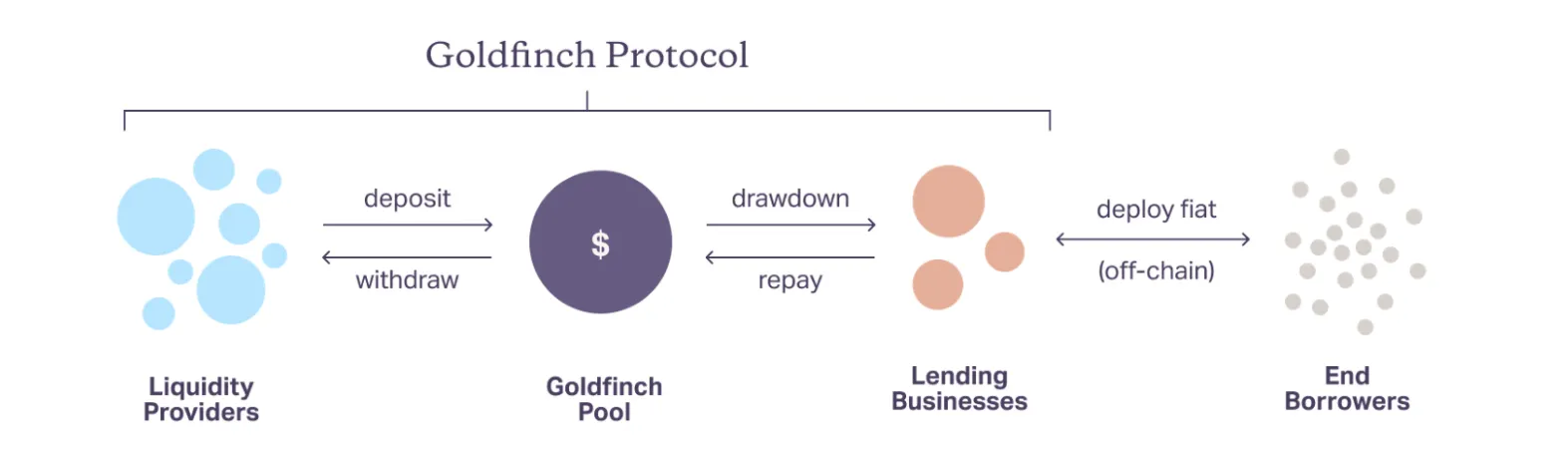

Goldfinch has a very different set of customers in mind: lenders in markets like India and Thailand that have sound loan books but that have trouble raising additional capital. Goldfinch aims to supply that extra capital by means of a pool of stablecoins—digital tokens pegged to a fiat currency—and a protocol that lets the lenders tap into them, and in turn loan them out to their customers.

According to Sall, Goldfinch's model doesn't require the "overcollateralization" that defines the current DeFi markets. The term describes the phenomenon whereby DeFi lenders require traders to post as much as 150% in crypto assets as a bond against potential default—a collateral level that makes sense when the borrowers are using the loan to trade highly speculative assets but is excessive when it comes to conventional borrowers who need funds for their home or business.

In practice, the way all this works is that investors holding USDC stablecoins agree to underwrite lending services like PayJoy, which finances smart phone buyers in Mexico, and QuickCheck, a microloan provider in Nigeria. Those services oversee loans to individual customers and then repay the pool of stablecoins from which the investors can take the resulting yield. Here is a graphic that depicts the lending model:

In time, say the Goldfinch founders, the protocol will come to power more decentralized projects—letting groups of investors stand up stablecoin pools in all corners of the globe and allowing local lending services to draw from them. The upshot is that Goldfinch and its network of partners could one day disrupt banks as the primary means of capital allocation in many places.

According to Sall and West, the Goldfinch protocol harnesses the unique qualities of crypto—specifically its ability to allocate capital quickly and efficiently across borders—and deploys it on a scale far beyond the niche areas of DeFi trading.

"Crypto has a lot capital chomping at the bit to participate in this stuff," Sall told Decrypt.

Sall added that the growth of stablecoins, as well as and the expansion of fiat-crypto onramps around the world, means the time is now right for DeFi to expand from niche finance markets and become a viable real world service.

If Goldfinch's vision for DeFi takes off, it will also mean that flow of capital from developing countries to emerging markets—which currently consists primarily of loans to governments and large companies—will come to encompass a much broader segment of society.

For now, the amount of capital being lent through Goldfinch's stablecoin pools is very modest. According to the company, it has helped deploy $2.5 million worth of loans since January, but that this amount is expanding rapidly. Goldfinch is also working with lenders in Indonesia, Singapore, and Vietman.

For now, only professional investors in the U.S., as well as those overseas, are eligible to participate in the stablecoin lending pools—a situation that reflects the regulatory uncertainty in the U.S. when it comes to retail investors participating in the crypto markets.

In addition to Andreessen Horowitz, investors participating in the new Goldfinch funding round include Mercy Corps Ventures, A Capital, SV Angel, Access Ventures, Divergence Ventures, Defi Alliance, Draft Ventures, Balaji Srinivasan, Wale Ayeni, Ryan Selkis, and Jason Choi.