In brief

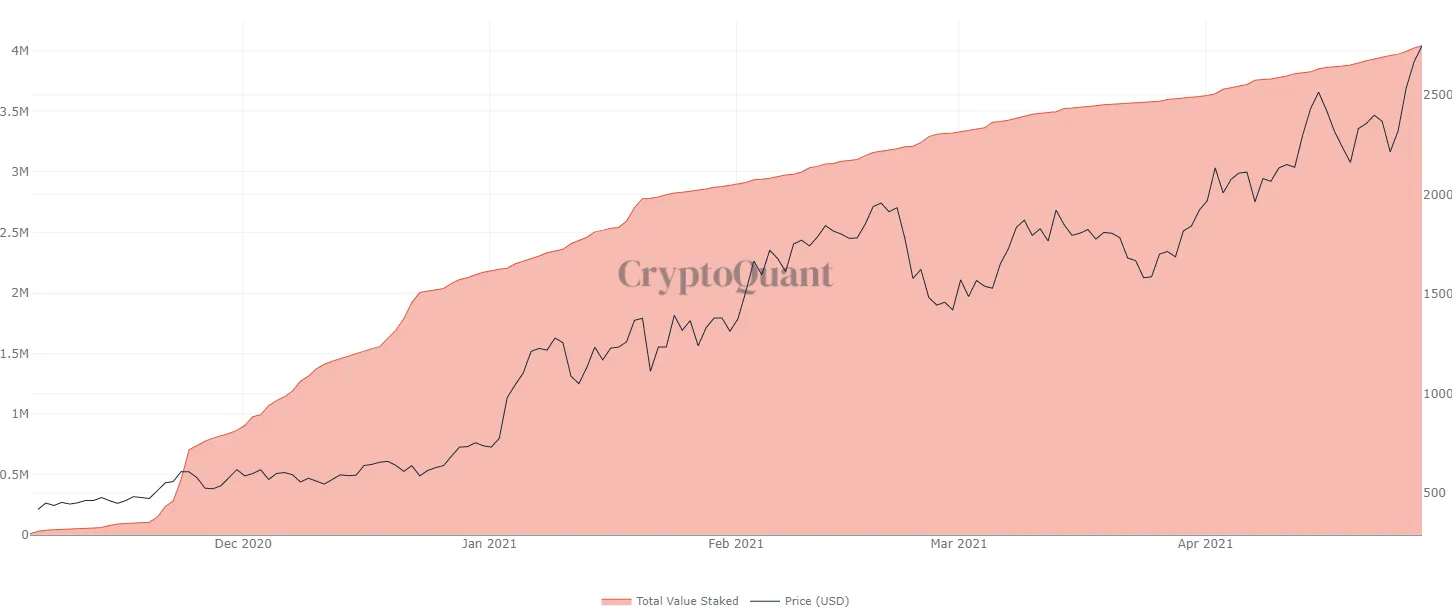

- The total amount of ETH locked up in the Ethereum 2.0 deposit contract has exceeded four million.

- This is eight times more than was required to initially deploy "Phase 0" of ETH 2.0.

The total amount of Ethereum (ETH) staked on the Ethereum 2.0 deposit contract has exceeded four million tokens, worth more than $11 billion at current prices, according to crypto metrics platform CryptoQuant.

Ethereum 2.0 is an ambitious multi-year upgrade plan that aims to switch the Ethereum blockchain from its current proof-of-work (PoW) consensus algorithm to a proof-of-stake (PoS) one. This will significantly reduce the network’s energy consumption and hardware requirements, potentially resulting in lower transaction fees (which are currently skyrocketing) and higher throughput.

Currently, ETH 2.0 is in the first stage of deployment, dubbed “Phase 0.” To initially launch it at the end of 2020, the network required over 16,000 validators—users running the software—and 500,000 ETH deposited. Initially, community members were seemingly reluctant to lock up their coins; the minimum threshold was crossed almost at the last moment before the deadline.

Since then, however, inflows of ETH into the Ethereum 2.0 deposit contract have grown considerably. By December 4 last year, users had locked up a total of one million ETH in the 2.0 contract—twice that required for the beacon chain’s launch. That figure doubled again just 20 days later, reaching two million ETH on December 24.

The ongoing crypto price rally has given a significant boost to the dollar value of staked ETH. In December, Ethereum traded at around $600 per token, but it's surged to over $2,700 since then, according to crypto metrics platform CoinGecko.

The recent influx of ETH staked in Ethereum 2.0 could be partly explained by a recent announcement from leading crypto exchange Coinbase. On April 16, the platform began moving customers off its waitlist for 2.0 staking. In exchange for locking up some of their ETH, Coinbase users can now earn up to 6% in annual interest.