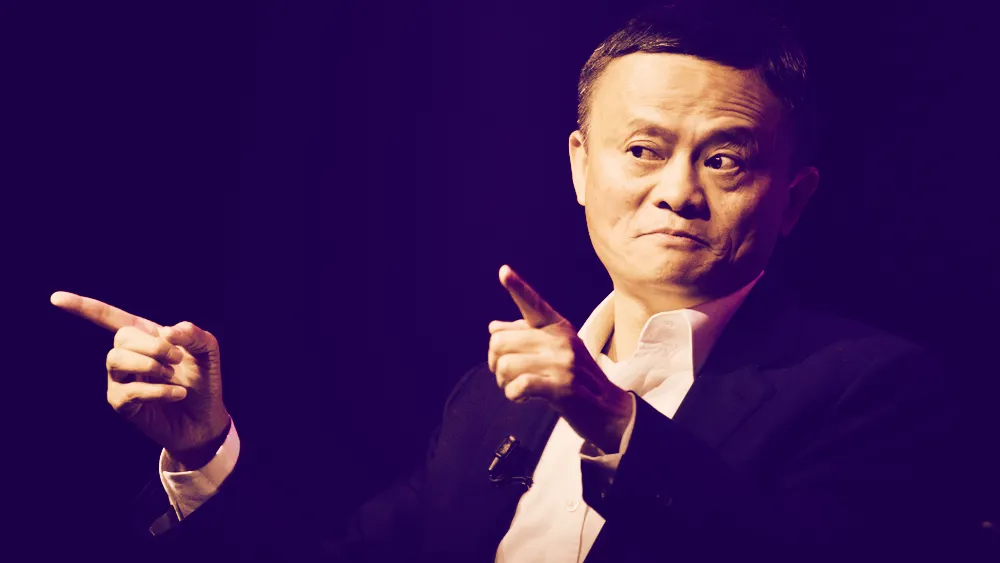

A $2.8 billion fine would blow any firm out of the water. But it was just a drop in the ocean to Jack Ma’s Alibaba Group, one of the Chinese tech behemoths behind China's recent so-called “digital leapfrogging” of the developed world.

On April 10, China's State Administration for Market Regulation finally made its move and slammed Alibaba with the highest-ever antitrust fine, an equivalent to about 4% of Alibaba’s domestic revenue in 2019. Does Alibaba deserve the punishment?

Arguably, yes. For years, it has prohibited its vendors from selling goods on other platforms, a practice known as "choose one out of two." But is it the only one doing it? Not really—another massive e-tailer, JD.com is also under the government’s scrutiny.

Ever since the regulators started looking into Alibaba’s business practices in late 2019, the journey has been grueling. The government has been making noises about monopolistic practices and even halted the IPO of its sister company, Ant Financial.

This week’s da bing looks into the long, strange trip Alibaba’s been on and asks a bold question: Could crypto be a way out for BABA?

Just fine for now?

Despite its size, the fine brought some closure to Alibaba’s regulatory limbo; the company’s Hong Kong-listed stock rose 6.5% by the following Monday. It signaled to investors that rather than waiting to be punished, a decision had been made at last. Now it’s time to move on.

But, though Alibaba might be off the hook for now, the implications of the fine are far-reaching. Many users have reported that Huabei, Alibaba’s consumer credit platform, has decreased its loan amounts in recent weeks. That comes as no surprise since the government had criticized Jack Ma for excessive lending to millennials and GenZ, encouraging rampant “consumerism” among the youth.

Many of Alibaba’s M&A deals are also under investigation. It’s no secret that tech giants such as Alibaba and Tencent “own” the majority of the Chinese tech world. Their venture arms have been scooping up any smaller companies that show signs of traction. In fact, both Alibaba and Tencent were fined in December for what was seen as monopolistic acquisition. So that's got to stop.

Another unsettled matter is whether Ant Financial, Alibaba’s Fintech arm, will continue pursuing its IPO. The situation looks less dire now that Alibaba has found a way out, but the government has already asked the firm to become a financial holding company, bringing scrutiny over how it generates profits.

Funnily enough, despite its size, the fine wasn’t the thing that got people talking. What really caused a stir on Chinese Weibo, the equivalent of Twitter, is that the government also forced Ma’s prestigious business academy, Hupan University, to suspend all enrollment. (Justin Sun’s alma mater!) That crackdown meant the Chinese government was cutting all ideology associated with Ma, not just his business. And that could be a bigger problem for him.

There are a few ways Alibaba could dig itself out of the political graveyard and tighten up its business holdings, including relying less on e-commerce.

A more transformative way, however, is to overhaul Alibaba’s business model, and concentrate on the value it delivers to customers.

Blockchain with Chinese characteristics

Here is where “blockchain-not-crypto”—a course encouraged by the government—comes into play.

Alibaba is no stranger to blockchain. During the 2019 Single’s Day shopping festival, the tech giant used blockchain technology to power a record-smashing $30 billion day of sales. Not surprisingly, Ant Group, the fintech arm of Alibaba, tops the charts as the largest holder of blockchain patents in 2020.

Going all in on blockchain-not-crypto—applying it to real, everyday life—would help Alibaba win its way back into the government’s good graces, earning it respect and trust again. These days, most blockchain use cases revolve around civil services and the digital yuan. There are fewer private sector use cases. If Alibaba manages to showcase the power of blockchain in turning itself around, it would likely get a huge thumbs up from the government.

Unleash the Ant(s)

The company is well positioned, and clearly ready to do this. Ant Group's own blockchain, AntChain, aims to bring small businesses and developers to the ecosystem and build applications at lower cost. One such use case is “Trust Made Simple,” a global trade platform for small-to-medium-sized companies to track, verify and execute trading orders with financial institutions. The platform also encourages SMEs to build their trustworthiness on AntChain, which is supposed to make the product more sticky.

This will not be easy, Alibaba’s competitors are hardly sitting still. JD.com has already won the government's blessing as one of the first e-commerce partners for its digital yuan rollout.

Did you know?

Jack Ma is commonly referred to as “Daddy Ma” in China. That’s partly because the “baba” in Alibaba is the same pronunciation as the word for “daddy.” It’s also because Ma, aka the "daddy," is one of the richest men in China who can afford to splash cash on anything. (Also, Ma registered “Alimama” when he registered “Alibaba,” in case someone wants to marry them.)

For Alibaba to get back on its feet, it will need a new model to conduct business and a more submissive tone to deal with the government.

The rise of Alibaba was partly due to the government’s eyes being only half-open. But now, the government's eyes are fully open, as it hunts for even the most minuscule mistake that Alibaba could make. Going all in on the government-sanctioned version of blockchain looks like a win-win situation for Alibaba, and might even help Jack Ma rehabilitate his image.