In brief

- Bitcoin and Ethereum prices cool as transaction fees hit record highs.

- The markets more broadly traded gains and losses.

- Stock markets are up but behaviour is becoming more unorthodox as artificial stimulus is pushing investors into more exotic products.

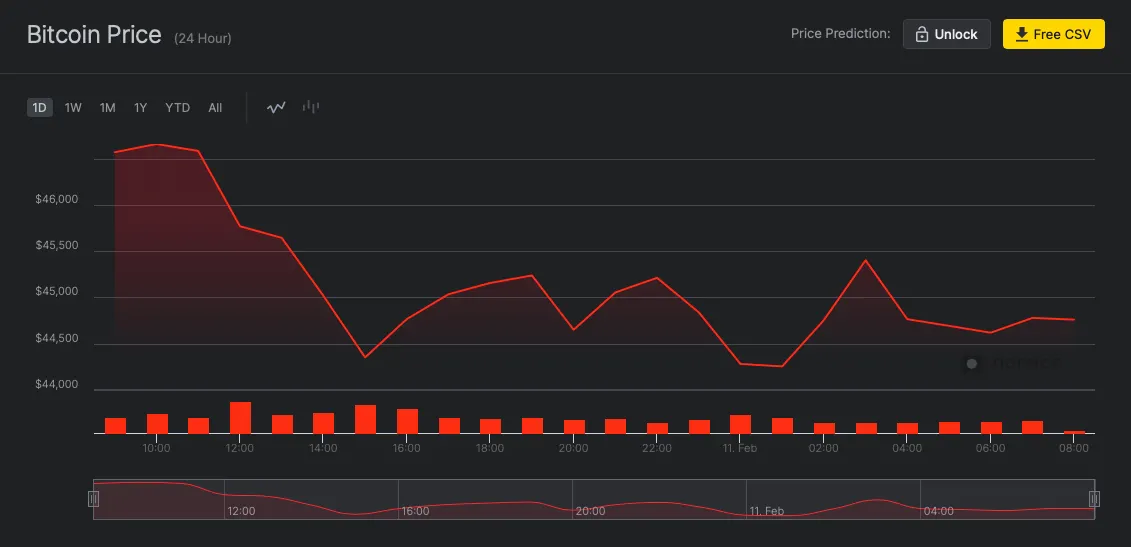

It was a mixed day on the crypto markets. The mega caps, Bitcoin and Ethereum both saw nearly 4% losses. For Bitcoin, the currency appears to have found an oscillating rhythm between $45,500 and $44,500, according to data company Nomics.

Interestingly, Ethereum has found a similar groove with its price. It spent the last 24 hours wavering between peaks of $1,750 and troughs of $1,700. Both projects saw trading volumes down by more than 10%.

The cooling off could have something to do with the skyrocketing fees across networks like Bitcoin and Ethereum. Bitcoin’s transaction fees are at their highest in three years, and Ethereum’s are just shy of all time highs of $25, set last week.

Further down the top 20, projects incurred more extreme gains and losses. Cardano, which has steadily grown to become the fourth largest cryptocurrency by market cap, saw 15% gains in the past 24 hours as news of its long awaited upgrades continue to exert upward pressure on its price.

Binance Coin meanwhile, which surged nearly 40% in a day, lost momentum overnight, dropping 16%. Other projects gained and lossed in less extreme swings, but the market appears to be treading water, for now.

But further afield, two giants have revealed their intentions to explore crypto later this year. The first, Amazon, is hiring developers to work on a digital currency project that’s due to launch in Mexico.

Not much is known about the project, bar the job description which states that when live it will “enable customer to convert their cash into digital currency using which [sic] customers can enjoy online services including shopping for goods and/or services like Prime Video."

The second, and perhaps more significant news for crypto is Mastercard’s announcement that will allow support for crypto payments later this year.

While the company has previously worked with payment rails providers Wirex and BitPay, this is the first time Mastercard is incorporating crypto payments into its network.

Last year, PayPal opened the door for its 150 million users to start using crypto. This year, with Mastercard’s move into the space, it will expose its 750 million card holders to digital money.

If Visa follows, we might have the mother of all bull markets on our hands.

Stock Markets Continue Strong Performance Thanks to Market Stimulus

Stock markets continue to hover around record closing highs, although the S&P and and Dow have ticked down for two days straight.

As earnings season draws to a close, many companies have delivered above expected results, according to market research company FactSet. Aggregate earnings are due to grow by 1.7% in the last quarter in spite of Covid's dogged persistence.

But the companies that have performed most strongly haven't been rewarded with gains in price, according to Yahoo! Finance. This has led some analysts to wonder why the markets are behaving unusually towards strong performers.

“Record low yields in fixed income, low expected returns in large-cap equities, and $23 trillion in policy stimulus (with more on the way) leave investors with no good reasons to be bearish but few inexpensive ways to be bullish,” Bank of America strategists wrote in a note Wednesday.

“Some are turning to alternatives. Crowd-sourced trading, the rise of cryptocurrencies and Special Purpose Acquisition Companies (SPACs), the lack of guidance in both foreign and domestic markets, and record savings gluts are all evidence of low investor trust in conventional methods and desperation for returns in a stagnant world,” they added.

With the Fed showing no signs of easing off its stimulus, crypto is inadvertantly benefitting from the lavish spending by the US government.

Brought to you by AAX

Learn More about partnering with Decrypt.