In brief

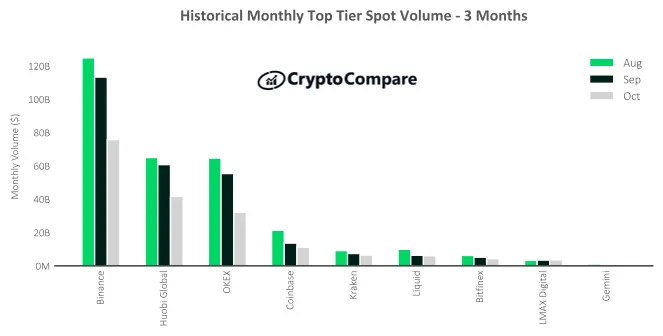

- Trading volume on top crypto exchanges sank last month.

- Crypto trading on Binance dropped 33.1%, for example.

- Analysts say a relative lack of Bitcoin price volatility is one of several potential reasons.

A report published by Crypto Compare today shows that cryptocurrency trading volumes fell by 17.6% last month, a surprise for those who thought that last week brought nothing but good news for the crypto market.

In October, Bitcoin spiraled upward, peaking on Friday at $15,889, up from around $10,500 at the start of last month.

But CryptoCompare reported large decreases in overall spot trading volumes for exchanges that the market research firm considers to post accurate figures.

Trading on Binance hit $75.7 billion, down 33.1% compared to the previous month. Huobi Global posted volumes of $41.7 billion, a 31.4% decrease.

Volumes on OKEx, which last month suspended withdrawals after police apprehended its co-founder, fell by 42%. Coinbase fell 17.5% to $11.3 billion, Kraken fell by 13% down to $6.5 billion, and Liquid fell by 4.3% to $6.1 billion.

Pedro Febrero, an analyst at Quantum Economics, told Decrypt that there are two possible reasons for the decline.

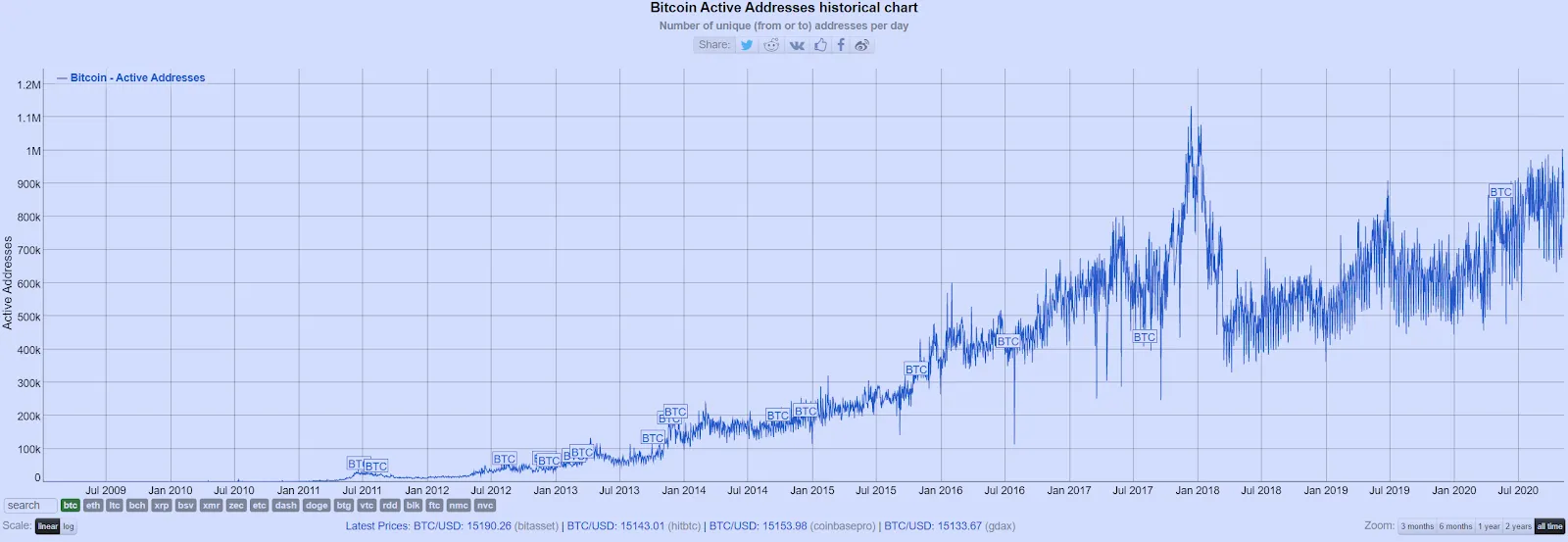

“First, it seems an increasing number of coins are being HODLed,” he said. Febrero pointed to the raised number of active Bitcoin addresses, which show how “there has been lots of activity,” and the average transaction value increased last month, too. “Both metrics show that users are in fact using BTC, but they are not sending it to exchanges,” he said.

Constantine Tsavliris, CryptoCompare’s spokesperson, told Decrypt a similar story. “The higher volatility in September and Bitcoin's decline from $12,000 to $10,000 generated significant trading volume. In October, there has been an almost uninterrupted rally and this lack of price reversal and volatility has led to a decline in month-on-month volumes,” he said.

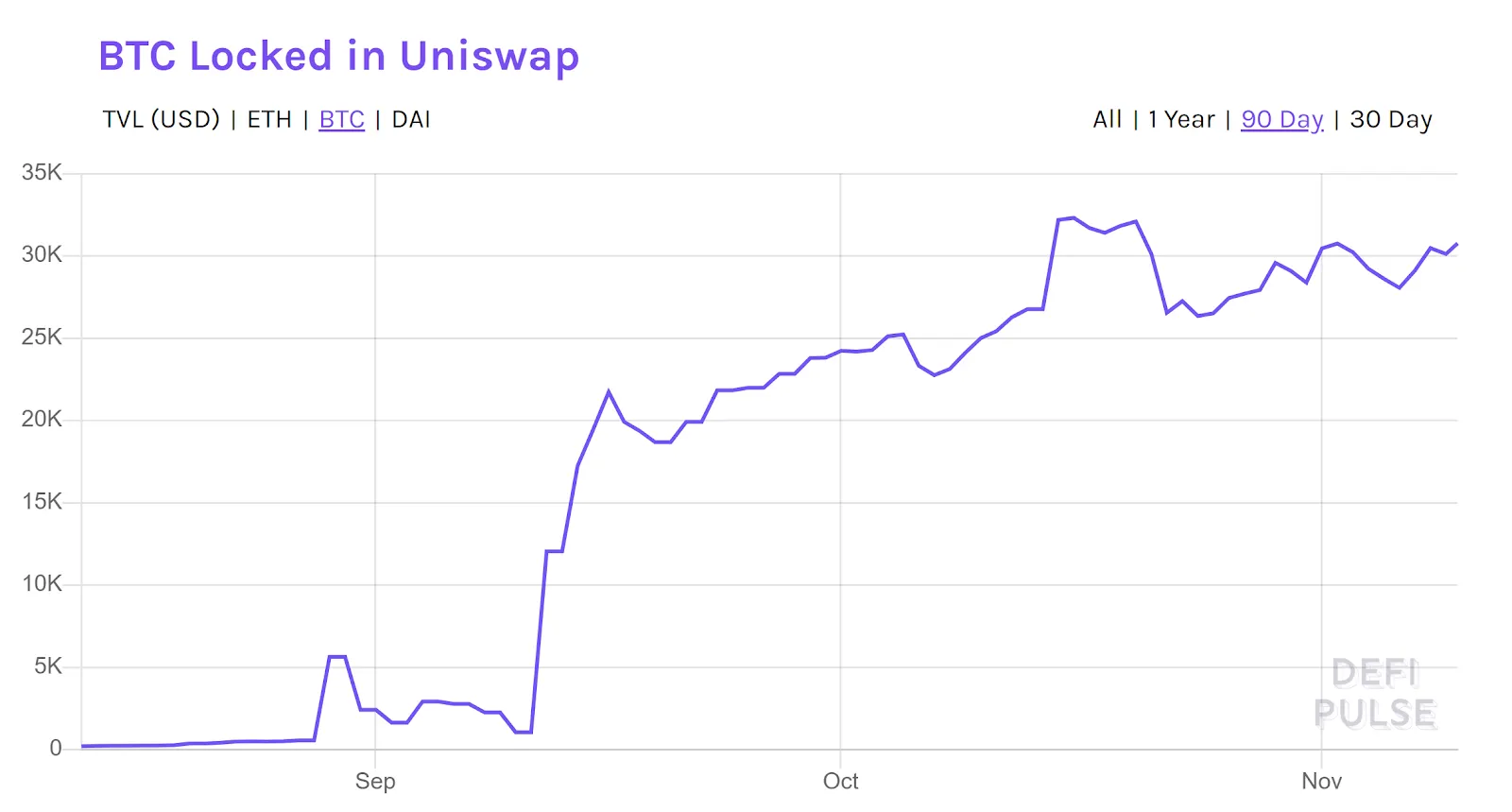

Febrero’s second reason: traders are locking in Bitcoin on decentralized exchange Uniswap, likely to make the most of liquidity fees offered by the protocol or to trade on the exchange (using synthetic representations of Bitcoin compatible with the Ethereum-based exchange).

According to metrics site DeFi Pulse, the total amount of Bitcoin locked in Uniswap increased during the past 30 days increased from 24,000 Bitcoin to 30,000 Bitcoin.

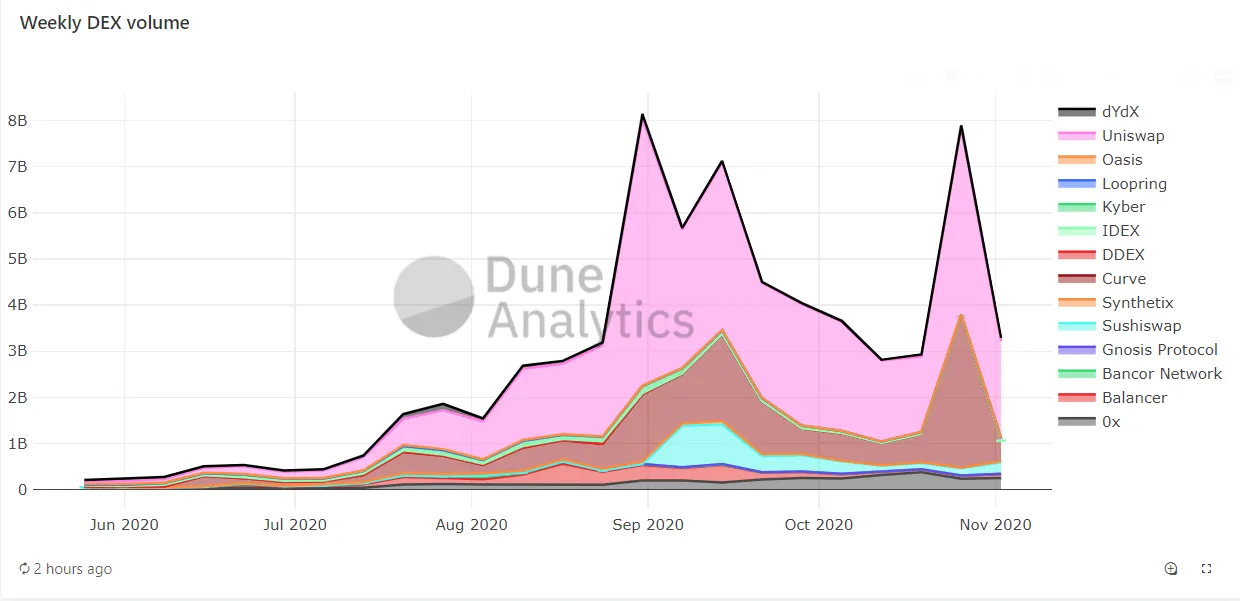

“What this shows is a continuation of the yearly trend that more and more users are switching from [centralized exchanges, such as Binance] to [decentralized exchanges, such as Uniswap],” said Febrero.

Indeed, over the summer, Uniswap’s daily trading volume once surpassed that of Coinbase Pro. Volumes have fallen by 18% over the past month, according to a dashboard on Dune Analytics, but volumes are still far higher than before this summer’s bull run started.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.