In brief

- One year after launch, Binance P2P trading volumes are seeing double-digit growth.

- The exchange's P2P trading volume topped $4.2 billion in the past 12 months.

- CEO Changpeng Zhao explains its strategy, and why growth is greatest in countries where crypto exchanges find it hard to operate.

Crypto exchange Binance last month celebrated the first anniversary of its peer-to-peer cryptocurrency trading service. The platform allows buyers and sellers to transact directly with each other, without a third party, and functions as a gateway to convert fiat money to crypto.

P2P is hugely popular in China, India and other countries where crypto trading is frowned on or even banned. Binance CEO Changpeng Zhao told Decrypt that Binance’s P2P trading is “seeing double digit growth. Sometimes even week-on-week.”

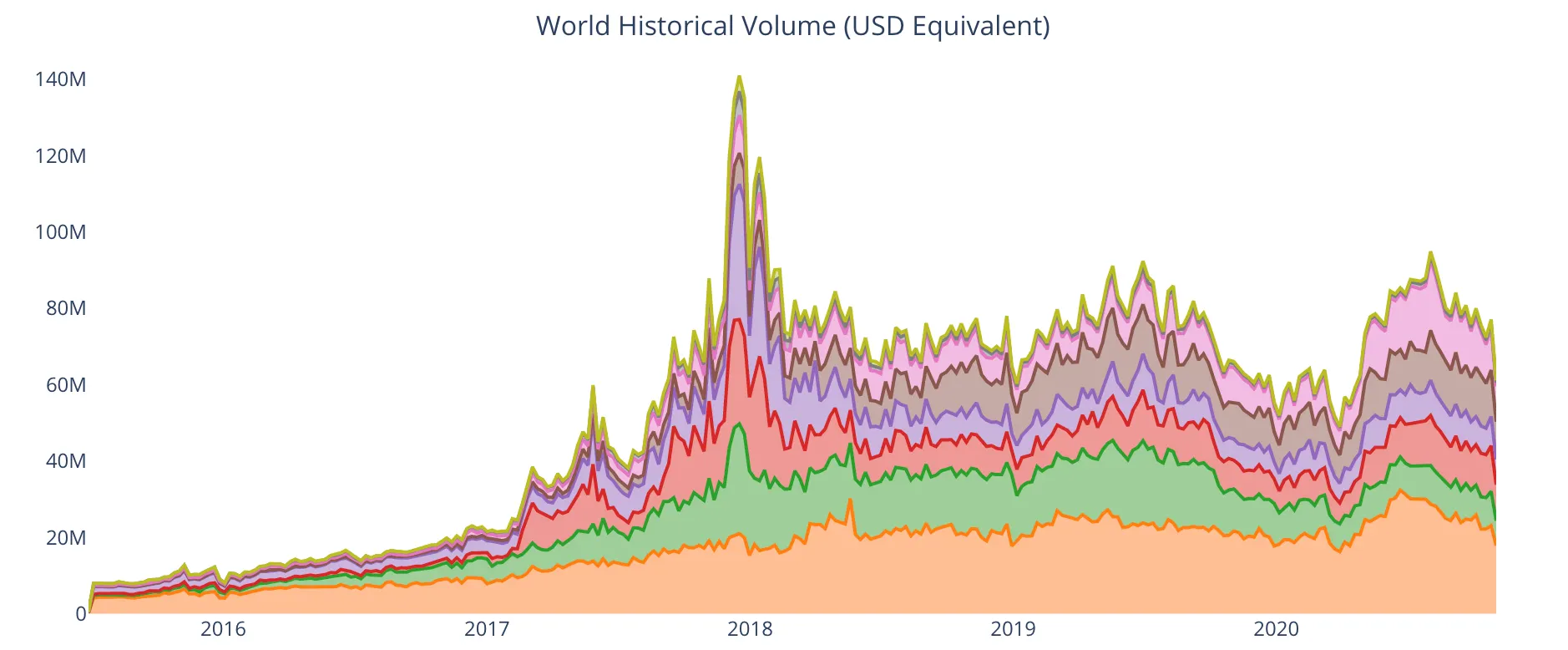

In China, Binance focuses solely on P2P and global trading volumes are in rude health. While just a drop in the ocean compared to the volumes for spot trading or its own futures offering, Binance’s P2P trading volume topped $4.2 billion in the past 12 months. And, on October 22, the network’s daily trading volume hit an all-time high of $46 million.

However, the exchange differs from the competition. “Other players, they are clearly much more China-focused, whereas our users are spread very evenly, globally. Strategically, [there are] a lot of differences,” he said.

Binance’s P2P trading plan

While Binance P2P is growing across all regions, growth is greatest in areas where traditional crypto exchanges find it hard to operate.

“Fundamentally we see that when banks or regulators don't allow cryptocurrency to be bought easily, people go to P2P markets,” Zhao said. And this, he said, opens the door to the wider crypto ecosystem.

Southeast Asia, specifically India, is a good example. “There is a lot of talk about a ban; there's a lot of uncertainty; there's a lot of difficulties in using a bank to buy and to transfer money to buy Bitcoin,” he said.

To capitalize on interest, Binance added new payment methods including Indian e-commerce platform Paytm, which has 58 million account holders.

But in terms of market share, “we're usually not the biggest player locally because there are usually more localized solutions available,” said Zhao.

P2P competitors Paxful and LocalBitcoins outperform Binance in many P2P markets. However, Binance P2P has two other advantages: The platform’s rapid growth means it now supports 100 different payment methods, and it’s not limited to Bitcoin—supporting 40 different fiat currencies.

Plus there are no fees, unlike many rival P2P exchanges. “So whatever price the buyer and seller agree on, they trade directly among themselves,” said Zhao. Meanwhile, Binance holds the fiat in escrow. “We provide a very secure platform for people to exchange P2P,” he explained.

#Binance Extends Zero Fee Promotion for P2P Trading to 2021/06/30https://t.co/ojbWbmaoPh

— Binance (@binance) October 26, 2020

No fees is a strategy smaller competitors, who are focused purely on P2P, find hard to emulate. Binance is able to support its P2P business through the profitability of its main crypto exchange. “Even at $4.6 billion dollars, it's like two days of trading on spot, over a 12 month period for P2P,” said Zhao. As a result, the no fee structure will be in place until at least June 2021.

“We want people to come into the crypto space. So that's why we provide the service,” said Zhao.

Binance’s P2P offering in China

Binance was originally launched in China in 2017, but relocated multiple times after the country introduced a ban on crypto exchanges later that year. (Although the company is officially registered in the Cayman Islands.) But, since Binance P2P launched, the exchange has wasted no time in tapping into the immense popularity of P2P trading in the country.

“China's really interesting right now. In China, 100 percent of users use P2P. That's the only way to get [a] crypto exchange again in China,” said Zhao.

In China, virtual public networks are often used to route around Internet restrictions, and Chinese users shun know-your-customer (KYC) safeguards, which are used to establish identity, in order to evade detection.

“China does have a decent crypto market size, but it's very hard to gauge the exact size because most people use VPNs or they don't do KYC,” said Zhao. “But just judging by social media, it is a pretty active market,” he added.

However, Binance doesn’t have the biggest share. “Some of the local players like Huobi [do.] And OKEX was bigger than us,” said Zhao.

OKEx, continued to conspicuously serve Chinese customers from abroad, behind a peer-to-peer OTC front. But it was forced to suspend withdrawals on October 16, after its founder, Star Xu, was taken away for questioning by police. it remains unclear when withdrawals will resume. Reports—denied by OXEx—suggested that Xu had sole control of users’ funds, being the only key holder.

Zhao has an ear to the ground, and previous associations with OKEx, however he claimed to know little beyond what’s been reported publicly.

“They are probably held in custody in China now,” he said. “There's a decent amount of user funds still tied up [on the exchange]. I don't think it's going to resolve that quickly, because if you… suddenly find out whoever you're holding in custody holds two billion dollars worth of Bitcoins, that's going to add an additional level of complexity. To resolve that is going to take some time.”

In the meantime, Binance has the opportunity to grow its share of the P2P market in the country, even though—when compared to its other trading offerings—it’s just a drop in the bucket.