In brief

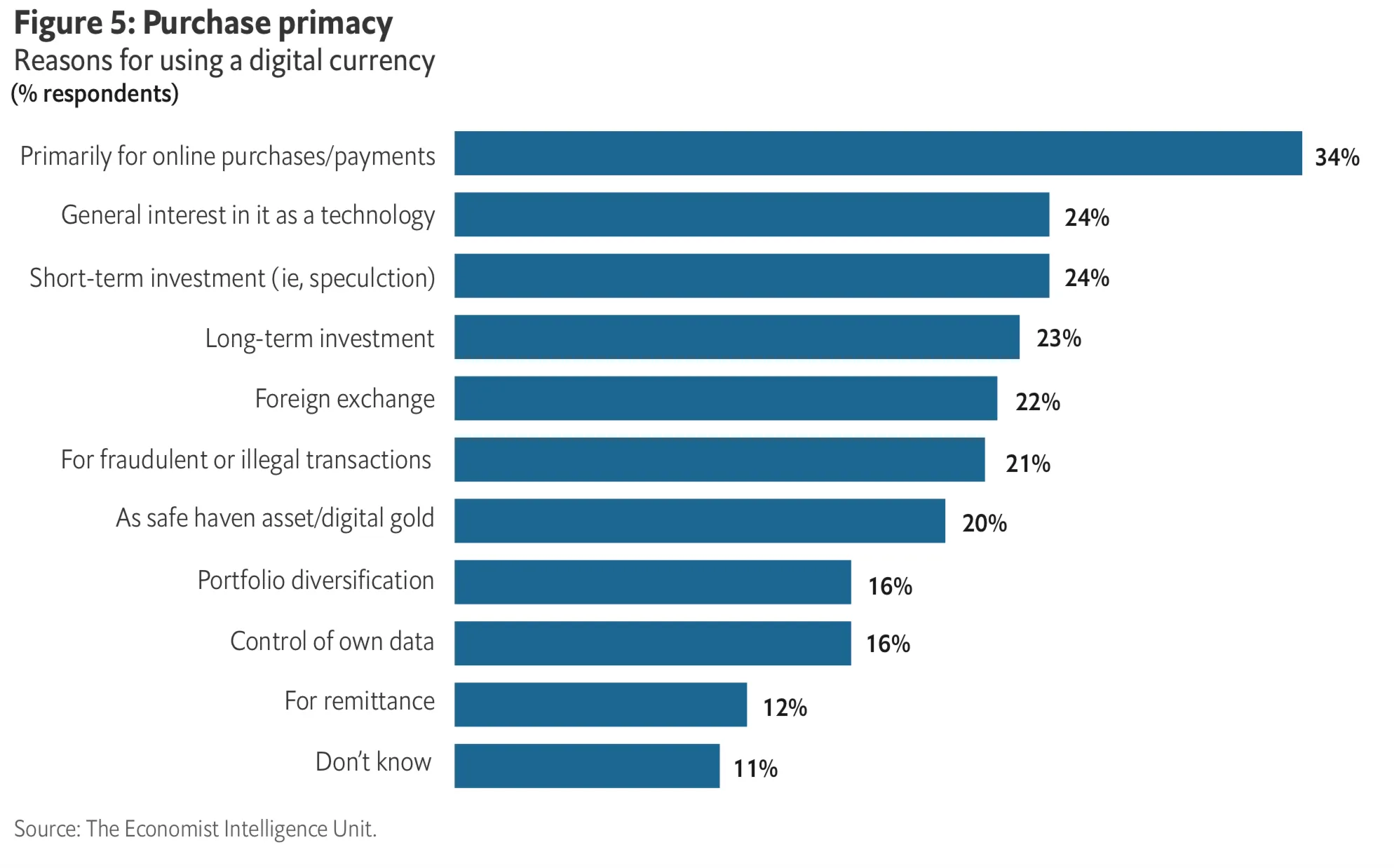

- The main use of Bitcoin and other digital currencies is for payments, said 34% of respondents to an Economist survey.

- 23% see it as a vehicle for long-term investment and 24% consider it a vehicle for short-term speculation.

- The survey found that 85% of those polled were familiar with cryptocurrencies.

Over a third of people say that the main use for digital currencies such as Bitcoin is for online payments and purchases, according to a recent survey.

The survey by the Economist Intelligence Unit and digital payments platform Crypto.com found that 34% of the 3,000 respondents believed digital currencies are primarily for online payments and purchases, while 85% of those polled said they were familiar with cryptocurrencies.

While the majority of respondents considered cryptocurrency’s main purpose to be making purchases, investment also figured heavily in the responses, with 23% seeing it as a long-term investment and 24% considering it a vehicle for short-term speculation. A further 20% saw cryptocurrency as a safe haven or “digital gold”. Almost a fifth (21%) considered the main use of cryptocurrencies to be fraudulent and illegal transactions.

Banking the unbanked

The survey’s respondents were drawn from both developed and developing nations; all were users of digital payment services (taking in cryptocurrencies, mobile payments, online banking and money transfer services). Those living in developing economies are more than twice as likely to own and use cryptocurrency compared to developed economies, according to the poll.

“Using digital currency for payment holds promise for the financial inclusion of people who are currently unbanked,” said Antony Lewis, author of “The Basics of Bitcoins and Blockchains,” who contributed to the survey. “Cryptocurrencies mean greater volatility but also greater acceptability,” he added.

Digital payment methods also bring greater efficiency, lower costs, and convenience.

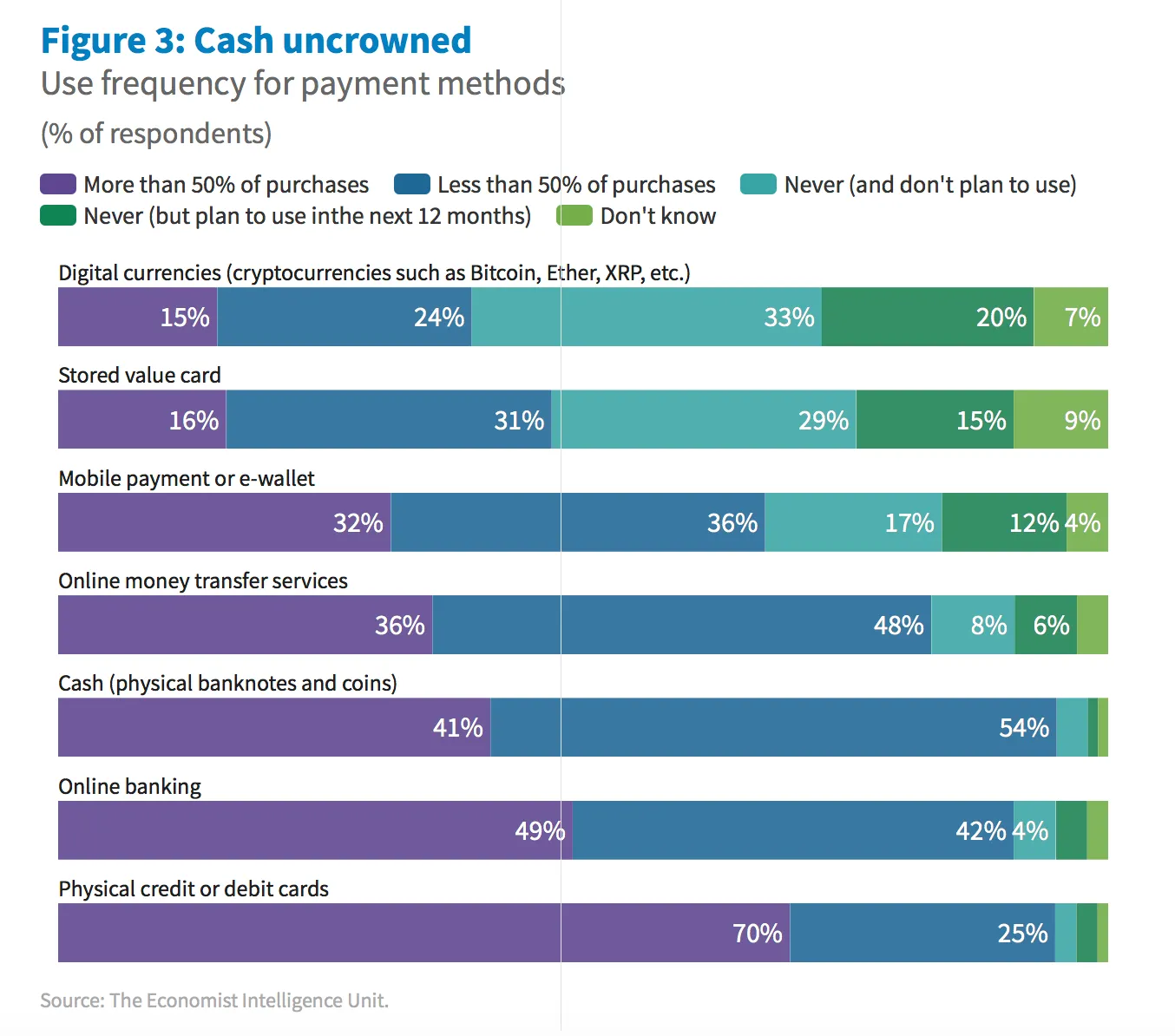

Notably, the survey also found that two-thirds of people use digital payment methods (excluding credit cards) for more than half of their payments. Alongside Bitcoin and other cryptocurrencies, these kinds of payments include online banking, mobile apps like AliPay and Google Pay, and services such as PayPal.

Cryptocurrency was the least popular method of digital payment; an unsurprising finding as it’s a much younger technology than the other options. However, of those who didn’t use digital currencies, one in five said they intended to do so in the following year.

Cryptocurrency has a mountain to climb

Commenting on the survey results, Crypto.com chief operating officer Eric Anziani said: “This is a strong indicator of a trend that shows digital currencies are on the right track for mass adoption; with its potential to enhance the existing payment infrastructure and efficiency.”

No doubt about it then, cash is on its way out—seven out of ten survey respondents believed that it will become a less common way to transact. In fact, one out of ten respondents said their country was “already cashless.”

The coronavirus pandemic could help drive the shift towards a fully cashless society. The World Health Organization has already warned that cash could carry the virus, prompting institutions such as the Louvre to ban banknotes from their ticket gates.