Bitcoin billionaire and BitMEX co-founder Arthur Hayes explained the historical economic cycles and their implications for the current market environment in his latest blog post, arguing that the present economic landscape is characterized by a local cycle of inflation. That makes Bitcoin a superior safe-haven asset compared to gold due to its independence from national control.

He separates economic cycles into local and global periods. In a local period, he wrote, authorities often resort to financial repression to fund wars and other significant expenditures, resulting in inflation. Conversely, a global period is marked by deregulated finance and promotes global trade, leading to deflation.

Hayes believes we are currently in a local cycle driven by inflationary pressures and geopolitical tensions.

"The world is moving from a unipolar US-ruled world order to a multipolar world order that contains leaders such as China, Brazil, Russia, etc,” he wrote.

This shift contributes to the current inflationary environment as nations turn inward and prioritize domestic economic stability.

He further elaborated on the investment implications of these cycles, stating, "If you believe in neither the system nor those governing it, you invest in gold or another asset that doesn’t require any vestiges of the state to exist, like Bitcoin.”

In his view, Bitcoin’s decentralized nature and the speed of transactions make it a more attractive option than gold in today’s economic climate.

Hayes provides a historical context, describing how past cycles influenced investment choices.

From 1933 to 1980, the Pax Americana Ascending Local Cycle saw the U.S. economy growing as it financed wars through financial repression. In contrast, the 1980 to 2008 Pax Americana Hegemon Global Cycle was characterized by deregulation and a stronger dollar, favoring stock investments over gold.

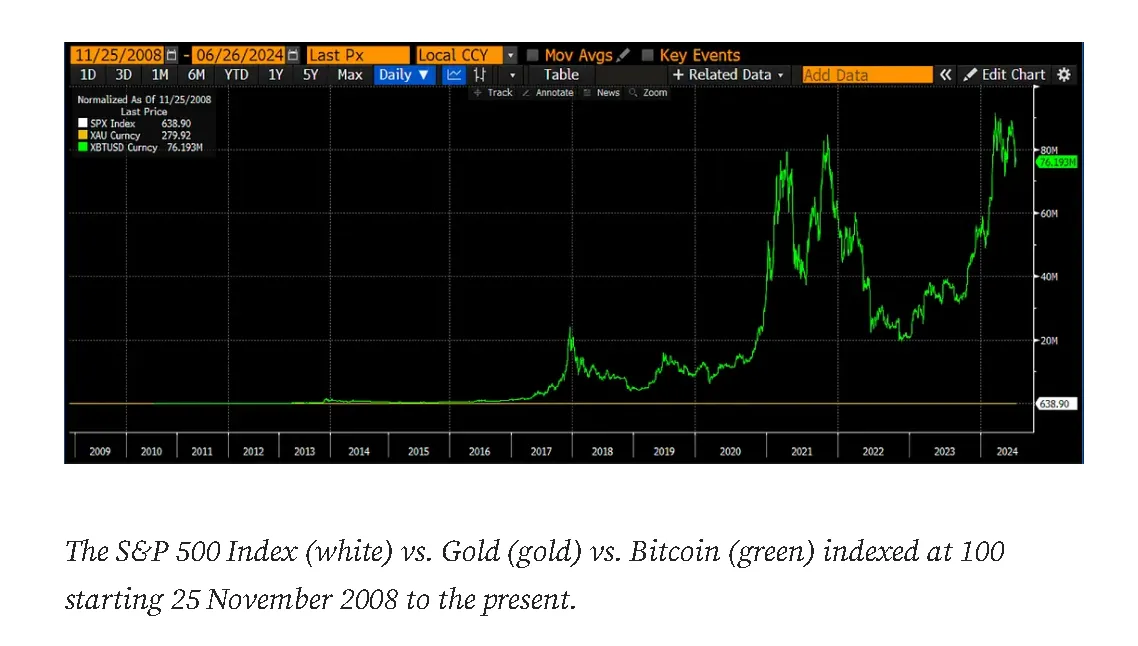

In the current cycle, which began in 2008, Hayes points out the emergence of Bitcoin as a significant development.

"The wrinkle is that at the start of the current local cycle, Bitcoin offered another stateless currency,” he wrote.

Unlike gold, Bitcoin is maintained through a cryptographic blockchain, allowing for faster and more secure transactions. This distinction has enabled Bitcoin to outperform gold since its inception.

Hayes further said that the ongoing local inflationary cycle and geopolitical tensions make Bitcoin a more reliable store of value than traditional assets like gold.

He emphasized the importance of understanding these cycles to make informed investment decisions.

"We know we are in an inflationary period, and Bitcoin has done what it’s supposed to: outperform stocks and fiat debasement. However, timing is everything. If you bought Bitcoin at the recent all-time high, you might feel like a beta cuck because you extrapolated past results into an uncertain future," Hayes wrote, highlighting the importance of strategic timing in investment decisions.

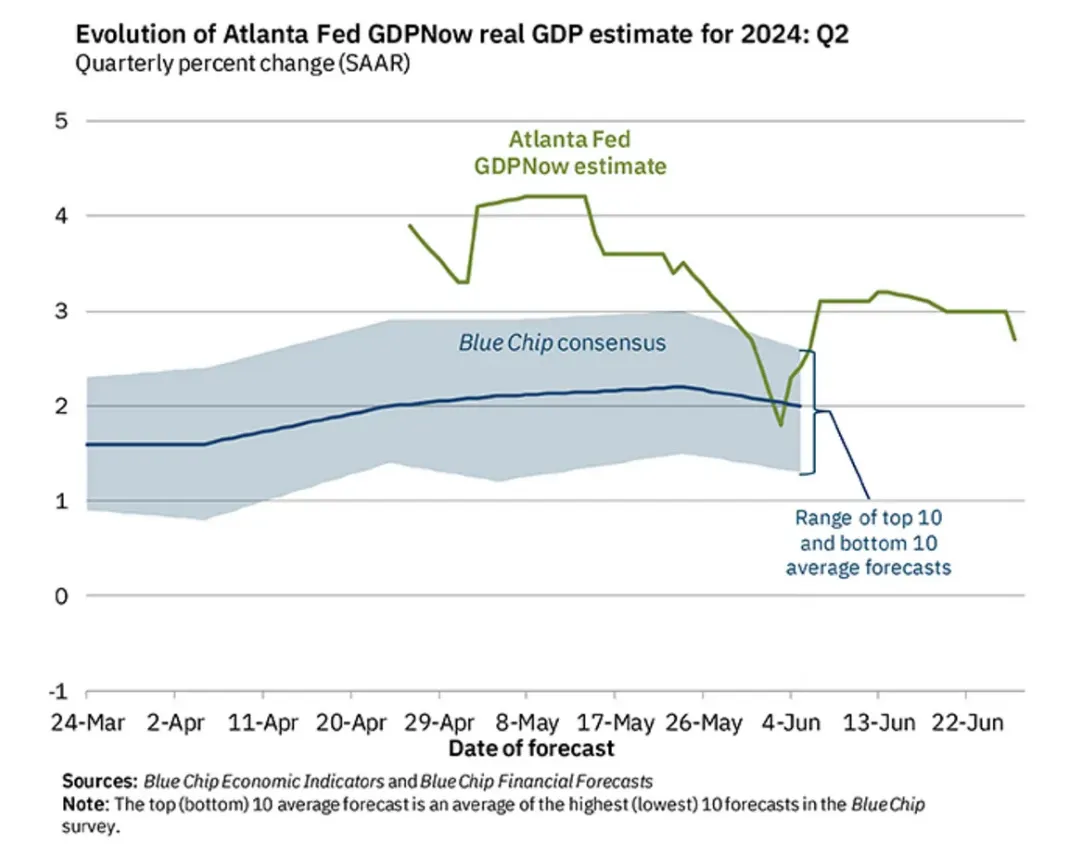

Looking forward, Hayes predicts a shift in credit allocation, stating, "How Pax Americana and the collective West allocate credit will resemble how the Chinese, Japanese, and Koreans do it."

He advises investors to monitor "fiscal deficits and the total amount of non-financial bank credit" as key indicators.

Edited by Stacy Elliott.