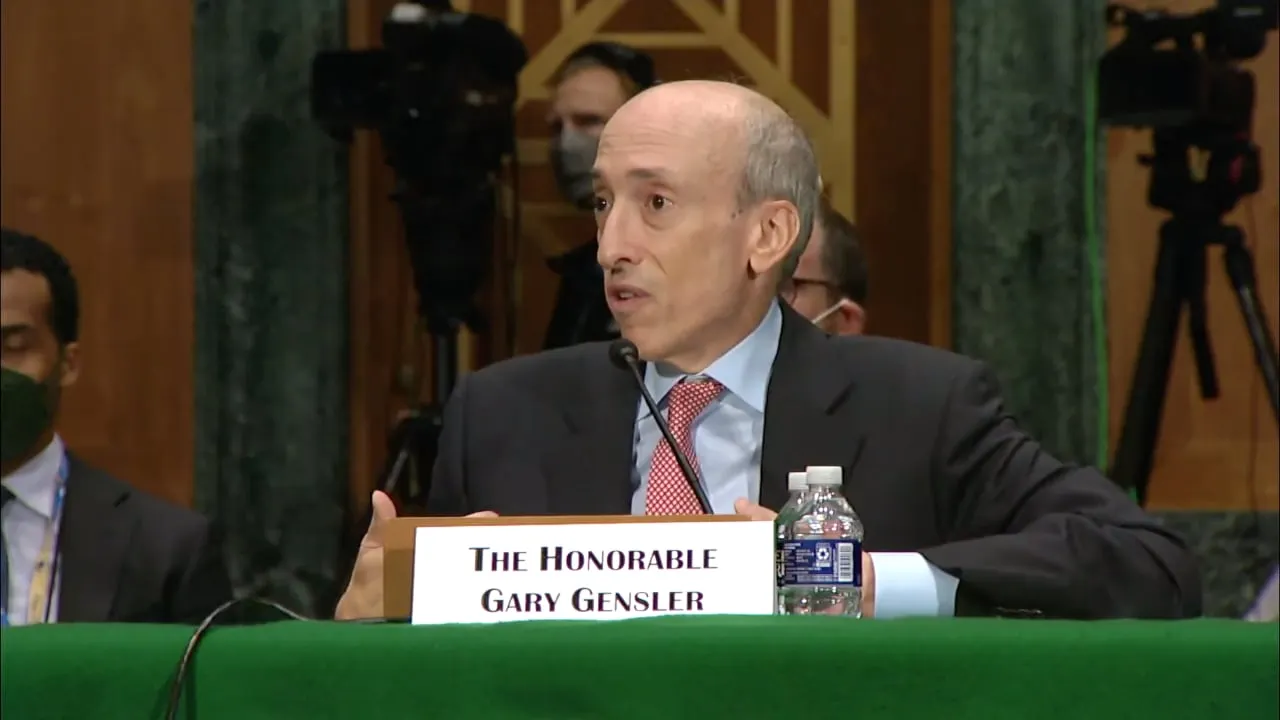

#NEW: Chairman @PatrickMcHenry, @RepFrenchHill, and @RepHuizenga sent a letter to @SECGov Chair Gary Gensler demanding more information on Prometheum’s plans to custody ETH given regulatory uncertainty surrounding its classification.

📖 Read more 🔗https://t.co/AERelaU54M pic.twitter.com/VpvG8whH42

— Financial Services GOP (@FinancialCmte) May 22, 2024

Coin Prices

BTC

$71,099.00

-3.50%ETH

$2,079.67

-3.82%BNB

$650.78

-1.59%XRP

$1.41

-3.04%USDC

$0.999942

-0.01%SOL

$88.81

-3.79%TRX

$0.282719

-1.49%FIGR_HELOC

$1.031

0.85%DOGE

$0.093773

-8.14%WBT

$54.47

3.05%USDS

$0.999996

-0.01%ADA

$0.26866

-4.51%BCH

$456.59

-3.00%LEO

$8.99

-0.75%HYPE

$30.62

-5.40%XMR

$370.56

1.70%LINK

$9.17

-3.38%USDE

$0.999272

-0.04%CC

$0.150668

-2.85%XLM

$0.155622

-4.40%USD1

$0.999451

-0.00%RAIN

$0.00958601

-2.86%HBAR

$0.09922

-2.86%LTC

$55.46

-2.80%PYUSD

$0.99984

0.02%AVAX

$9.36

-2.78%ZEC

$230.14

-5.38%SUI

$0.948351

-3.22%TON

$1.34

3.35%SHIB

$0.0000055

-4.79%CRO

$0.076957

-2.11%XAUT

$5,047.93

-0.98%WLFI

$0.100982

-7.34%M

$1.46

5.92%UNI

$4.00

-1.18%PAXG

$5,086.68

-1.06%DOT

$1.50

-2.66%MNT

$0.69974

-0.91%BUIDL

$1.00

0.00%OKB

$95.61

21.89%USYC

$1.12

0.00%PI

$0.189202

1.37%AAVE

$117.89

0.65%SKY

$0.076938

-0.16%TAO

$184.39

-4.53%USDF

$0.997443

-0.03%ASTER

$0.706603

-3.17%USDG

$0.999857

-0.02%NEAR

$1.26

-3.66%RLUSD

$0.999929

-0.01%BGB

$2.20

0.30%PEPE

$0.00000347

-7.62%HTX

$0.00000158

-0.99%ICP

$2.51

-1.12%ETC

$8.62

-2.78%BFUSD

$0.999139

-0.04%ONDO

$0.262401

-4.34%PUMP

$0.00200786

-4.37%WLD

$0.406292

-4.43%GT

$7.04

-1.72%POL

$0.101384

-3.23%MORPHO

$1.95

1.32%KCS

$8.02

-1.19%USTB

$11.01

0.01%NIGHT

$0.059889

-3.51%ENA

$0.114053

-2.86%QNT

$66.41

1.46%ATOM

$1.84

-2.45%USDY

$1.11

0.29%NEXO

$0.896019

-1.35%EUTBL

$1.21

-0.31%HASH

$0.01525332

5.36%USDTB

$1.00

0.06%KAS

$0.0305551

-5.12%FLR

$0.00925637

-2.00%ALGO

$0.087075

-2.91%APT

$0.986658

-2.31%FIL

$1.012

-1.20%TRUMP

$3.23

-6.72%OUSG

$114.48

0.01%JAAA

$1.026

0.01%USDD

$1.00

-0.03%RENDER

$1.36

-5.69%XDC

$0.03476344

-2.29%JUP

$0.187436

-3.19%VET

$0.00724475

-3.88%YLDS

$0.999956

-0.00%BDX

$0.079816

-0.99%ARB

$0.102206

-3.08%JTRSY

$1.096

0.01%STABLE

$0.02744873

-6.77%USD0

$0.998453

0.16%GHO

$1.00

0.01%BONK

$0.00000606

-5.34%DCR

$30.50

-2.46%TUSD

$0.999903

0.02%KITE

$0.274696

20.43%A7A5

$0.01253777

-0.62%STX

$0.263087

-3.12%FTN

$1.09

0.10%VIRTUAL

$0.710232

-7.70%EURC

$1.16

-0.42%CAKE

$1.39

-2.84%SEI

$0.067281

-4.78%USDAI

$1.00

0.01%PENGU

$0.0070188

-5.32%DASH

$34.22

-4.15%JST

$0.04881688

3.56%XTZ

$0.382672

-1.58%ETHFI

$0.541633

-0.31%KAU

$163.23

-1.27%CHZ

$0.03768253

-0.55%ZRO

$1.85

-5.13%FDUSD

$0.999795

-0.22%CRV

$0.251128

-4.47%BARD

$1.62

50.96%USX

$0.999591

-0.01%SIREN

$0.488656

30.44%PIPPIN

$0.347499

8.01%GNO

$130.60

-4.69%FET

$0.151873

-3.02%NFT

$0.00000034

0.16%AERO

$0.356333

-4.49%BTT

$0.00000033

-3.14%PRIME

$1.018

-0.18%OM

$0.067238

1.44%RIVER

$16.11

-7.42%KAIA

$0.053804

-1.47%SPX

$0.337656

-8.21%ADI

$3.19

4.34%SUN

$0.01585886

-0.86%INJ

$3.02

-3.29%LIT

$1.21

-8.50%TIA

$0.334525

-1.96%IP

$0.842352

-4.58%BSV

$14.65

-5.34%VVV

$6.55

7.07%IOTA

$0.066297

-4.38%H

$0.156136

26.13%PYTH

$0.04923739

-4.27%GRT

$0.02607913

-2.62%JASMY

$0.00565946

-3.40%FLOKI

$0.00002876

-4.30%SYRUP

$0.236566

-4.89%FRAX

$0.988133

0.18%OHM

$17.33

-1.08%CRVUSD

$1.003

-0.07%XPL

$0.118378

1.15%OP

$0.124977

-3.75%LDO

$0.310346

-4.04%BTSE

$1.57

-0.35%CFX

$0.04918544

-4.25%TEL

$0.00266154

-3.54%2Z

$0.072392

-3.62%MON

$0.0219712

-6.10%LUNC

$0.00004286

-3.87%AB

$0.00236373

-1.85%ENS

$6.10

-4.18%UDS

$1.87

1.43%NUSD

$0.999275

-0.27%HNT

$1.21

-5.16%APEPE

$0.00000107

2.90%B

$0.222272

6.41%SAND

$0.083054

-5.64%STRK

$0.03974539

-4.05%USDA

$0.984022

0.00%AUSD

$1.00

-0.01%USTBL

$1.076

0.01%WIF

$0.210681

-3.54%PENDLE

$1.27

-3.67%ZBCN

$0.00214061

-1.46%TWT

$0.498263

0.91%BCAP

$22.75

0.00%AXS

$1.20

-3.73%THETA

$0.192351

-4.14%BORG

$0.194085

-5.96%PC0000031

$1.00

0.00%VSN

$0.052429

-2.00%MANA

$0.096606

-3.82%ULTIMA

$4,924.71

-0.96%NEO

$2.60

-3.99%FT

$0.097462

-0.30%REAL

$0.057896

-3.41%FLUID

$2.31

0.17%FDIT

$1.00

0.00%CVX

$1.93

-2.36%XCN

$0.00469702

-2.14%WFI

$2.16

1.44%ZK

$0.01894945

-1.20%TIBBIR

$0.174712

-11.71%WAL

$0.07784

-3.48%COMP

$17.95

-1.74%FF

$0.072976

-0.47%IUSD

$1.00

0.04%MX

$1.84

-0.09%GALA

$0.00351255

-4.46%FARTCOIN

$0.166475

-7.80%9BIT

$0.02020774

-1.17%DEXE

$3.54

-2.01%KOGE

$48.11

0.18%RAY

$0.605595

-4.62%S

$0.04133757

-3.78%SATUSD

$0.981068

4.15%GRASS

$0.287578

-2.39%RUNE

$0.436874

-1.83%EURS

$1.23

-0.05%BAT

$0.102162

-2.91%SENT

$0.02100071

-2.31%GUSD

$1.003

0.22%COCO

$0.149822

0.53%TRAC

$0.315517

-4.22%USDF

$0.998683

-0.02%COW

$0.248661

1.78%RLB

$0.078895

-1.52%XEC

$0.00000682

-4.82%1INCH

$0.097011

-3.20%THBILL

$1.014

-0.09%SFP

$0.266821

-4.36%SKR

$0.02338097

3.51%IMX

$0.156087

-3.05%WEMIX

$0.286148

0.43%ACRED

$1,094.12

-0.05%GLM

$0.130825

-1.64%0G

$0.61261

-1.96%EXOD

$12.16

12.28%A

$0.077827

-4.27%MWC

$11.43

-3.66%EIGEN

$0.19393

-2.21%OZO

$0.130591

-0.03%SHFL

$0.321971

9.78%KTA

$0.247164

-4.66%FORM

$0.320582

-4.84%BERA

$0.532886

-2.92%ONYC

$1.081

0.04%EGLD

$4.14

-4.37%AMP

$0.00143873

-0.73%GOMINING

$0.298546

-1.71%QRL

$1.53

1.33%PUSD

$0.999883

0.00%JTO

$0.270171

-3.63%FRXUSD

$1.00

-0.04%LION

$0.00381313

-3.99%ATH

$0.00665362

2.79%LPT

$2.34

-2.07%USR

$1.00

0.02%SNX

$0.328133

-3.30%REUSD

$1.064

-0.04%AVUSD

$0.999905

0.01%