With Ethereum’s historic Shanghai upgrade completed and the dust (more or less) settled, it's time to revisit some of the key staking takeaways.

The Shanghai upgrade allowed Ethereum stakers to finally withdraw their funds from the mainnet. Some had been waiting to do so since the staking feature was first introduced in December 2020.

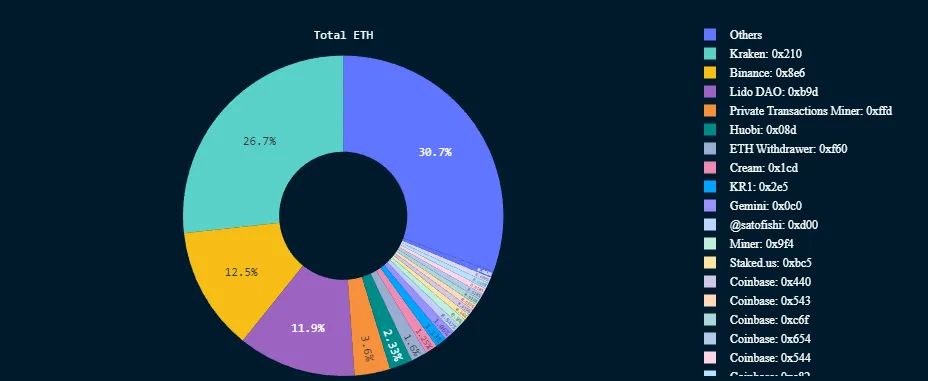

Perhaps the most important development revealed by the event is that Kraken U.S. staking customers appear to have been more or less flushed from the system.

This is because of regulatory action taken against the crypto exchange, which saw it settle with the SEC for $30 million and shutter its staking operations for Americans back in February.

There’s still a sliver waiting to exit, but this bearish player has mostly been removed from the system.

In terms of entities still waiting to withdraw staked funds, Coinbase is by far the largest, with more than 55,000 ETH primed to exit.

The next most important discovery here is that the net amount of Ethereum being staked is positive, indicating that there are more addresses depositing their Ethereum than there are withdrawing.

As of today, the figure is 97,586 ETH or $189 million at today’s prices.

This suggests that folks are still pretty bullish on staking with Ethereum and scooping up that extra ETH-denominated yield for doing so.

Some analysts indicate that this is also good for the asset because all this Ethereum getting locked up for staking needs means less ETH getting sold on the open market.

Finally, diving deeper, the upgrade continues to be a huge boost for liquid staking leaders Lido Finance.

Liquid staking refers to depositing your Ethereum in a protocol that then stakes that ETH on your behalf. In return, you get another token representing your staked position that also accumulates rewards. Lido’s token is called stETH and Coinbase’s equivalent is called cbETH.

Per Nansen, Lido’s staked ETH commands 79% of the total market of entities measured, hosting a whopping 6 million Ethereum. Second place goes to Coinbase, with about 15% of that market.

Decrypting DeFi is our DeFi newsletter, led by this essay. Subscribers to our emails get to read the essay before it goes on the site. Subscribe here.