Stablecoins have emerged as the life-blood of the crypto industry.

At a hefty $150 billion in total market capitalization, even after the collapse of Terra’s algorithmic stablecoin UST earlier this year, they may be one of crypto’s best current use cases.

At least according to one of the earliest DeFi founders.

“Whether you're a retail user, a hedge fund, an exchange, a business that wants to do payments, stablecoins have crazy traction everywhere,” Compound founder Robert Leshner told Decrypt at Chainlink SmartCon in New York. “In some ways, what everyone expected Bitcoin to do… stablecoins have done.”

Compound, launched in 2018, is one crypto’s first decentralized borrowing and lending platforms, letting users earn yield on their idle tokens or take out crypto-backed loans.

These days, Compound’s largest borrowing market is for Circle’s USDC stablecoin. That shift has come as no surprise to Leshner.

Stablecoins, he said, are “fundamentally better than the old payment rails of wiring money, or ACH money, or writing a paper check, or using a credit card,” he said. “Stablecoins are superior. They're faster, they're cheaper, they're better, and left to their own devices, they will win and conquer everything.”

Regulators appear to have reached the same conclusion, and have zeroed in on stablecoins as the route through which to regulate the entire industry.

Regulators take aim at stablecoins

Regulatory scrutiny has primarily revolved around transparency as well as determining how these assets could affect traditional financial markets.

Tether, for example, has faced years of negative attention due to how opaque the firm has been about its reported 1:1 backing with the U.S. dollar. This lack of clarity has improved some over the years, with Tether now delivering monthly asset attestations; but the stablecoin issuer has never worked with a “Big Four” accounting firm to date.

Circle has battled similar issues and now issues a regular attestation.

In February of this year, Democrat Congresswoman Maxine Waters brought these risks to the fore during a House Committee on Financial Services that risks around the backing of stablecoins “could harm both ordinary users of these products as well as our financial system overall,” before calling for Congress to take action.

More recently, researchers at the Bank of New York argued that the size of stablecoins, including those with traditional assets backing them, demand regulators pay closer attention.

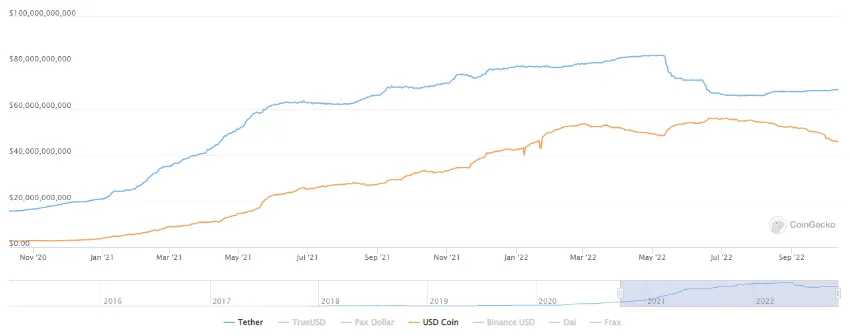

Even amid these concerns, both stablecoins have grown bigger. Tether’s USDT currently commands a market capitalization of $68 billion, making it the third-largest cryptocurrency after Bitcoin and Ethereum. Circle’s USDC is the fourth-largest, with a market cap of $45 billion.

In October 2020, USDT was at just $15 billion and USDC just shy of $3 billion.

These assets have grown in size by 353% and 1,400%, respectively, in just two years.

And that’s making regulators nervous.

“If you're a legislator right now, you're looking at stablecoins and seeing something that's massively successful,” said Leshner. “And it might alarm you.”