In brief

- The NFT market saw depressed trading volume for the month of March, but daily trading volume is climbing in recent weeks.

- Overall, the market generated more than $12 billion worth of trading in Q1 2022, per DappRadar.

After setting records in January, the NFT market saw gradually sinking trading volume over the course of February—and that decline continued into March. But the latest data suggests that NFT trading is on the rebound of late, and total trading volume in Q1 2022 topped $12 billion.

According to data provided by DappRadar, the wider NFT market generated $2.63 billion worth of total trading volume in March across all platforms. That figure is down from $3.87 billion in February and $5.63 billion in January.

All told, that puts total NFT market trading volume at about $12.13 billion for the first quarter of 2022. Considering that the wider market generated $25 billion in trading volume for all of 2021, per DappRadar, it suggests a potentially sizable year-over-year increase to come for 2022 if the market continues at this pace.

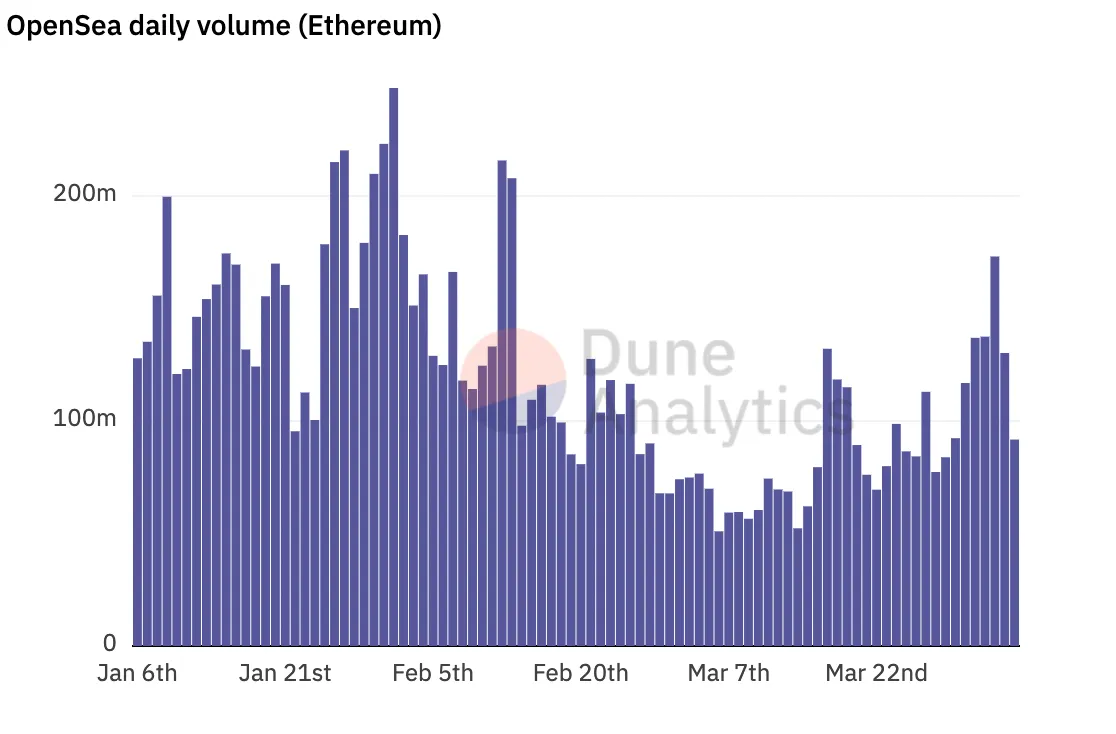

Daily trading volume on leading marketplace OpenSea (via Dune Analytics) declined gradually across February and into early March. However, it has been climbing over the last two weeks, and Sunday (April 3) was OpenSea's best single day of Ethereum trading volume in weeks with $173 million worth. Already in April, the platform has logged about $669 million of Ethereum volume.

DappRadar’s figures show that 27.7 million total NFTs were traded across platforms during the first quarter of 2022. Interestingly, the amount of NFTs sold each month didn’t decline at the same rate as trading volume, dropping from 11.3 million in January to over 7 million in March—a 38% dip, compared to a 55% drop in monthly trading volume between January and March.

“Volumes are indeed down, far from the high January numbers,” explained Pedro Hererra, senior data analyst at DappRadar. “However, the number of trades and unique traders is increasing which shows that the demand for NFTs is still strong, and the market is maturing. We also see increased activity in blockchains not called Ethereum, namely Avalanche and Solana,” he said.

DappRadar’s figure accounts for only "organic" volume, omitting suspicious activity on LooksRare, an Ethereum-based marketplace that has seen rampant “wash trading,” or trades of NFTs that are sold for massively inflated sums back and forth between the same wallets. LooksRare offers token rewards, and some traders have sought to manipulate that model by selling NFTs between multiple controlled wallets for as much as $50 million worth of ETH each way.

In January, analytics platform CryptoSlam told Decrypt that LooksRare had generated more than $8 billion worth of wash trading in less than a month. At the time, about 87% of LooksRare trades were considered to be manipulated, or not organic.

Now CryptoSlam pegs the total of LooksRare wash trades at about 95%, according to a Bloomberg report from yesterday. DappRadar reports that LooksRare has registered about $19.7 billion worth of trading volume through the end of March.

The largest NFT projects in March, according to data from CryptoSlam, include the Bored Ape Yacht Club, which registered over $227 million worth of trading volume on the back of hype around ApeCoin (APE). The Mutant Ape Yacht Club likewise topped $155 million in March, while upstart project Azuki generated nearly $106 million worth of trading volume.

Ultimately, Herrera believes that despite depressed numbers in March, the data suggests that NFT buyers are getting smarter—and projects seen as scams or cash grabs are having limited impact as the market matures.

“There are NFT collectors that have been in the space for over a year and are now knowledgeable enough to distinguish good projects from bad ones," said Herrera, adding that newcomers to the market have also learned quickly from high-profile "fiascos."

“All in all, the market is consolidating and is primed for an excellent year,” he said.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.