Tax season is upon us, which means that it's time to trawl through your finances and get your incomings and outgoings in order.

Tax liability is a thorny area when it comes to Bitcoin and other digital assets. The truth is that Internal Revenue Service (IRS) reporting guidelines on crypto are still evolving. This, combined with the frequency with which transactions may take place, can make filing crypto taxes seem like a daunting task for investors and traders alike.

Fortunately, new tools like Cointelli's crypto tax reporting software can help to take the sting out of the process. In this article, we'll answer some common questions and misapprehensions about taxes on cryptocurrency—starting with “Do I have to pay tax at all?”

"Do I have to pay taxes on my crypto?”

In the past 24 months, the IRS has cast a much broader net, and taxing crypto is seen as an important new revenue source to pay for mounting pandemic expenses, foremost the $1.2 trillion infrastructure bill.

Notably, a standard 1040 form now asks every American if they own crypto—which is classed as property—and gains must be reported to the IRS as with any investment. In some cases, even if zero money is owed, you are still required to file your taxes.

“What happens if I don't pay?"

New legislation from last November requires brokers and cryptocurrency exchanges to notify the IRS directly of crypto transactions, closing a loophole that enabled some investors to hide their gains.

But oftentimes payment failures are the result of taxpayers not understanding the process—which one congressional witness described as nothing short of a nightmare.

Taxpayers must file their taxes before the April 18 deadline and failure to file can result in penalty fees, interest, audits, and even jail.

“How is crypto taxed?”

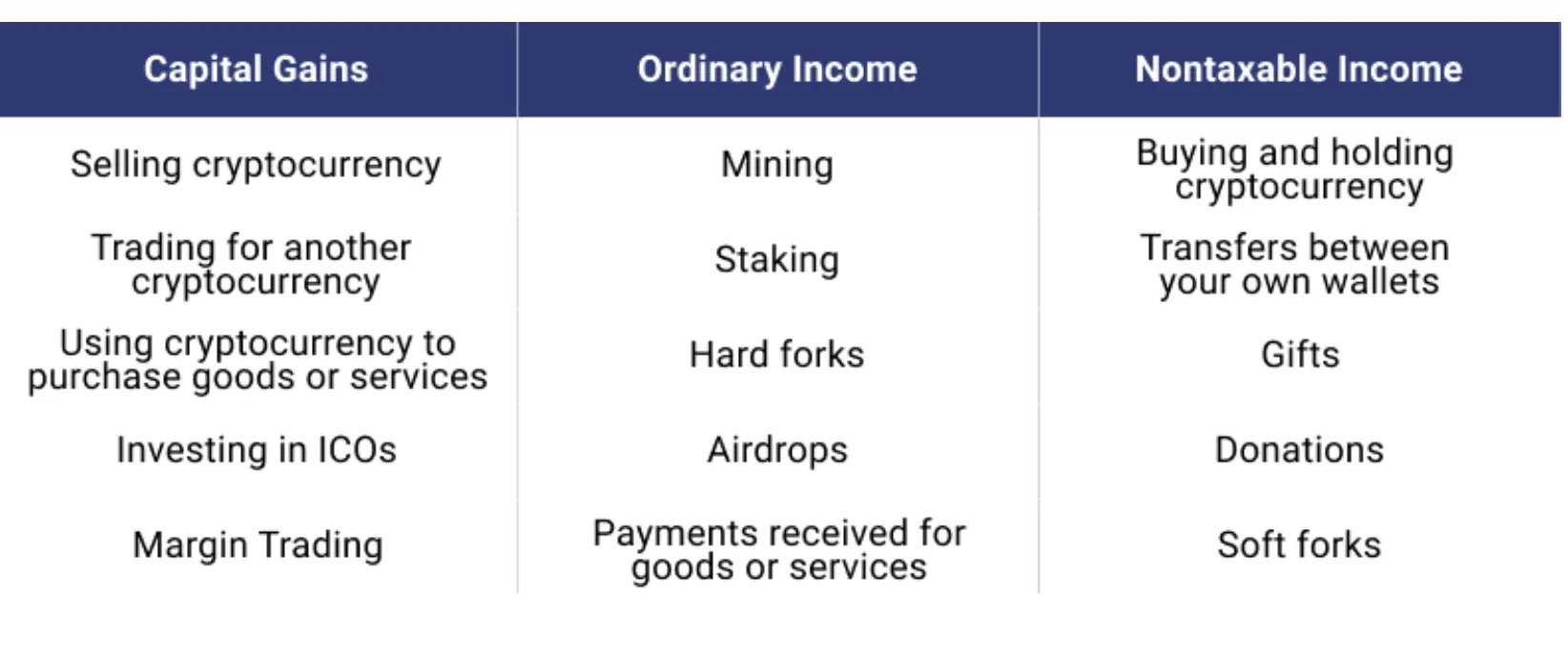

Crypto transactions fall into three categories: capital gains, ordinary income, and nontaxable transactions.

Selling or investing in crypto can incur capital gains tax. But the IRS also distinguishes between short-term and long-term gains, which are dealt with differently. Just as with other investments, losses can be offset against gains.

Paying for goods or services using cryptocurrency also generates capital gains if the person making the transaction profited from the difference between the price of the good or service and the purchase price of the cryptocurrency used.

Meanwhile, mining, staking, and other payment streams are dealt with as ordinary income. However, depending on whether you engaged in mining as a business or hobby, the overall tax treatment may be different.

And don’t expect the taxman to turn a blind eye to new coins received from a hard fork resulting in a coin splitting into two. These are also taxable—even retroactively. One example is when Bitcoin Cash forked off from Bitcoin in 2017, which is considered a “taxable event,” meaning that tax becomes due even if the new asset is not sold.

The third category, non-taxable income, includes buying, holding, and donating crypto.

“What are the crypto tax rates?”

Gains are taxed at income tax rates that range from 10% to 37% depending on your overall income.

The tax situation becomes more favorable if you hold your crypto for more than a year and then sell. The tax that then becomes due is in the form of a long-term capital gain, which is usually applied at the much lower rates of either 0%, 15%, or 20% for high-income earners.

What’s new in crypto taxes in 2022?

Inflation is running at a four-decade high in the U.S., and the IRS has responded by making wide-ranging adjustments that affect crypto investors. Two of the biggest are an increase in the amount of the “Standard Deduction,” which everyone is entitled to before they are taxed, and there are also changes to income brackets.

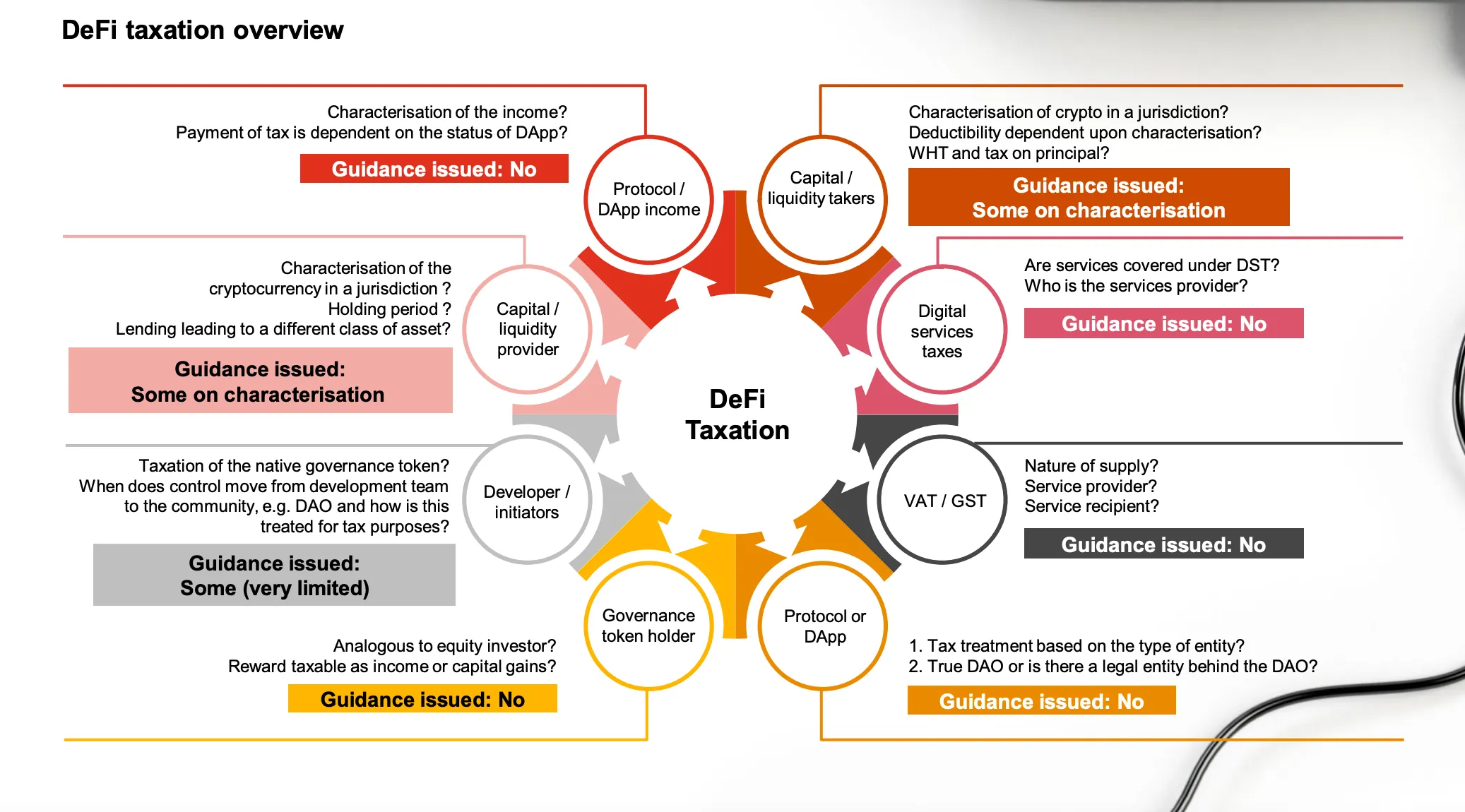

More specific to crypto, guidance on tax arising from Decentralized Finance (DeFi) could also be in prospect, pending the outcome of an ongoing lawsuit against the IRS.

The case could determine whether staking rewards should be taxed only when they're sold—rather than when they're earned, which the current law implies.

The popularity of non-fungible tokens (NFTs) comes with tax evasion concerns, putting authorities on the alert. NFT creators, buyers and marketplaces are all potentially liable to pay tax on profits, as consultancy PwC outlines in its 2021 report—which also addresses the current taxation for DeFi.

"The IRS has not released any specific guidance on DeFi or NFTs yet, and they are currently being inferred based on current crypto tax guidelines from the IRS," Cointelli CEO Mark Kang told Decrypt. "Authorities are concerned about tax evasion because of the ambiguous reporting requirements. In the absence of clear rules, large amounts of crypto income can go untraced and unreported."

How to file your crypto taxes

For many of us, filing a tax return might only mean logging one or two trades, but for investors who have bought NFTs, benefited from airdrops and yield farming, it can be a monumental task.

The first step is to calculate gains and losses; tax software platform Cointelli has a guide here.

For capital gains, the sum liable to tax is the difference between the purchase price and the selling price when the cryptocurrency is sold. You need the dates you sold and purchased crypto, the sales price, the cost basis, and the crypto gains and losses.

There are a number of key tax forms that may apply, including Form 8949 for reporting sale of assets and Form 1099-B for reporting sale of assets on an exchange. And while Form 8949 is used for reporting every transaction individually, a Schedule D declaration is required to report net gains and losses, with the total reported on a Form 1040.

Having to pay for crypto taxes can be annoying but are you also paying high prices for your crypto tax software? We offer an all-inclusive fee of $49 with no hidden costs. What a steal! #CryptoTaxSoftware #cryptotax #cryptocurrency https://t.co/YxdbyhwunZ

— Cointelli (@cointelli) February 27, 2022

Then there are potential earnings from crypto-related income. For instance, hobbyist miners need to complete Form 1040 Schedule 1 (which deals with additional Income) and list expenses on a Schedule A. Meanwhile, business miners use a Schedule C for both (profit or loss from a business.)

If it all sounds complex, that’s because it is. But the good news is that Cointelli makes it easy to categorize transactions. "Cointelli provides support for over 100 wallets, exchanges and blockchains, and syncs a host of transaction types into a single report," Kang explained. Using that information, it's able to generate a report that automatically organizes crypto purchase costs and dates, selling costs and dates, holding periods, and fees in one place.

How to reduce your crypto taxes

There are various strategies to minimize the tax burden, such as long-term holding, crypto tax-loss harvesting—which means reducing tax by offsetting any capital gains with capital losses—and charitable deductions.

Using a retirement plan can defer or avoid investment gains, but can be trickier than investing through an exchange.

Users have also had some success in challenging IRS notices, which some received when a discrepancy between their own declaration and one made by a crypto exchange surfaced.

"One strategy that you can use to lower your crypto tax liability is to choose the cost-basis method that will result in the most favorable tax liability," explained Kang, who outlined three main methods: FIFO (first in, first out), LIFO (last in, first out), and HIFO (highest in first out).

"If all your transactions took place in the last year, then HIFO is generally the go-to method for the lowest reported gains and highest reported losses," Kang said. He added that taxpayers should "be careful, as choosing the highest cost basis for this year may result in a lower cost basis for next year, and this may cause increased capital gains. So think of it more as a deferral of income, rather than a reduction."

Another strategy Kang recommended for reducing crypto tax liabilities is to hold on to crypto assets for more than a year before disposing of them, because "long term capital gains tax rates are significantly lower than short term rates." The FIFO method, he explained, "reports your first assets purchased as the first assets sold, so you can increase your holding period more than any other cost-basis method."

Click here for more on determining an optimal cost basis.

What's next for crypto taxes

In the coming year, crypto tax legislation threatens to become more pervasive. This could take the form of tightening reporting rules around DeFi, airdrops, hard forks, and reporting rules for privately held wallets.

"Currently, the 'Build Back Better' bill is under negotiation," said Kang. "If the bill passes, then cryptocurrency transactions will be subject to the wash sale rule—possibly for transactions taking place in 2022 or later."

In addition, we could see more frameworks for approaching DeFi transactions such as lending, borrowing liquidity provision, and yield farming, and guidance on the broadening range of use cases for NFTs and Web3 business models such as Decentralized Autonomous Organizations (DAOs). All are sorely needed.

Brought to you by Cointelli

Learn More about partnering with Decrypt.