In brief

- Markets recover strongly after yesterday's flash crash.

- Bitcoin racks up its best quarter since 2013.

- Wider stock markets also up as it heads into historically big quarter.

As Q1 draws to a close, markets gave investors a bumper day as almost every asset in the global top 20 cryptocurrencies was in the green.

Global market cap gained 2.1% bringing it back into the $1.9 - $2 trillion range after yesterday’s flash crash.

The cause of the crash was Bitcoin, which fell off a cliff earlier yesterday after it approached $60,000.

The cause appears to have been a wave of triggered stop-losses - automated trades that execute if the markets look like they’re heading the wrong way - that led to $1,800 being wiped from Bitcoin's value in a single 5-minute candle.

The crash led to the liquidation of some $600 million worth of futures contracts in one hour. As we reported earlier in the week, the markets are becoming increasingly frothy making predictions tougher.

$600 million liquidated in the past hour.

Chart: @bybt_com pic.twitter.com/8v3iHwFNXO

— Bloqport (@Bloqport) March 31, 2021

On March 26, more than $2.4 billion in futures contracts were wiped out in one 24 hour period as markets changed rapidly. But the picture today is looking decidedly more rosy.

Bitcoin is now back in the $59,000 range, and Ethereum, which more than recovered from the drop yesterday gained 6.5% to take to an all-time high of $1,944

Other big gainers were Filecoin, which added an eye-watering 41% to its coin price helping it break into the top 10 biggest currencies for the first time. Chainlink added 11%, Polkadot 12% and Algorand 7%.

The only losses yesterday came from Theta Token, the surprise performer of Q1 that rose from obscurity to one of the world’s largest projects. Its price fell 5% taking it out of the top 10 largest currencies.

But the overall trend for crypto in the start of 2021 is positively bullish. Bitcoin had its best Q1 performance since 2013, and has spent more than 30 days above $50,000 for the first time in the project’s history.

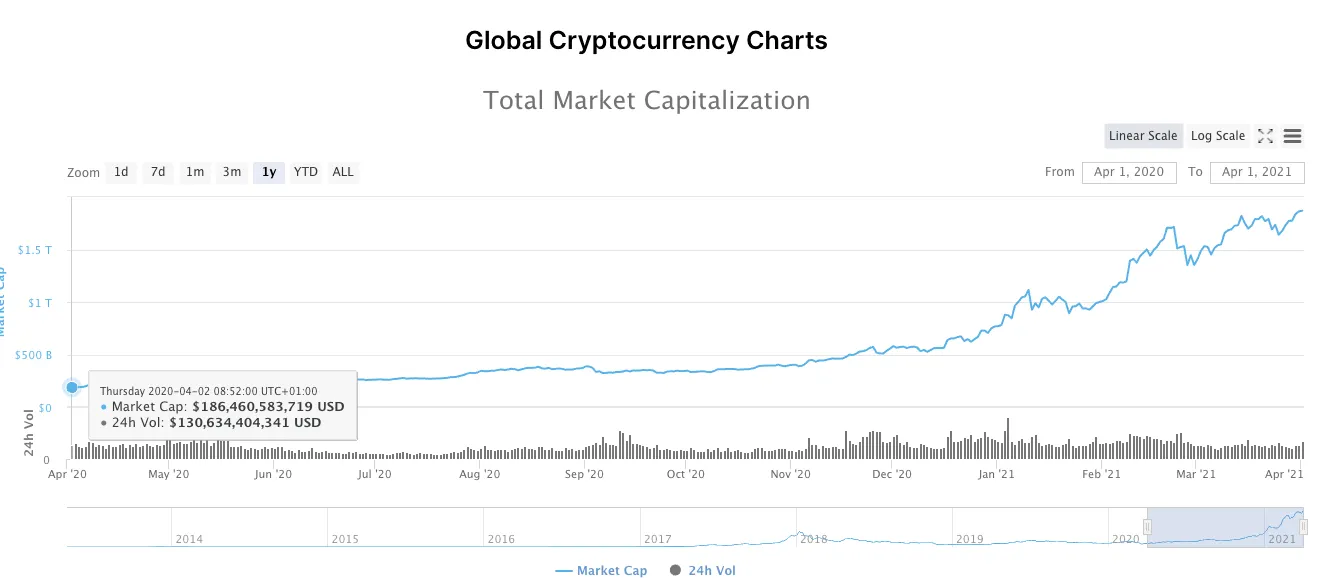

The global crypto market went from $180 billion to $1.8 trillion in 12 months, and all signs point to continued gains. The same can be said for the broader stock market.

The Dow has ended the quarter up 8%, the S&P 500 up 6%, the tech-heavy Nasdaq, despite a move away from the growth stocks that dominate that market is up 3%. But the star of this quarter’s show was the Russell 2000, which saw 13% gains for the quarter.

April, for both Bitcoin and the stock markets, has been an auspicious month. Stocks have closed April higher in 14 out of the past 15 years, and since 1950 it has been the second-best month for stocks, according to Ryan Detrick, LPL Financial chief market strategist. The same can be said of Bitcoin - the cryptocurrency has only gone down in April twice in its history. The only other month Bitcoin has performed this well has been May.

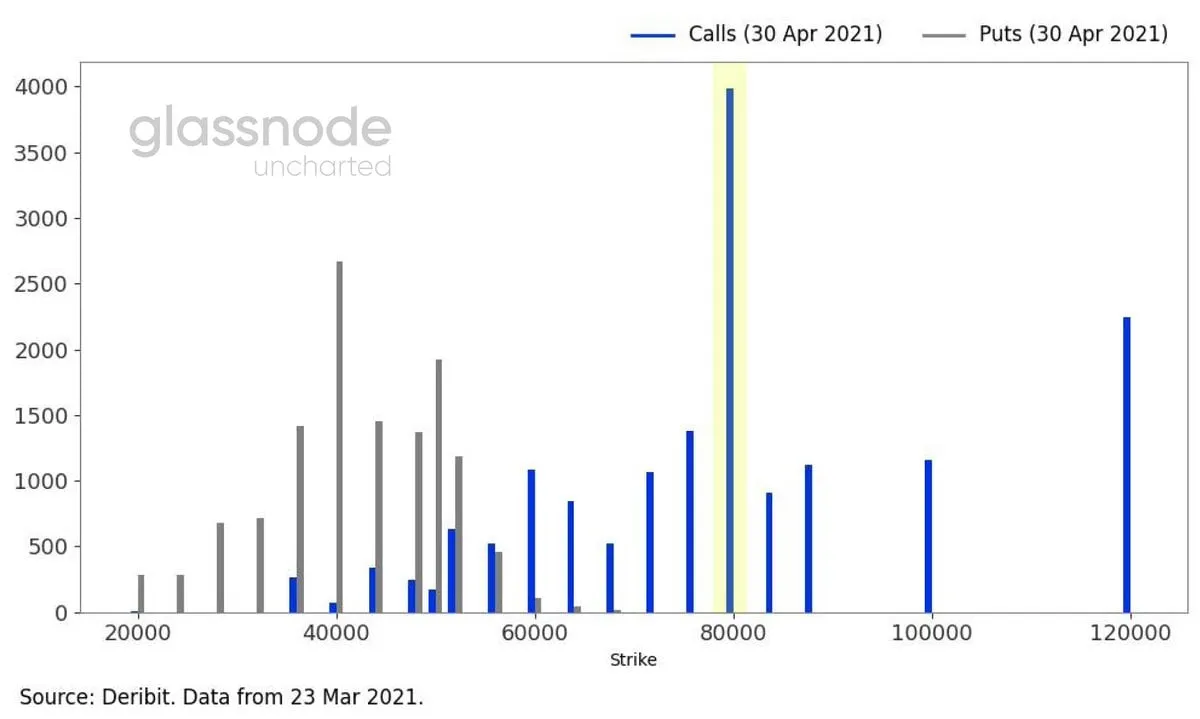

It's no wonder the bulk of futures contracts for the next quarter put Bitcoin's price at $80,000, according to Glassnode.

Hold on to your hats, people.

Sponsored post by AAX

Learn More about partnering with Decrypt.