In brief

- A new report by Voyager Digital suggests that retail investors are more bullish on Cardano (ADA) than Bitcoin.

- Nevertheless, 80% of retail investors plan to buy more Bitcoin in March.

Bitcoin may have staged a comeback in recent days, but investors are turning their attention to Cardano (ADA). That's the finding of the inaugural Digital Asset Investor Sentiment Survey, conducted by crypto trading broker Voyager Digital.

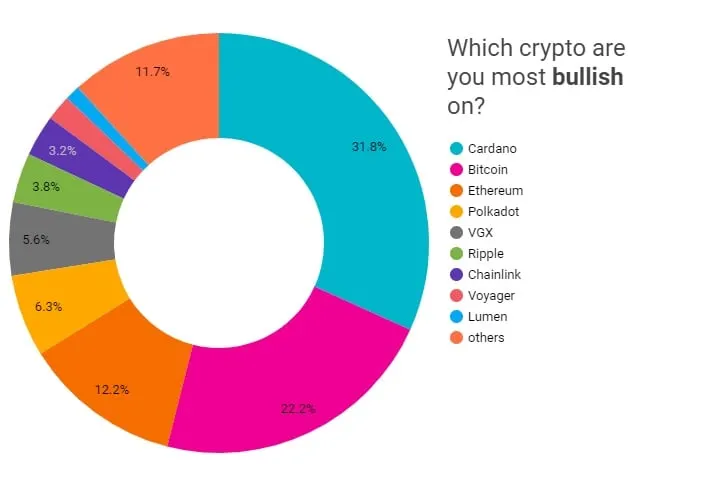

The survey found that 31.8% of investors polled described themselves as "most bullish" on Cardano, versus 22.2% for Bitcoin. Last month, Cardano hit an all-time high of $1.48, briefly becoming the third-largest cryptocurrency by market cap. The third and fourth rankings in the survey fell to Ethereum, at 12.2%, and Polkadot, at 6.3%.

“This clearly demonstrates the enthusiasm that our user base has towards cryptocurrencies, both from the investment and trading perspectives,” Steve Ehrlich, CEO of Voyager Digital, told Decrypt. “Of course, everyone is talking about Bitcoin these days, but seeing Cardano coming ahead of it was a really big surprise for us.”

In Ehrlich’s view, the survey results also demonstrate that the cryptocurrency space has become a truly diverse ecosystem, with a growing number of digital assets for investors to choose from.

Bitcoin buyers assemble

Despite Bitcoin’s 26% dip in February, retail investors remain bullish on the asset’s prospects. The survey, which polled 1,385 respondents in the United States, found that the majority of investors expect Bitcoin's price to reach between $51,000 and $60,000 by the end of March, with 80% of participants planning to buy more Bitcoin this month.

The respondents broadly take a bullish view of the crypto investment landscape; a “bearish/bullish scale” saw investor sentiment score 8 out of 10, where 1 indicated extreme bearishness and 10 extreme bullishness for both the next 6 months and the next 12 months. Just one in five agree that Bitcoin is currently in “bubble territory.”

They don't completely rule out a bear market—and should it come to pass, the majority of investors expect the price of Bitcoin to plummet between 20%-40%.

Nevertheless, 60% of the respondents are confident that Bitcoin and other digital assets represent the greatest store of value, surpassing precious metals such as gold (8%), equities (6%) and top-tier government bonds (1%).