Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

$68,786.00

6.68%$2,066.00

11.31%$1.46

7.60%$631.27

7.10%$0.9999

-0.00%$89.16

13.26%$0.286046

1.11%$0.103935

12.86%$1.035

0.53%$0.310334

19.12%$51.33

6.29%$513.35

6.27%$0.999922

-0.06%$8.77

3.62%$28.66

4.96%$9.40

14.20%$338.93

5.14%$0.163734

1.44%$0.999691

0.03%$0.167206

10.80%$1.00

0.05%$0.00965807

2.57%$0.104685

9.04%$57.95

12.45%$255.58

3.88%$9.68

15.72%$1.00

0.02%$1.001

15.20%$0.00000639

7.68%$0.079429

6.43%$1.32

-0.07%$0.117088

6.03%$1.62

29.66%$5,169.39

0.63%$4.07

21.92%$5,200.37

0.41%$1.35

-5.10%$0.622944

5.43%$1.00

0.00%$122.40

6.93%$0.00000433

10.44%$183.60

8.14%$0.714166

2.32%$0.997373

-0.02%$78.44

6.17%$0.999979

0.01%$0.07047

7.98%$1.12

0.00%$0.170228

4.46%$2.25

2.20%$1.001

0.06%$1.20

22.70%$0.00000165

0.64%$9.42

11.85%$0.285621

14.43%$2.44

14.53%$0.999397

-0.04%$0.117067

4.33%$0.4227

12.04%$8.91

7.54%$11.00

0.01%$0.00191952

8.78%$7.19

6.28%$2.07

3.64%$0.061837

8.43%$65.88

5.99%$0.111977

13.17%$0.01667864

2.09%$0.883863

7.47%$0.03169223

8.05%$3.60

4.73%$1.001

0.15%$0.00979469

6.64%$0.093338

10.54%$1.05

26.93%$1.081

22.02%$1.51

9.58%$1.24

0.26%$0.761068

-8.07%$1.00

0.02%$114.40

0.01%$1.027

0.00%$1.11

0.39%$0.03459538

3.54%$0.00795781

11.13%$1.84

13.74%$0.081254

1.37%$0.103889

11.75%$0.03215125

12.54%$0.00000656

12.71%$1.096

0.01%$0.996266

-0.51%$0.162879

12.24%$0.999936

0.00%$0.01295907

3.35%$28.91

3.41%$0.272854

13.84%$0.276191

7.54%$0.99937

-0.01%$0.072309

9.26%$1.087

-0.18%$0.00740739

15.34%$0.705592

15.98%$1.00

0.01%$1.18

0.24%$35.63

8.45%$1.34

11.13%$0.39998

8.39%$167.48

1.02%$0.534804

3.30%$0.04419438

-4.13%$0.171584

11.61%$0.26129

16.56%$1.00

-0.01%$1.096

7.22%$0.085173

9.11%$1.48

2.21%$0.0354125

4.39%$0.999743

-0.01%$131.85

9.15%$0.372792

13.79%$1.019

-0.13%$0.00000034

3.79%$3.34

5.05%$16.68

7.94%$0.00000033

0.62%$0.056378

6.78%$0.055728

9.48%$0.361474

20.08%$1.58

4.61%$0.01649574

0.47%$3.20

1.60%$0.07177

9.10%$0.329666

13.00%$0.02847815

9.53%$0.00003131

11.37%$0.0059829

7.35%$0.998517

0.15%$0.334273

11.47%$0.99498

0.29%$0.052879

9.59%$17.43

2.24%$0.128422

9.46%$0.230591

12.29%$0.076917

10.83%$0.00278421

10.01%$1.41

-3.35%$1.61

-2.10%$6.77

11.36%$0.04598745

10.07%$0.135819

1.10%$0.00249377

0.12%$0.091029

15.48%$0.107432

22.56%$0.02209886

9.21%$1.38

11.89%$1.002

0.36%$0.317016

-3.55%$1.78

5.39%$0.220587

11.60%$0.999999

0.00%$0.0022298

5.82%$0.986033

-0.26%$0.521497

4.11%$0.999998

0.01%$1.30

9.87%$1.075

0.01%$22.79

0.00%$0.00003735

6.77%$0.204019

11.05%$0.099235

-1.06%$2.86

10.03%$0.00000096

0.46%$5,292.36

-1.10%$0.101642

12.49%$0.193649

0.61%$0.054132

4.60%$0.926278

53.47%$0.02057313

7.26%$1.00

0.00%$0.189211

13.19%$0.125397

7.98%$0.00502964

5.17%$0.00394735

11.44%$0.079831

0.29%$4.22

15.29%$18.93

6.54%$1.98

14.17%$1.00

0.00%$0.648942

10.38%$0.775749

0.29%$0.172522

15.44%$0.055419

8.95%$2.18

11.28%$1.001

0.15%$2.13

1.92%$8.59

-8.29%$0.02321317

1.18%$1.81

1.12%$0.04374331

10.19%$0.01995454

-0.47%$48.00

0.02%$0.00000808

7.63%$3.37

-3.93%$1.26

0.82%$0.1562

5.88%$0.180491

13.75%$0.340265

9.98%$0.947466

-4.76%$1.002

0.03%$0.998683

0.02%$0.422391

8.66%$1.013

-0.01%$0.305726

0.03%$0.660213

3.99%$4.71

10.15%$0.098098

11.95%$0.08418

8.14%$0.134706

8.67%$0.267496

6.40%$0.621018

4.13%$0.02330797

-6.30%$0.082494

12.77%$0.298276

5.73%$11.84

0.34%$0.131268

4.50%$1,097.72

0.00%$0.074446

0.32%$0.375145

3.39%$0.314666

-0.62%$0.00150795

3.14%$0.224765

2.78%$0.0040767

4.01%$1.90

1.80%$0.131271

0.52%$0.250059

1.23%$0.995328

0.00%$0.203934

8.09%$2.43

7.91%$1.001

0.00%$0.343634

4.38%$1.039

0.92%$7.64

-11.94%$12.13

3.81%$1.47

2.68%$1.00

0.00%$1.064

0.14%$0.999794

-0.23%

Bitcoin set a new all-time high this morning after breaking the $50,000 barrier on Tuesday night, data from markets tool CoinGecko shows.

The asset saw a record price of $51,421 after a sudden surge from the $49,000 price level last night. It had earlier set a high price in the $50,450 region on Tuesday—a move that quickly retraced within minutes at the time.

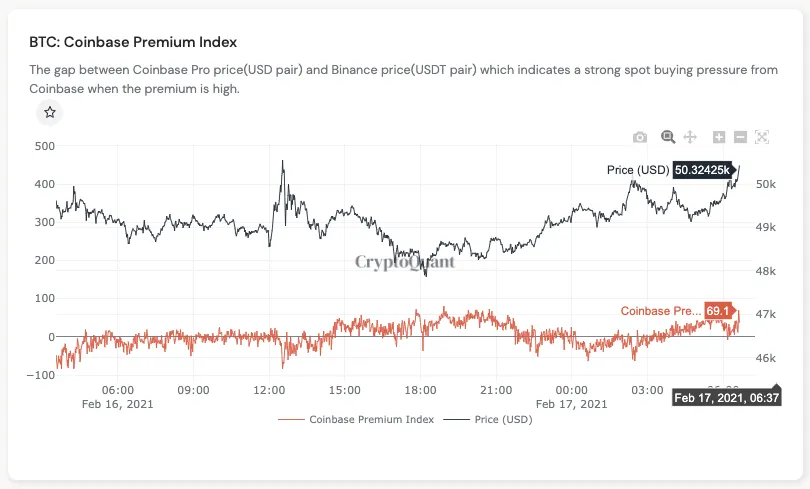

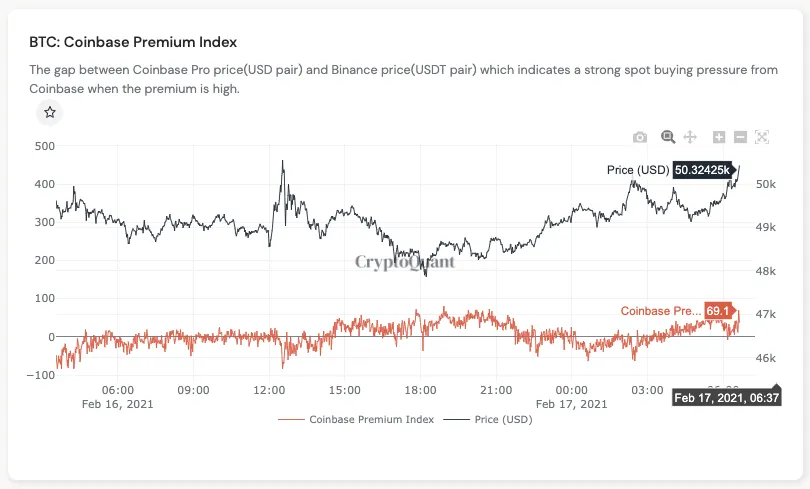

But one key indicator is back on the right side for Bitcoin bulls, according to Cryptoquant CEO Ki Young Ju. Yesterday he noted that there was a negative premium on Coinbase, meaning prices were lower there than in the rest of the market. He argued that this would need to change for the cryptocurrency to rise further.

Today, Ju pointed out that the premium has returned, showing a strong desire for Bitcoin by Coinbase's institutional traders. "$BTC Coinbase Premium looks good after breaking 50k. We can go higher now," he tweeted.

As the below image shows, Bitcoin remains in a firm uptrend and trades above its 34-period moving average—a popular tool that computes the average traded price of a certain asset and is used by traders to determine the market trend. Furthermore, the current price is unprecedented, and there is no “resistance” level, or a price where sellers are known to sell their holdings.

The move comes a day after business analytics firm MicroStrategy announced it would sell $600 million worth of convertible notes in an upcoming offering and use the proceeds to buy Bitcoin. Such a purchase would add to its big warchest of 71,079 BTC (valued at $3.7 billion at press time).

Meanwhile, the euphoria runs high among crypto circles. Some industry participants say that institutions getting involved in the Bitcoin space mean a better long-term fundamentals for the volatile asset.

“Institutions aim for long-term deals, which acts as a preventive measure, protecting Bitcoin from crashing in a manner similar to what we saw in 2018,” said Konstantin Anissimov, executive director at Bitcoin exchange CEX.io, in a note to Decrypt.

But as is with all markets, the music can always stop. For now, however, Bitcoin continues to enter uncharted territory.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.