In brief

- Bitcoin mining helps to keep the Bitcoin network secure against attacks.

- With the right combination of equipment, electricity costs, and a few other considerations, Bitcoin mining can be profitable.

- Bitcoin mining profitability has increased as a result of the 2020-21 bull run—but there are shortages of mining hardware.

Bitcoin mining is the process of participating in Bitcoin’s proof-of-work (POW) consensus mechanism to discover new blocks and help with transaction validation. The combined efforts of all the Bitcoin miners is responsible for the integrity of the blockchain, and ensures that transactions remain essentially irreversible.

Each time a new block is discovered, the miner receives a reward, known as the Bitcoin block reward. Following the 2020 halving, this is currently set at 6.25 BTC per block, but most miners generally receive much less due to working together as part of a mining pool.

Rather than buying or trading Bitcoin, many individuals choose to simply mine their own, since it often costs less to mine Bitcoin than it does to buy it on the open market. As a result, mining and selling Bitcoin can be a profitable business endeavor, under the right conditions.

Here’s how to get involved.

What you need to mine Bitcoin

If you’re looking to get involved in Bitcoin mining, then you’re going to need to get to grips with a few things first.

First and foremost, you will need a Bitcoin wallet. The exact type of wallet you use doesn’t really matter, so long as it’s secure. This will be used to receive your mining proceeds, which, depending on your mining setup, could be substantial. Hardware wallets are widely considered to be the gold standard in security, but they’re more cumbersome to use. Many miners instead use software wallets like Electrum, due to their convenience.

Next up, you’re going to need your mining hardware. We’ll cover this in greater depth in the next section, but this is the machine you will use to actually participate in the Bitcoin mining process. In general, the more powerful your machine (in terms of hash rate), the greater your rewards—but there are other considerations too (more on this later).

Lastly, there’s the mining software. This is software that you run on your computer which tells your mining hardware how to perform, such as which mining algorithm it should work on, when it should operate, and which Bitcoin address mining rewards should be sent to. This can affect your mining yields, so it’s wise to choose carefully.

Types of mining hardware

When Bitcoin mining first began in 2009, the difficulty was so low that low-power devices could participate in the mining process using their CPU resources. At the time, even individual miners using their regular computer could discover blocks—earning 50 BTC apiece by doing so.

However, as the popularity of Bitcoin mining grew, miners began looking for ways to get an edge on the competition—and thus GPU mining was born. In 2010, people began hooking up large arrays of graphics processing units (GPUs) to mine Bitcoin—which, according to mining consultancy firm Navier, yields a six-times efficiency improvement over CPU mining.

But the era of GPU mining was short-lived. In 2011, it was found that a specialized type of hardware known as field programmable gate arrays (FPGAs) could be designed to mine Bitcoin with even greater efficiency. This type of hardware ran the Bitcoin mining roost until 2013, when it was usurped by application-specific integrated circuit (ASIC) miners—which still dominate to this day.

Nowadays, unless you plan to mine Bitcoin from a supercomputer with tens of thousands of CPU or GPU cores, you are unlikely to be competitive as a Bitcoin miner—and almost invariably won’t turn a profit. You will almost certainly need an ASIC miner, unless your acquisition and electricity costs are negligible.

As of writing, Bitmain’s AntMiner S19 Pro, S19, and T19 are arguably the most efficient Bitcoin miners available—but getting hold of stock is challenging.

How profitable is Bitcoin mining?

Though Bitcoin mining profitability has improved in recent months—largely due to Bitcoin’s rapidly increasing market value, the amount of money you can earn can vary considerably based on several parameters.

The most important of these is your hardware. More powerful hardware can crunch the calculations required to discover Bitcoin blocks much faster—thereby earning you more rewards. But it’s also generally more expensive.

The next most important consideration is your electricity costs. Cheap, reliable electricity can help to maximize your mining yield, since electricity costs will be your primary expense. Moreover, you will need to factor in your maintenance costs, such as cooling, modifications, installation costs etc., and if you use a pool, consider how the pool fee will affect your yield.

Find out more about the profitability of Bitcoin mining.

How to choose mining software

Before you get your Bitcoin mining hardware up and running, you are going to need to choose the mining software for your computer. This is used to control which mining algorithm you want to work with, which pool you will use, and acts as the hub for controlling your miner.

Though these all offer the same basic utility, they can vary considerably in both their efficiency and the additional features they offer. Moreover, choosing the right mining software can impact the efficiency of your Bitcoin mining operation, so it’s often a good idea to try out a few before committing long-term.

When selecting your mining software, these are some of the basic considerations you will want to make:

- 🖥️ Operating system support: Check that the software works with your operating system—e.g. Windows, macOS, Raspberry Pi OS, Linux, etc.

- 🧮 Algorithm support: Bitcoin uses the SHA256 mining algorithm, the software will need to support this to successfully mine Bitcoin.

- 🧰 Hardware support: Some programs support CPU, GPU, FPGA, and ASIC mining, whereas others will only support specific hardware.

- 🏋️♂️ Efficiency: Low resource miners are generally more efficient, but they are often more difficult to use.

- 💱 Additional functionality: Automatic coin switching, remote access, mining scheduling are among some of the most popular additional features.

Oftentimes, Bitcoin mining software can be downloaded and used free of charge. However, you will often find that these software programs offer additional features for a fee (or donation), while those that are the simplest to use and setup come at a cost.

Find out more about the best Bitcoin mining software available in 2021.

What are Bitcoin mining pools?

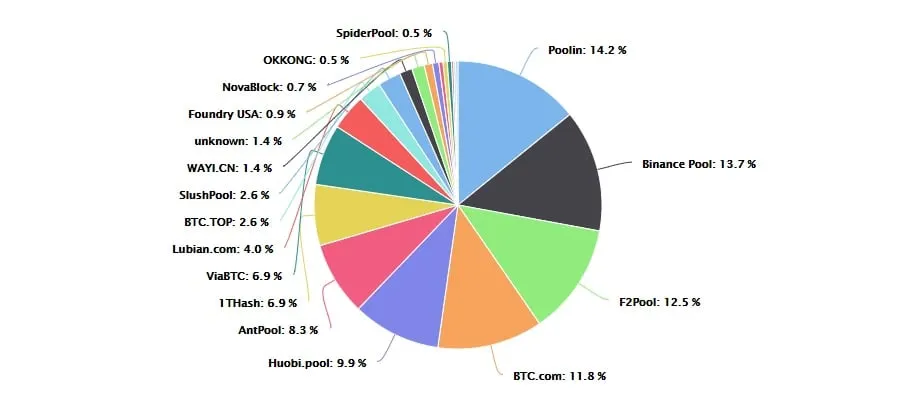

A Bitcoin mining pool is a coordinated group of Bitcoin miners that work together to improve their odds of successfully mining BTC. The combined efforts of a large number of Bitcoin miners ensures that they are able to discover more blocks than when working alone and hence generate a more stable income.While it is possible to mine Bitcoin solo, doing so is unlikely to ever yield any rewards—unless you are packaging some serious hardware. Instead, with Bitcoin mining pools, everybody aligns their mining power to the same purpose for the common good of the pool.

When mining Bitcoin as part of a pool, you will share in the rewards generated by that mining pool in proportion to your fraction of the hash rate controlled by the pool. As such, if you contribute 1% of the hash rate, you will get 1% of the rewards—regardless of which miner in the pool actually discovers the blocks.

Choosing which pool works best for you will mostly come down to personal preference. But in general, the larger the pool the more consistent your income will be. On top of this, you may want to consider pools based on their task assignment mechanism, minimum payout threshold, fee schedule, and transparency, among other parameters.

“A good pool must have a good reputation, technology and know-how. Additionally, it is important you consider pools that are attempting to help the ecosystem grow. A pool that wants the best for Bitcoin is a pool you should always go for,” Alejandro De La Torre, VP at Poolin, told Decrypt.

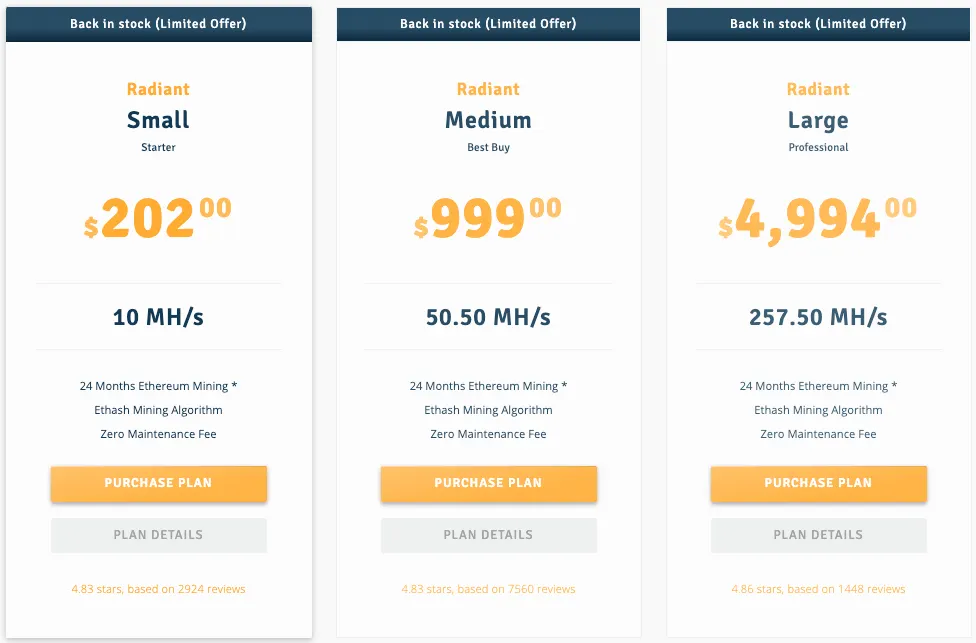

What is cloud mining?

Although most Bitcoin miners tend to set up their own hardware and work together with a mining pool, it’s not the only way to get involved.

Cloud mining is rapidly gaining popularity as a simpler alternative. Cloud mining providers are online platforms that allow you to rent computing power used for cryptocurrency mining. This allows you to get started with Bitcoin mining with essentially zero barriers to entry. You simply create an account, choose a mining plan, make your payment, and earn your Bitcoin—completely eliminating the efforts and costs involved in purchasing your own hardware and setting it up.

These platforms either pool mining power from their users, or have their own massive mining operations—leveraging the economies of scale to offer mining power to users at near cost rates. But though these platforms are cheaper to start with, there is no guarantee that they are profitable, and they often require lengthy contracts to get the best rates.

When choosing a cloud mining provider, it’s important to read into the specifics of your contract and use one of the numerous Bitcoin mining profitability calculators to estimate if your plan will be profitable over its lifetime.

Bitcoin Mining in 2021

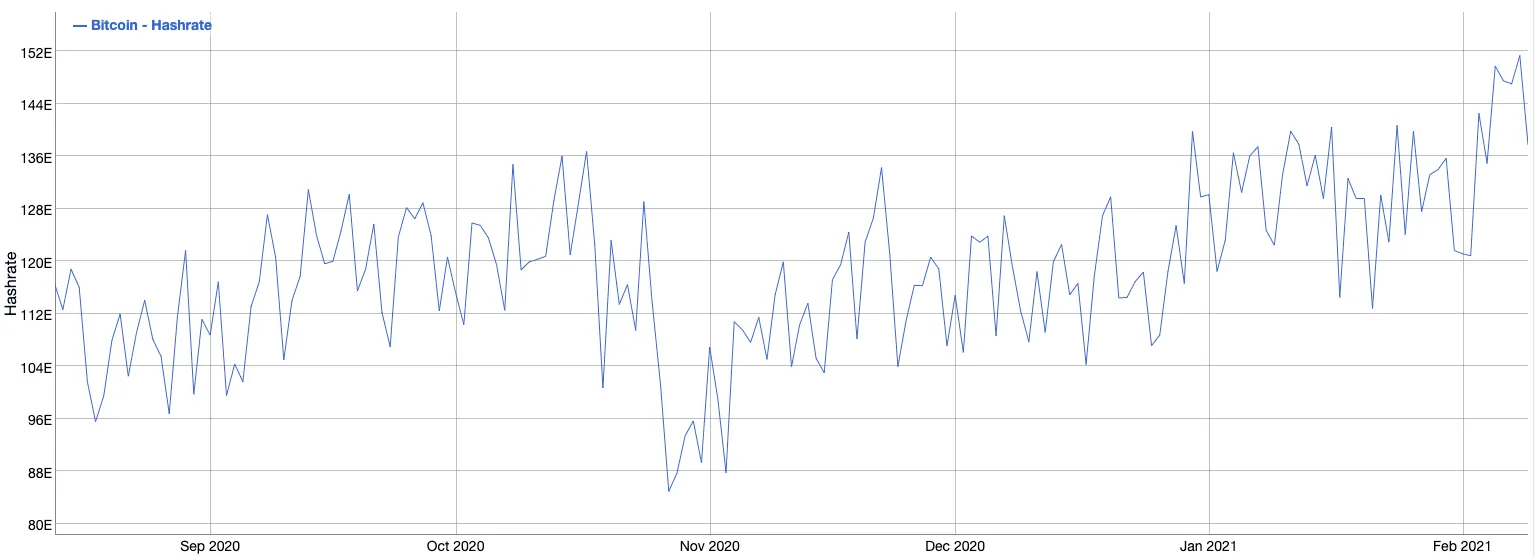

Starting in July 2020, Bitcoin mining profitability began surging in line with Bitcoin’s increasing value. Since then, the estimated yield per hash rate has multiplied fivefold, climbing from $0.065/TH/s in July 2020 to $0.32/TH/s in Feb 2021—its highest value since July 2019.

As a result, many long-term Bitcoin miners are making five times more profit than they were six months ago.

Despite the dramatic increase in profitability, the overall Bitcoin mining network hasn’t grown quite so fast. In fact, over the last six months, the hash rate has only increased from around 116 EH/s to just shy of 160 EH/s—equivalent to around a 38% increase.

This may be partly due to a major shortage of new ASICs, thanks to a confluence of supply constraints, overdemand, and major mining operations buying up supplies right out of the gate. As a result, most major ASIC manufacturers and distributors are sold out until mid-2021—including both Bitmain and Ebang, who are sold out until August and May 2021 respectively.

Assuming the difficulty increases by a further 38% between now and August, those buying now may find they’re earning less than expected—unless Bitcoin’s value continues growing to make up for the difference (as it has in previous months).

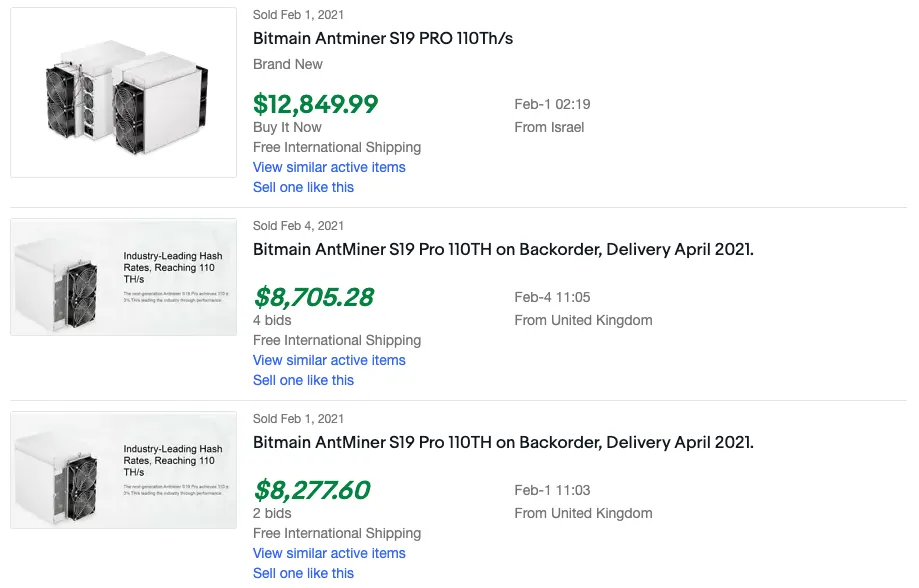

On the other hand, this shortage has led to a revival of the ASIC secondary market, with prices for mining hardware soaring on eBay—and some units selling for more than triple their usual price.

Unfortunately, with Bitcoin recently touching its highest-ever value, institutional adoption rising, and search interest through the roof, it’s unlikely the ASIC situation is likely to ameliorate any time soon.

Disclaimer

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.