While non-fungible token (NFT) sales have reached an all-time high of $100m globally, the topic has remained a niche among China’s crypto circles. Other than a few crypto art collectors who started to advocate the value of digital art, the majority are busy farming yields on DeFi protocols.

The fact that NFTs haven’t yet caught on in China Is hardly surprising. Digital collectibles, artwork, and virtual land parcels are esoteric concepts that require a deep knowledge of crypto and industry knowledge, and since the field is still so new, good English. Yet, the embers of China-born NFTs could be starting to smolder. This week’s da bing looks at the NFT market through the dragon-eyes of one project: Dragon City, the largest plot of virtual land on Decentraland.

China, literally built on the chain

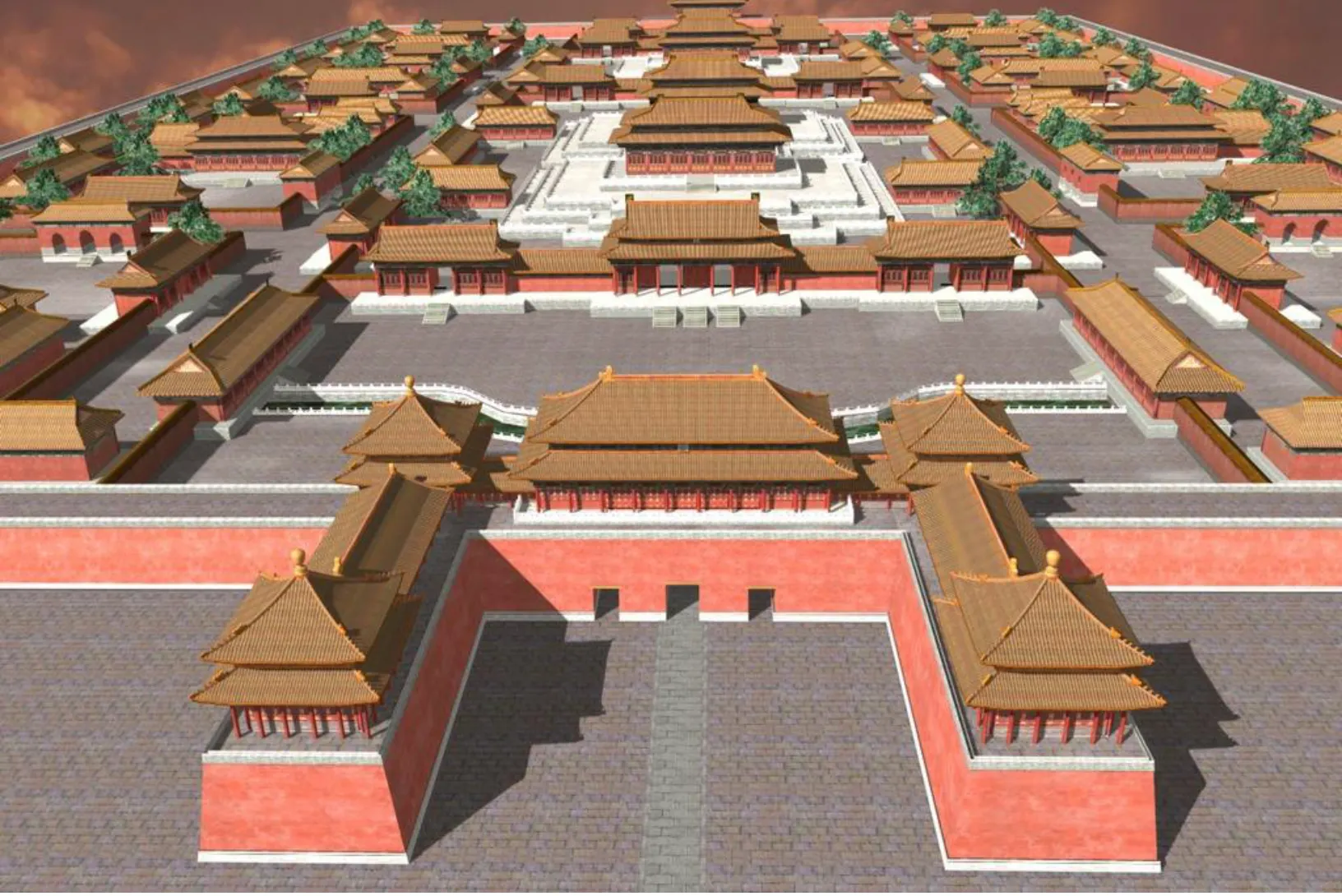

Dunhuang is a city situated at the heart of Silk Road where the east and west converged during Western Wei dynasty (535-557 AD). Its exquisite and exclusive Buddhist murals often remained closed to tourists for conservation reasons—but that is what Roy Zou, founder of Metaverse, and his five-person dev team, are trying to recreate in Dragon City.

Dragon City is the largest plot of virtual space within Decentraland, which itself is a virtual world-building platform powered by the Ethereum blockchain. Decentraland, which launched in 2017, offers users drag and drop tools to build, well, just about anything. It’s sort of like Second Life—but on a blockchain.

Unlike Second Life though, the idea is that here, users can create, experience, and monetize what they build and what they own. For example, leasing a parcel of land to another user generates revenue, so is building a casino on the land and having users pay crypto to use it.

The emergence of Dragon City represents a growing group of Chinese crypto fans who aspire to not only participate in the global NFT movement but also to contribute.

“Dragon City is a virtual city deeply rooted in Chinese mythology tracing back to the beginning of the world,” Zou told me, “I was inspired by how western mythology is systematically built upon Greek Mythology, while Chinese mythology is rather scattered and inconsistent.”

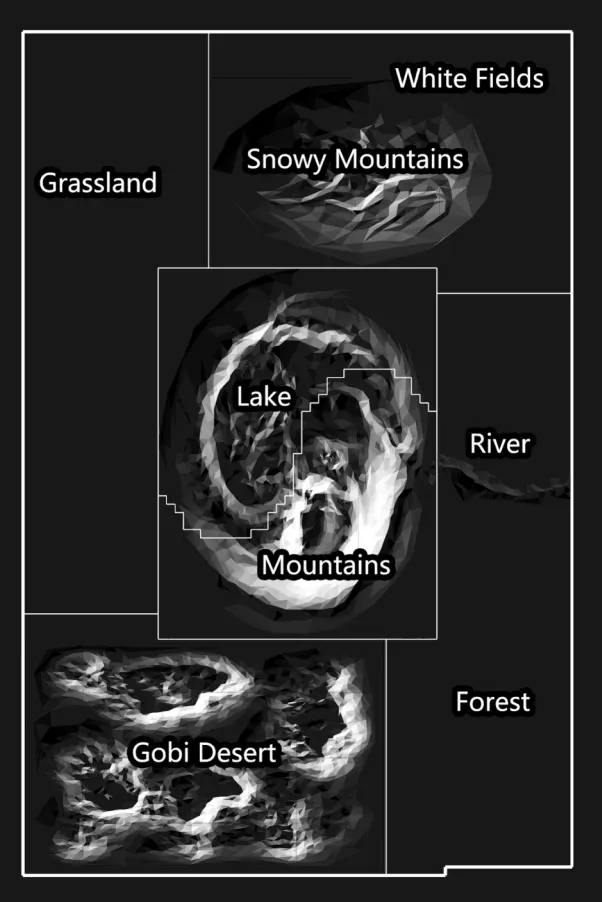

Looking at Dragon City’s construction plan, one can find ancient concepts such as Yin/Yang, Sixiang, and Bagua, representing principles by which ancient Chinese build homes, villages, and cities.

For example, the city maps show that the lake is situated to the left of a mountain because lakes normally represent Yin, which according to the rules of Taoism, must locate on the west side of Yang, which is represented by mountains.

NFTs embody ownership and value

In explaining why Decentraland has gathered a small group of loyal followers in China, Zou told me “In real life, there is no private land ownership under Chinese law. People can use the land, but they don’t own it. The very concept of actually owning something, even though it is virtual, is attractive.”

If ownership is the first step to understand owning land parcels, the second step is valuation. Decentraland operates on two types of tokens. It raised $26 million in a 2017 ICO. (Perhaps unsurprisingly, Zou was a participant of its presale.) Later, it issued LAND, the NFT token that represents plots of land people can own. (Dragon City itself is 6,485 LAND.) And that’s where economic value comes in.

The belief is that just like real estate in the real world, a plot of land will only appreciate if it becomes more desirable. And it will only become more desirable if it is developed.

“We are marketing Dragon City to Chinese as the first China-themed city on the blockchain,” Zou told me. “ We think this concept will also attract foreigners who are interested in Chinese culture.”

Playing the culture card, despite being noble, is step zero. Zou and his team have to build an entire city with features that draw in people and get them to spend their time on a platform that, right now at least, has little more than pretty murals. That’s the intrinsic value of a city.

Scarcity rules

Fortunately, or unfortunately, the crypto market never prices a token based on its intrinsic value. In the same way that cryptokitties became an overnight success in 2017, Zou and his team want to create a sense of “scarcity” so Dragon City will stand out from millions of land parcels being auctioned on the blockchain.

That story-telling might be the real intrinsic value of NFT.

Vincent Niu, founder of DappReview and an avid NFT advocate, told me that “for NFT’s to get mass adoption in China, the product has to be associated with an existing brand, with a large group of followers.”

The examples he listed were Dapperlabs’ NBA Topshots, and the partnership between WAX and Topps. Both leveraged a large fan base that actively sought out the brand in the real world. This offline connection is particularly crucial in China where celebrity culture is especially strong. From celebrities to influencers, the psychology of group behavior has been manifested in the burgeoning fan economics that is worth multi-billions.

For Dragon City, finding that offline hook might be the crucial next step to get NFT really on fire in China.

Three other things that happened this week

1. Justswap, not quite Uniswap yet

You knew it was only a matter of time before Justin Sun launched, or copied, DeFi products on his Tron “ecosystem.” Justswap, a replica of Uniswap, was Sun’s obvious answer to the DeFi farming trend. Claiming that tokens on Justswap would moon 100x from day one, many retail investors flooded to it for an, er, IJO.

The result? Well, since DeFi is completely permissionless, many scammy protocols are now listed on Justswap apparently for the sole purpose of pumping and dumping. Investors are already forming groups accusing Sun of not monitoring his platform diligently, even though the whole point of a DEX is for any token to be listed.

Not only is Justswap troubled by scammy tokens, his star project Alphalink, the equivalent of Chainlink on Tron, failed within an hour of launch. Apparently, its developers accidentally locked $20 million worth of TRX in the smart contract.

One can certainly get a good laugh out of Justin’s farce, but what the show tells us is that DeFi’s bubble is real. For many Chinese investors, they can blame Justin for messing up his platform, but they are the one who chose to farm from Justswap, rather than the original Uniswap.

A farmer can only earn produce when the soil is fertile.

2. Miniswap, not quite Justswap yet

Remember Fcoin? The crypto exchange that went bust in 2019 is coming back with its own version of Uniswap: Miniswap. Claiming that it’s combining the merits of Fcoin and Uniswap, Miniswap intends to avoid the mistake of Justswap by actually filtering the types of projects listed on its exchange.

We all know that this is just Fcoin’s attempt to stage another “comeback.” The last one was the launch of FMex, which claimed to return the lost fund to investors. Its real purpose appears to be attracting liquidity rather than developing new projects.

3. Floods in China cause severe damage to mining farms

While the rest of the world struggles with coronavirus, China has passed the pandemic phase. But it is fighting another war as the country experiences the biggest flood season in recent history.

Mining farms in Sichuan have been particularly damaged, as can be seen by the big drop in bitcoin’s hashrate. The floods have not only caused an electricity shortage, but also natural disasters such as a landslide on the mining facility. Reports have shown people disappearing—swallowed up by water and mud—after these accidents.

The floods this year are making another argument to diversify mining from China to locations that are more favorable. North America is high on the list, as are parts of Europe.

Do you know?

“盲盒 or Blind Box” is a vending machine that spits out random plastic toys upon payment. Collecting these toys from blind boxes has become a growing trend among GenZ for the past two years. The hype has created a burgeoning secondary market where people spend thousands of dollars trading these “rare” plastic toys.

From collecting fancy sneakers, to paying extra for a lucky toy popping out of a box, Chinese love collecting, especially products that have an inherent speculative nature and that can be showcased in front of friends and family. It doesn’t take much for Chinese to speculate on anything. Maybe NFTs will be next.