Bitcoin is booming and the crypto industry is making a comeback—but layoffs keep happening lately.

The latest firm to make such a move is American Bitcoin miner Foundry. Based in Rochester, New York, Foundry confirmed that it has cut 16% of its staff. The company is one of the biggest U.S. Bitcoin miners.

It said in a statement to Decrypt that it “made the difficult decision to reduce Foundry’s workforce, resulting in layoffs across multiple teams.” The firm added that it had also cut a small team in India.

Blockspace first reported word of layoffs, though Foundry said a smaller number of roles were affected than originally claimed.

“We recently made the strategic decision to focus Foundry on our core business—operating the number-one Bitcoin mining pool in the world and growing our site operations business—while we supported the development of DCG’s newest subsidiaries, including Yuma and the spinout of Foundry’s successful self-mining business,” it said in a statement.

Yuma is an artificial intelligence (AI) platform and Foundry subsidiary. Digital Currency Group (DCG), which owns Foundry, said in a letter to shareholders after the U.S. election that its mining operation would work best as a “standalone business.” Foundry also provides staking services for other digital assets like Ethereum.

Despite surging crypto prices, major companies across the space—including Ethereum giant Consensys, top digital asset exchange Kraken, and New York platform dYdX—have cut headcount this year. Experts told Decrypt before the election that regulatory uncertainty played a part in companies slimming down.

Bitcoin mining is a particularly difficult industry. Rewards for miners get slashed every four years, and it becomes more expensive for companies to run their businesses.

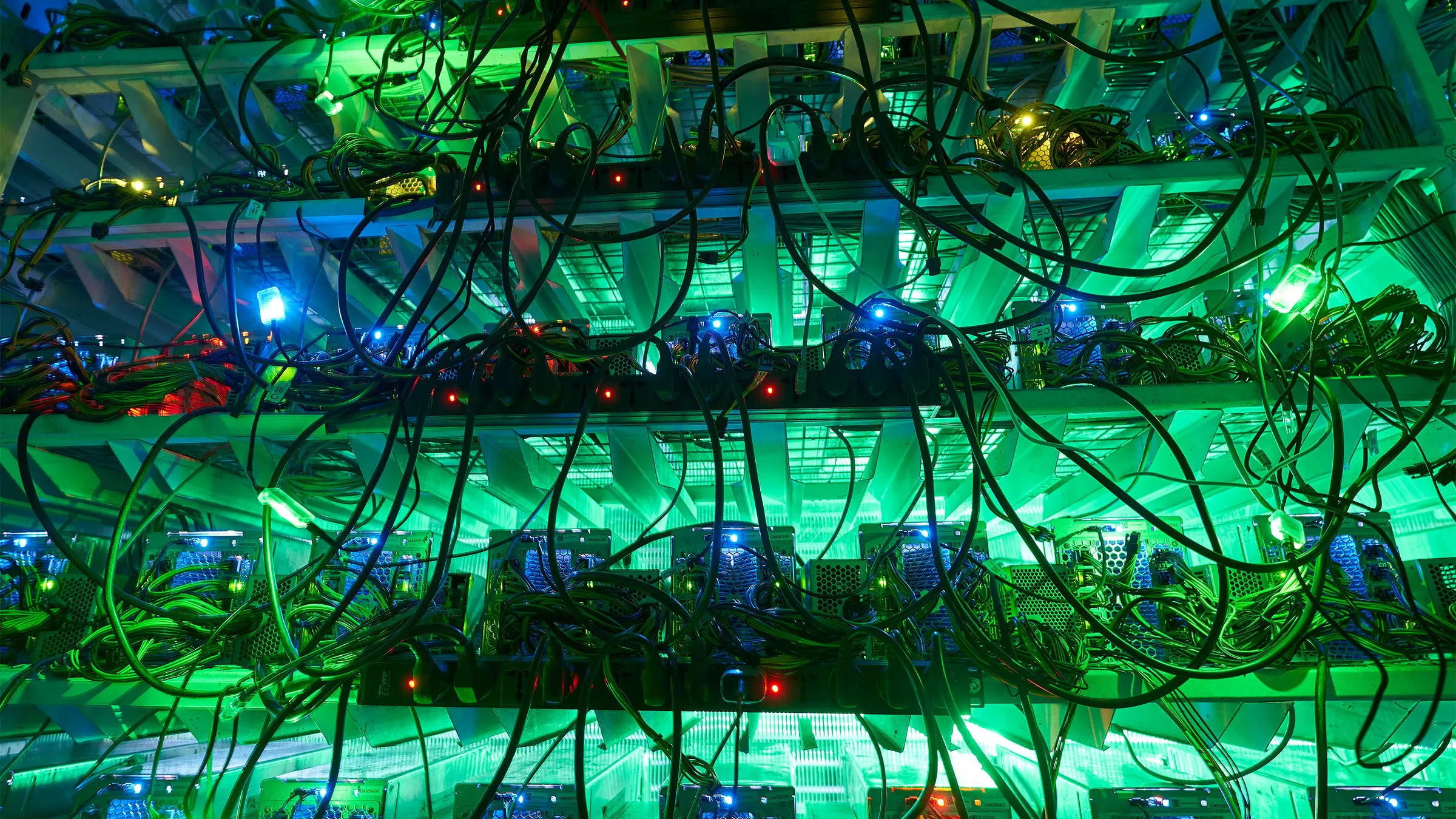

Bitcoin mining is the process of using powerful computers to verify transactions on the biggest crypto network.

Back in the day, over 14 years ago, it was possible to do the process on a home PC. But as the network has grown, so has the industry—and the competition. Miners are typically now large operations using server farms and a lot of electricity.

Miners receive newly minted Bitcoins for their work, and as the years go by, the process of producing coins becomes more difficult—and even more energy-consuming.

However, JP Morgan said that Bitcoin mining revenue grew in November amid the surging price of BTC, which came within a few hundred dollars of the $100,000 mark for the first time late last month.

Edited by Andrew Hayward